- Canada

- /

- Oil and Gas

- /

- TSX:CCO

TSX Stocks Estimated Below Intrinsic Value In April 2025

Reviewed by Simply Wall St

As global economic uncertainties and tariff-related tensions continue to influence market dynamics, the Canadian economy remains resilient, supported by strong household balance sheets and a robust labor market. In this environment, identifying undervalued stocks on the TSX can be particularly rewarding for investors seeking opportunities that align with long-term investment strategies amidst potential volatility.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Computer Modelling Group (TSX:CMG) | CA$7.09 | CA$11.10 | 36.1% |

| Savaria (TSX:SIS) | CA$15.83 | CA$31.13 | 49.2% |

| K92 Mining (TSX:KNT) | CA$11.19 | CA$18.36 | 39.1% |

| Galaxy Digital Holdings (TSX:GLXY) | CA$12.34 | CA$21.54 | 42.7% |

| Thunderbird Entertainment Group (TSXV:TBRD) | CA$1.57 | CA$3.12 | 49.7% |

| Lithium Royalty (TSX:LIRC) | CA$4.85 | CA$9.46 | 48.7% |

| illumin Holdings (TSX:ILLM) | CA$1.86 | CA$3.69 | 49.5% |

| AirBoss of America (TSX:BOS) | CA$3.50 | CA$5.09 | 31.2% |

| AtkinsRéalis Group (TSX:ATRL) | CA$63.58 | CA$122.27 | 48% |

| CAE (TSX:CAE) | CA$30.03 | CA$50.41 | 40.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

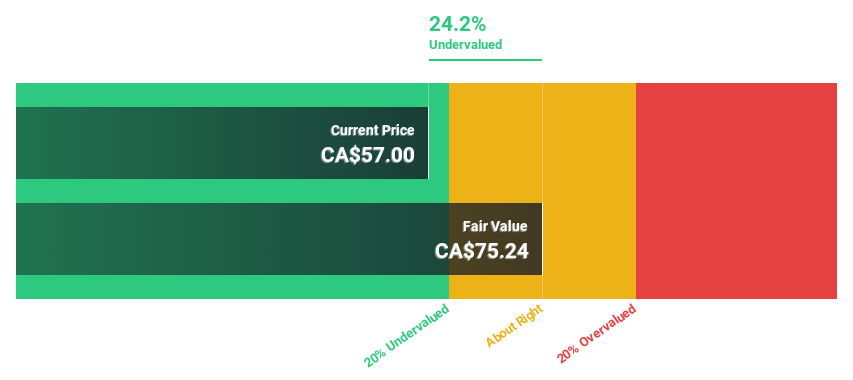

Cameco (TSX:CCO)

Overview: Cameco Corporation is involved in supplying uranium for electricity generation and has a market capitalization of approximately CA$23.43 billion.

Operations: Cameco's revenue segments include Uranium at CA$2.68 billion, Fuel Services at CA$459.15 million, and Westinghouse (WEC) at CA$2.89 billion.

Estimated Discount To Fair Value: 30%

Cameco is trading at CA$52.94, below its estimated fair value of CA$75.66, indicating potential undervaluation based on cash flows. Despite a decline in net income to CA$171.85 million for 2024 from the previous year, analysts forecast significant earnings growth of over 30% annually, outpacing the Canadian market average. However, profit margins have decreased to 5.5%. The company plans to double its dividend by 2026 as part of its capital allocation strategy.

- Our growth report here indicates Cameco may be poised for an improving outlook.

- Get an in-depth perspective on Cameco's balance sheet by reading our health report here.

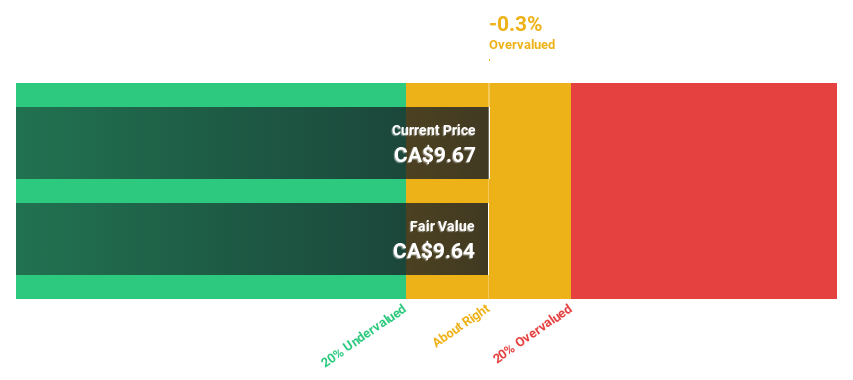

China Gold International Resources (TSX:CGG)

Overview: China Gold International Resources Corp. Ltd. is a mining company engaged in the acquisition, exploration, development, and mining of gold and base metal properties in China, with a market cap of approximately CA$3.55 billion.

Operations: The company's revenue segments include Mine - Produced Gold at $246.95 million and Mine - Produced Copper Concentrate at $509.70 million.

Estimated Discount To Fair Value: 19.3%

China Gold International Resources, trading at CA$7.96, is undervalued with a fair value of CA$9.87 based on cash flow analysis. The company reported a net income of US$62.73 million for 2024, reversing a prior loss, and announced a total dividend of US$0.08 per share for the year ended December 31, 2024. Earnings are projected to grow significantly at 38% annually over the next three years, surpassing Canadian market averages.

- The analysis detailed in our China Gold International Resources growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in China Gold International Resources' balance sheet health report.

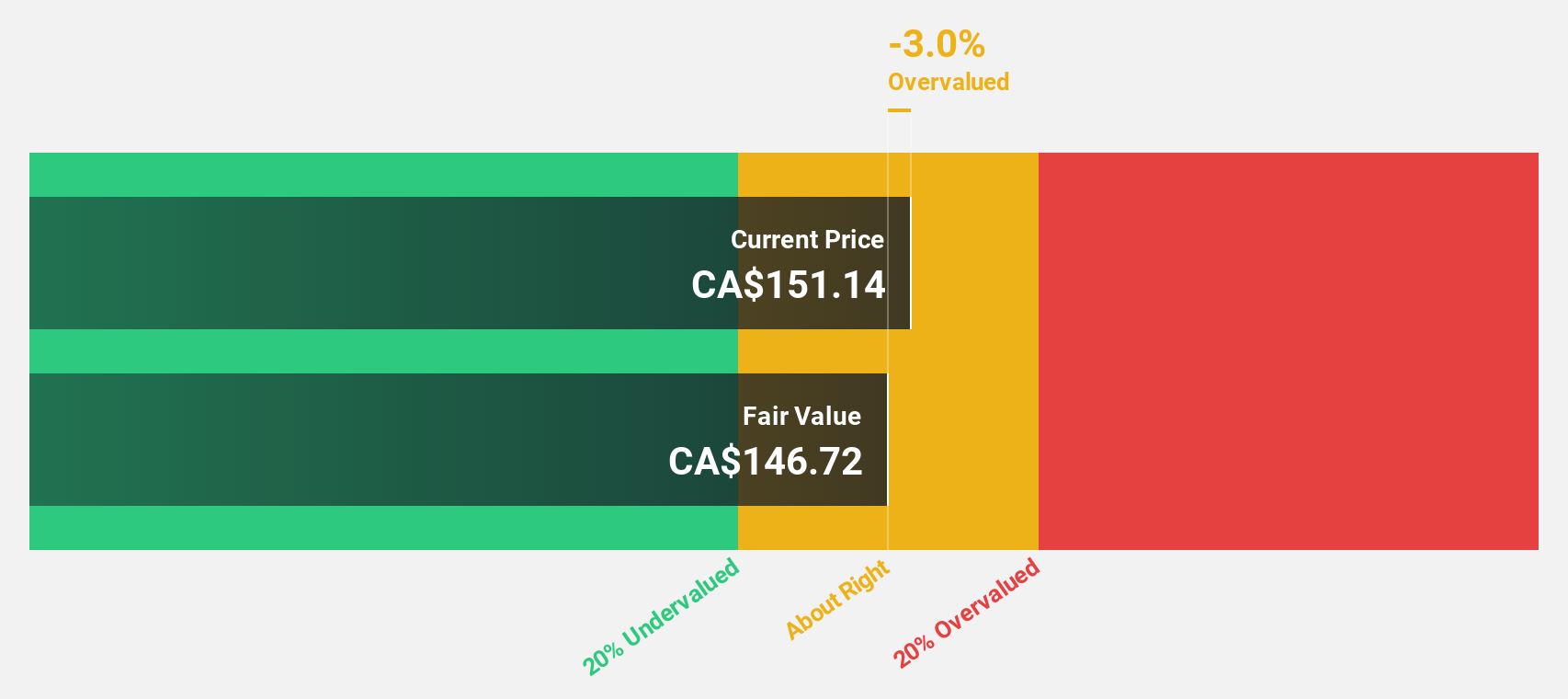

Stantec (TSX:STN)

Overview: Stantec Inc. is a professional services company offering infrastructure and facilities solutions to both public and private sectors across Canada, the United States, and internationally, with a market cap of CA$13.03 billion.

Operations: The company's revenue segments are comprised of CA$1.43 billion from Canada, CA$1.40 billion from global operations, and CA$3.04 billion from the United States.

Estimated Discount To Fair Value: 10.8%

Stantec, trading at CA$113.75, is undervalued based on cash flow analysis with a fair value of CA$127.52. The company reported significant earnings growth for 2024, with net income rising to CA$361.5 million from the previous year’s CA$316.5 million and a revenue increase to CA$5.87 billion from CA$5.07 billion year-over-year. Stantec's revenue is projected to grow faster than the Canadian market average, supported by strategic M&A activities and infrastructure projects like the Mojave Groundwater Bank in California.

- Our earnings growth report unveils the potential for significant increases in Stantec's future results.

- Dive into the specifics of Stantec here with our thorough financial health report.

Where To Now?

- Delve into our full catalog of 27 Undervalued TSX Stocks Based On Cash Flows here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CCO

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives