The board of NFI Group Inc. (TSE:NFI) has announced that it will pay a dividend of CA$0.21 per share on the 15th of October. This means the annual payment is 3.5% of the current stock price, which is above the average for the industry.

Check out our latest analysis for NFI Group

NFI Group Might Find It Hard To Continue The Dividend

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Even while not generating a profit, NFI Group is paying out most of its free cash flows as a dividend. Generally it is unsustainable for a company to be paying a dividend while unprofitable, and with limited reinvestment into the business growth may be slow.

Over the next year, EPS might fall by 44.4% based on recent performance. This means the company won't be turning a profit, which could place managers in the tough spot of having to choose between suspending the dividend or putting more pressure on the balance sheet.

Dividend Volatility

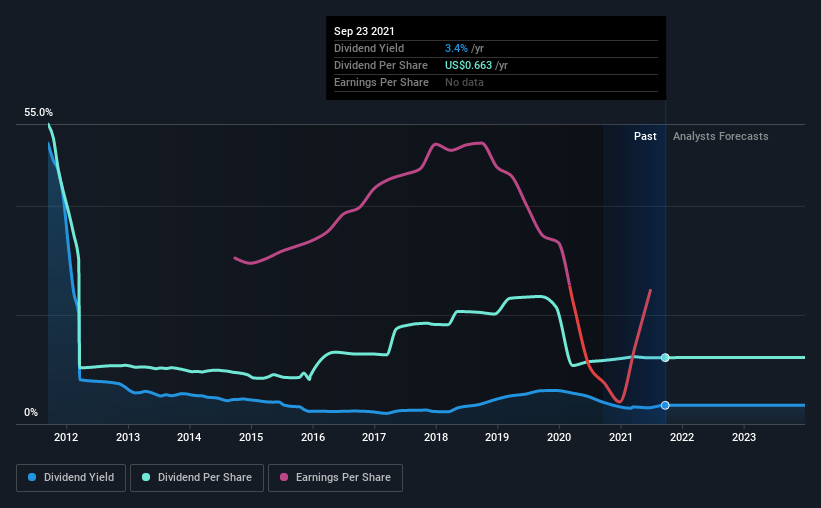

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. The first annual payment during the last 10 years was US$3.00 in 2011, and the most recent fiscal year payment was US$0.66. The dividend has fallen 78% over that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend Has Limited Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Over the past five years, it looks as though NFI Group's EPS has declined at around 44% a year. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future.

The company has also been raising capital by issuing stock equal to 14% of shares outstanding in the last 12 months. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

NFI Group's Dividend Doesn't Look Sustainable

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. The track record isn't great, and the payments are a bit high to be considered sustainable. This company is not in the top tier of income providing stocks.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. To that end, NFI Group has 4 warning signs (and 1 which shouldn't be ignored) we think you should know about. We have also put together a list of global stocks with a solid dividend.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if NFI Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:NFI

NFI Group

Manufactures and sells buses in North America, the United Kingdom, rest of Europe, and the Asia Pacific.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)