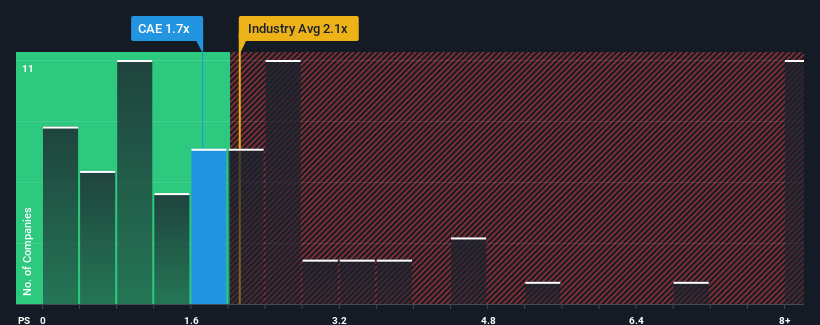

You may think that with a price-to-sales (or "P/S") ratio of 1.7x CAE Inc. (TSE:CAE) is a stock worth checking out, seeing as almost half of all the Aerospace & Defense companies in Canada have P/S ratios greater than 2.3x and even P/S higher than 5x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for CAE

What Does CAE's P/S Mean For Shareholders?

Recent times haven't been great for CAE as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think CAE's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like CAE's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 6.8%. Pleasingly, revenue has also lifted 44% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 6.2% per year during the coming three years according to the analysts following the company. That's shaping up to be materially higher than the 2.6% each year growth forecast for the broader industry.

With this information, we find it odd that CAE is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On CAE's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems CAE currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 1 warning sign for CAE you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:CAE

CAE

Provides simulation training and critical operations support solutions in Canada, the United States, the United Kingdom, Europe, Asia, the Oceania, Africa, and Rest of the Americas.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives