The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like MDA Space (TSE:MDA). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide MDA Space with the means to add long-term value to shareholders.

How Fast Is MDA Space Growing Its Earnings Per Share?

In the last three years MDA Space's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. MDA Space's EPS skyrocketed from CA$0.41 to CA$0.65, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 59%.

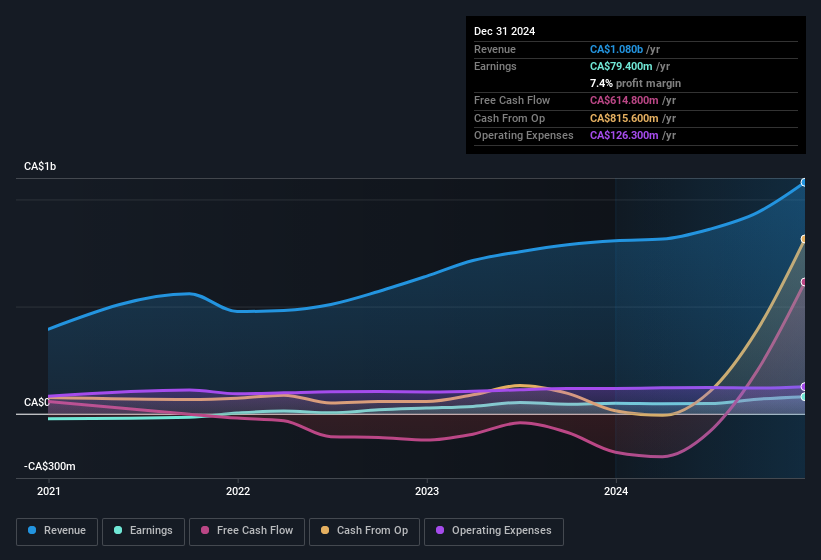

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for MDA Space remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 34% to CA$1.1b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Check out our latest analysis for MDA Space

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for MDA Space's future EPS 100% free.

Are MDA Space Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Although we did see some insider selling (worth CA$23k) this was overshadowed by a mountain of buying, totalling CA$3.1m in just one year. This bodes well for MDA Space as it highlights the fact that those who are important to the company having a lot of faith in its future. We also note that it was the Independent Chairman of the Board, Brendan Paddick, who made the biggest single acquisition, paying CA$1.8m for shares at about CA$26.87 each.

On top of the insider buying, it's good to see that MDA Space insiders have a valuable investment in the business. Indeed, they hold CA$55m worth of its stock. That's a lot of money, and no small incentive to work hard. Even though that's only about 1.7% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Should You Add MDA Space To Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into MDA Space's strong EPS growth. On top of that, insiders own a significant stake in the company and have been buying more shares. These things considered, this is one stock worth watching. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if MDA Space is trading on a high P/E or a low P/E, relative to its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of MDA Space, you'll probably love this curated collection of companies in CA that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MDA

MDA Space

Provides space technology solutions and in Canada, the United States, Europe, Asia, the Middle East, and internationally.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives