- Canada

- /

- Aerospace & Defense

- /

- TSX:BBD.B

How Canada’s Global 6500 Order At Bombardier (TSX:BBD.B) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- Bombardier recently announced that the Government of Canada purchased six Global 6500 aircraft for worldwide utility, humanitarian, and national security missions, in a deal valued at about US$400 million including military modifications, with assembly in the Greater Toronto Area and interior completion in Greater Montreal.

- This order, alongside Bombardier Defense’s role in Germany’s PEGASUS SIGINT platform and its expanding global service network, underlines how government and aftermarket programs are becoming increasingly central to the company’s long-term business mix.

- Next, we’ll examine how this Canadian Global 6500 order reshapes Bombardier’s investment narrative around defense exposure and aftermarket growth.

We've found 13 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Bombardier Investment Narrative Recap

To own Bombardier today, you need to believe it can keep compounding value off a focused business jet franchise while steadily growing higher-margin defense and aftermarket revenue. The Canadian Global 6500 order reinforces that thesis but is small beside the broader challenge of managing a concentrated, cyclical product line and ongoing supply chain and inventory pressures, which remain the key near term swing factors.

The Abu Dhabi Al Bateen service centre announcement ties directly into this story, since it speaks to Bombardier’s push to relieve capacity constraints in its aftermarket network and support long term, recurring service revenue. As these facilities ramp up alongside government and defense programs, they may help offset some of the volatility inherent in large, lumpy jet deliveries and lengthened backlogs.

Yet, despite these positives, investors should be aware that Bombardier’s heavy reliance on premium business jet demand still leaves the company exposed if...

Read the full narrative on Bombardier (it's free!)

Bombardier's narrative projects $10.2 billion revenue and $980.5 million earnings by 2028. This requires 5.4% yearly revenue growth and a $531.5 million earnings increase from $449.0 million today.

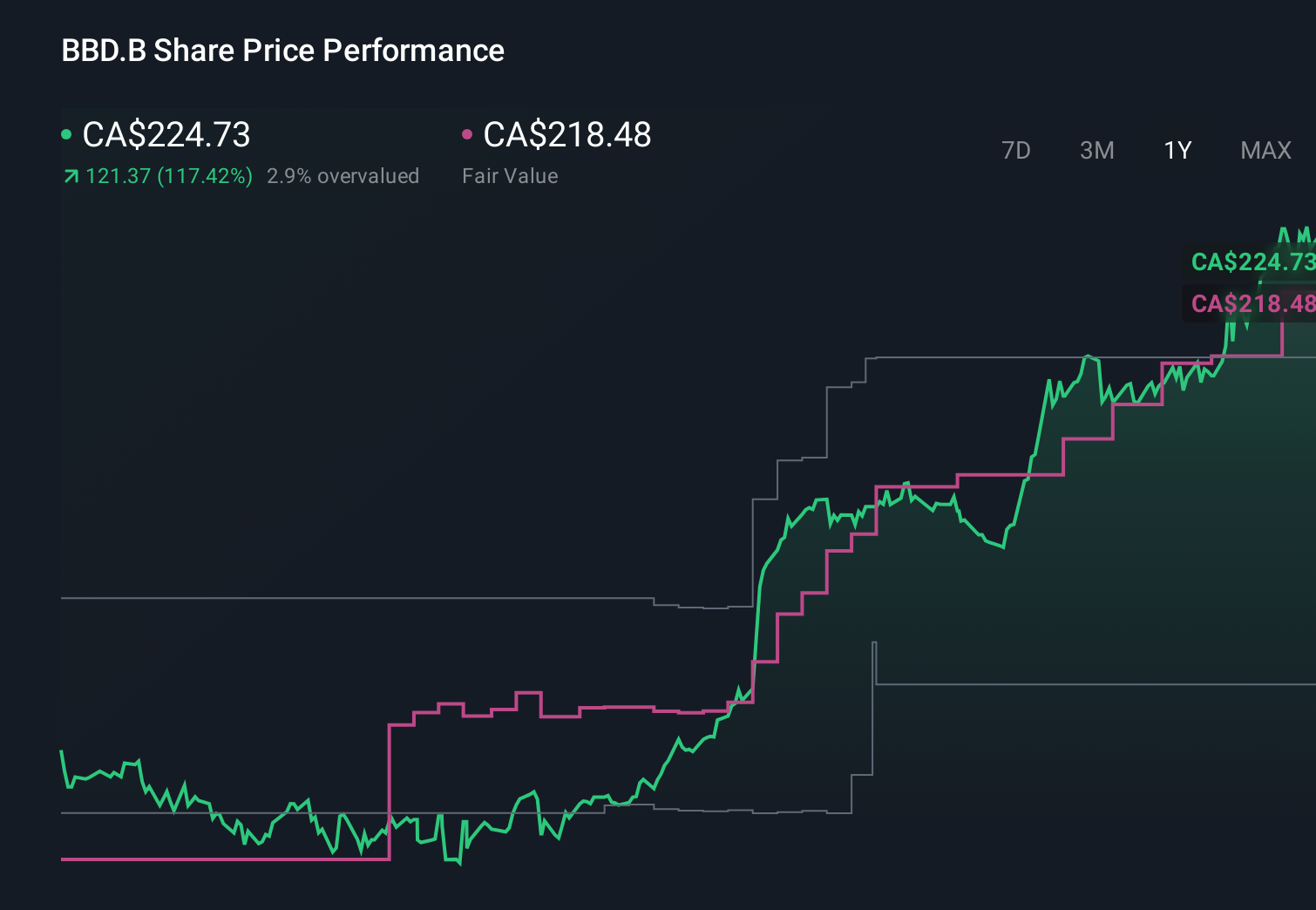

Uncover how Bombardier's forecasts yield a CA$218.48 fair value, a 3% downside to its current price.

Exploring Other Perspectives

Eleven Simply Wall St Community valuations for Bombardier span roughly CA$28 to CA$342 per share, reflecting very different expectations for the business. Against that backdrop, Bombardier’s growing dependence on a single, cyclical business jet segment gives those varied views real weight for anyone assessing how resilient future performance might be.

Explore 11 other fair value estimates on Bombardier - why the stock might be worth as much as 52% more than the current price!

Build Your Own Bombardier Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bombardier research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bombardier research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bombardier's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Bombardier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BBD.B

Bombardier

Engages in the design, manufacture, and sale of business aircraft and aircraft structural components worldwide.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)