- Canada

- /

- Construction

- /

- TSX:BDGI

Badger Infrastructure Solutions (TSE:BDGI) Has Re-Affirmed Its Dividend Of CA$0.052

The board of Badger Infrastructure Solutions Ltd. (TSE:BDGI) has announced that it will pay a dividend of CA$0.052 per share on the 15th of July. This means the annual payment is 1.6% of the current stock price, which is above the average for the industry.

See our latest analysis for Badger Infrastructure Solutions

Badger Infrastructure Solutions' Payment Has Solid Earnings Coverage

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Before making this announcement, Badger Infrastructure Solutions' dividend was higher than its profits, but the free cash flows quite comfortably covered it. Given that the dividend is a cash outflow, we think that cash is more important than accounting measures of profit when assessing the dividend, so this is a mitigating factor.

Analysts expect a massive rise in earnings per share in the next year. Assuming the dividend continues along recent trends, we estimate that the payout ratio could reach 73%, which is in a comfortable range for us.

Dividend Volatility

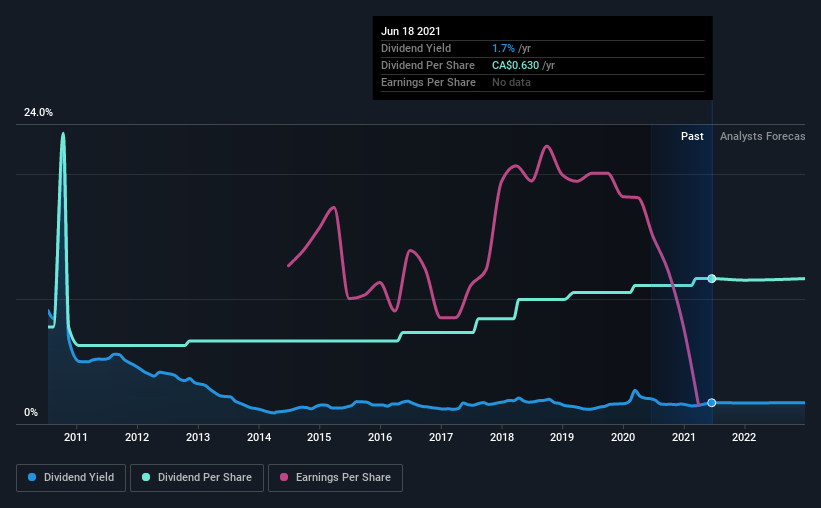

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. The first annual payment during the last 10 years was CA$0.42 in 2011, and the most recent fiscal year payment was CA$0.63. This works out to be a compound annual growth rate (CAGR) of approximately 4.1% a year over that time. Modest growth in the dividend is good to see, but we think this is offset by historical cuts to the payments. It is hard to live on a dividend income if the company's earnings are not consistent.

Dividend Growth Potential Is Shaky

With a relatively unstable dividend, it's even more important to see if earnings per share is growing. Over the past five years, it looks as though Badger Infrastructure Solutions' EPS has declined at around 30% a year. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. Taking the debate a bit further, we've identified 4 warning signs for Badger Infrastructure Solutions that investors need to be conscious of moving forward. We have also put together a list of global stocks with a solid dividend.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Badger Infrastructure Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:BDGI

Badger Infrastructure Solutions

Provides non-destructive excavating and related services in Canada and the United States.

Outstanding track record with high growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)