- Canada

- /

- Electrical

- /

- TSX:BLDP

Investors Who Bought Ballard Power Systems (TSE:BLDP) Shares Three Years Ago Are Now Up 130%

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. For instance the Ballard Power Systems Inc. (TSE:BLDP) share price is 130% higher than it was three years ago. Most would be happy with that. It's also good to see the share price up 32% over the last quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report.

View our latest analysis for Ballard Power Systems

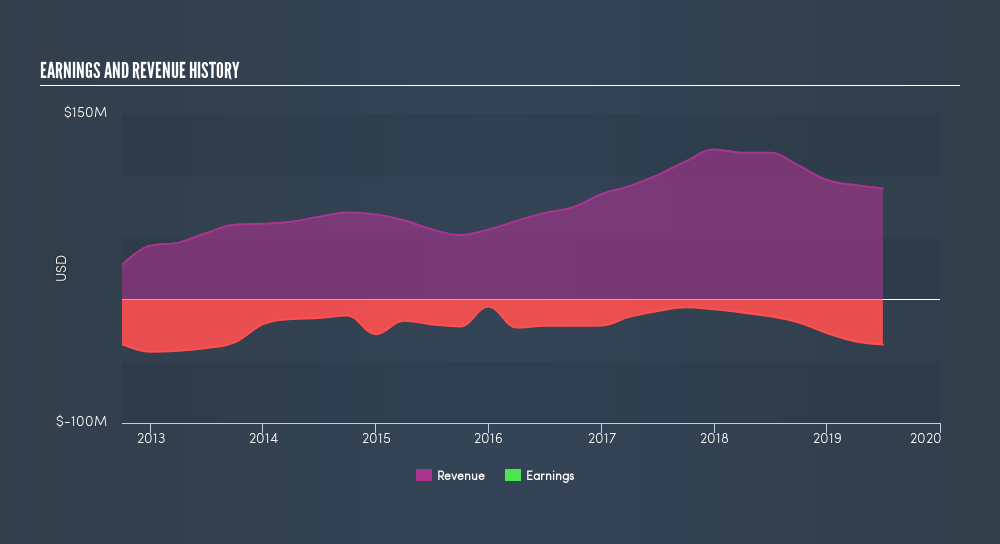

Ballard Power Systems isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 3 years Ballard Power Systems saw its revenue grow at 7.8% per year. Considering the company is losing money, we think that rate of revenue growth is uninspiring. In comparison, the share price rise of 32% per year over the last three years is pretty impressive. Shareholders should be pretty happy with that, although interested investors might want to examine the financial data more closely to see if the gains are really justified. It may be that the market is pretty optimistic about Ballard Power Systems if you look to the bottom line.

This free interactive report on Ballard Power Systems's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that Ballard Power Systems shareholders have received a total shareholder return of 49% over one year. That gain is better than the annual TSR over five years, which is 6.3%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

But note: Ballard Power Systems may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:BLDP

Ballard Power Systems

Engages in the design, development, manufacture, sale, and service of proton exchange membrane (PEM) fuel cell products.

Flawless balance sheet and overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)