- Canada

- /

- Aerospace & Defense

- /

- TSX:BBD.B

Does Bombardier Still Offer Upside After Recent 20% Jump and Earnings Pullback?

Reviewed by Bailey Pemberton

If you’ve been keeping even half an eye on Bombardier’s stock, you know it’s been a wild ride. This action has turned heads all across the market. You might be wondering whether Bombardier has enough momentum for a fresh rally, or if it’s burned too hot. After all, the company’s stock soared 20.2% in the last month alone and is up an impressive 96.7% year to date. Even more eye-popping, over the past three years it’s delivered a jaw-dropping 574.5% return, and an astonishing 2,241.2% over five years. That kind of performance is hard to ignore and it’s no wonder there’s plenty of debate about what comes next.

Of course, the last seven days have seen a pullback of -5.5%, likely as investors digest recent market news involving shifts in travel demand and increased competition in the transportation sector. But here’s what really matters for long-term investors: Does the current price still make sense given Bombardier’s fundamentals?

With a valuation score of 5 out of 6 key checks, Bombardier is currently considered undervalued in almost every way that counts. There are strong reasons to look more closely. In the next sections, I’ll walk you through these valuation approaches, from classic ratios to deeper industry comparisons. But there’s an even smarter way to evaluate Bombardier that most investors overlook, and I’ll share it with you at the end of this article.

Approach 1: Bombardier Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This approach captures both the business’s growth and the time value of money. For Bombardier, recent data shows the company generated Free Cash Flow (FCF) of approximately $79.4 million over the last twelve months, with analysts forecasting accelerated growth over the coming decade.

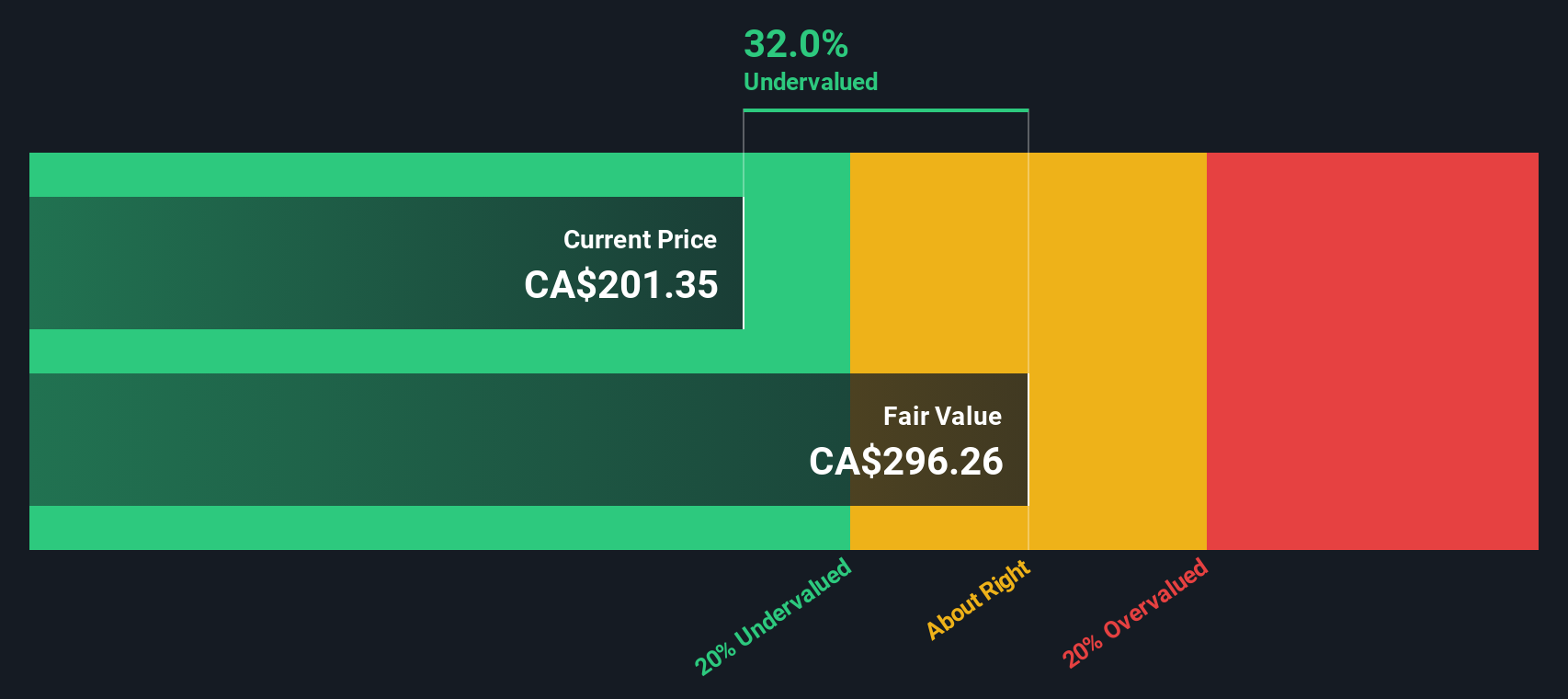

Looking ahead, FCF is projected to reach $1.17 billion by 2029, extrapolated from both analyst estimates and longer-term trend models. The DCF calculation incorporates these annual increases and applies discount rates to adjust future values for today’s perspective. The result is an estimated intrinsic value of $287.00 per share, indicating that the stock is currently trading at a 33.7% discount to this fair value.

This substantial gap suggests Bombardier shares are significantly undervalued compared to the company’s projected future cash-generating ability. For investors seeking value, the DCF model offers a compelling case that there is meaningful upside available at current prices.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bombardier is undervalued by 33.7%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Bombardier Price vs Earnings (PE Ratio)

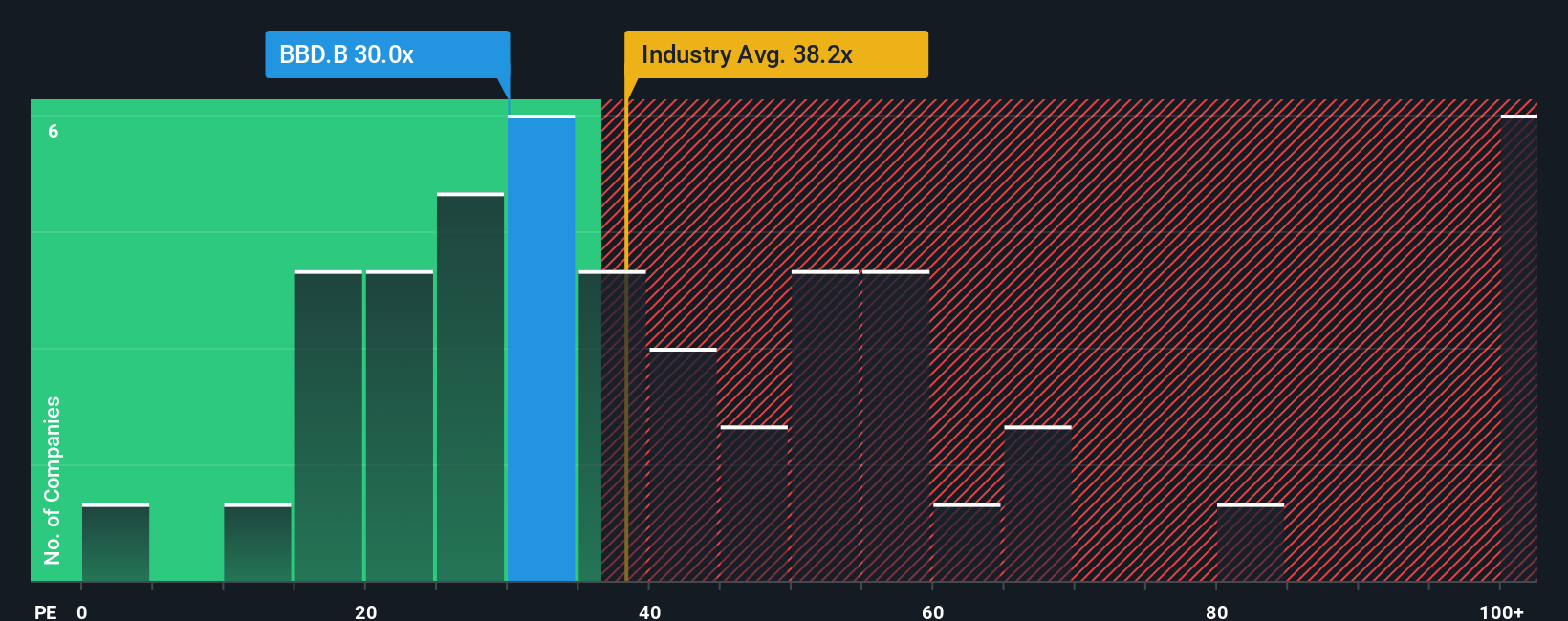

For companies that are consistently profitable, the Price-to-Earnings (PE) ratio is often the most straightforward way to understand how the market is valuing their earnings power. The PE ratio tells investors how much they are paying for each dollar of current earnings, and it is especially useful for assessing established businesses with stable or growing profits like Bombardier.

What is considered a “normal” or “fair” PE ratio depends heavily on a company’s future growth and risk profile. Higher expected earnings growth typically justifies a higher PE, while higher risk or slowing growth leads to a lower PE. Comparing Bombardier’s current PE of 30.0x to the average for the Aerospace & Defense industry (46.6x), as well as its peer group (33.6x), suggests that Bombardier is trading at a discount relative to others in the sector.

Simply Wall St’s proprietary “Fair Ratio” calculation takes this a step further. Rather than just looking at raw averages, the Fair Ratio estimates a company’s justified PE multiple based on its own earnings growth, profit margins, industry characteristics, market cap, and underlying risks. For Bombardier, the Fair Ratio is 35.1x, which sits above its current PE of 30.0x. This suggests that, on a risk- and growth-adjusted basis, the stock is undervalued right now, even when compared with peer and industry benchmarks, giving investors additional confidence in the value opportunity.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bombardier Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your unique story about Bombardier. It is the perspective or thesis you have about where the company is headed and why. With Narratives, you connect your view of Bombardier’s future (like assumptions about revenue growth, profit margins and business risks) directly to a financial forecast and a calculated fair value, so you are not just reacting to numbers, but grounding your decisions in a story you believe in.

This tool is built right into the Community page on Simply Wall St, making it accessible to millions of investors. Narratives empower you to clearly link your investment thesis to a buy or sell action by continuously comparing your fair value calculation with the current share price. Even better, Narratives automatically update as soon as new company news, earnings, or industry information is released, so your view remains accurate and dynamic in real time.

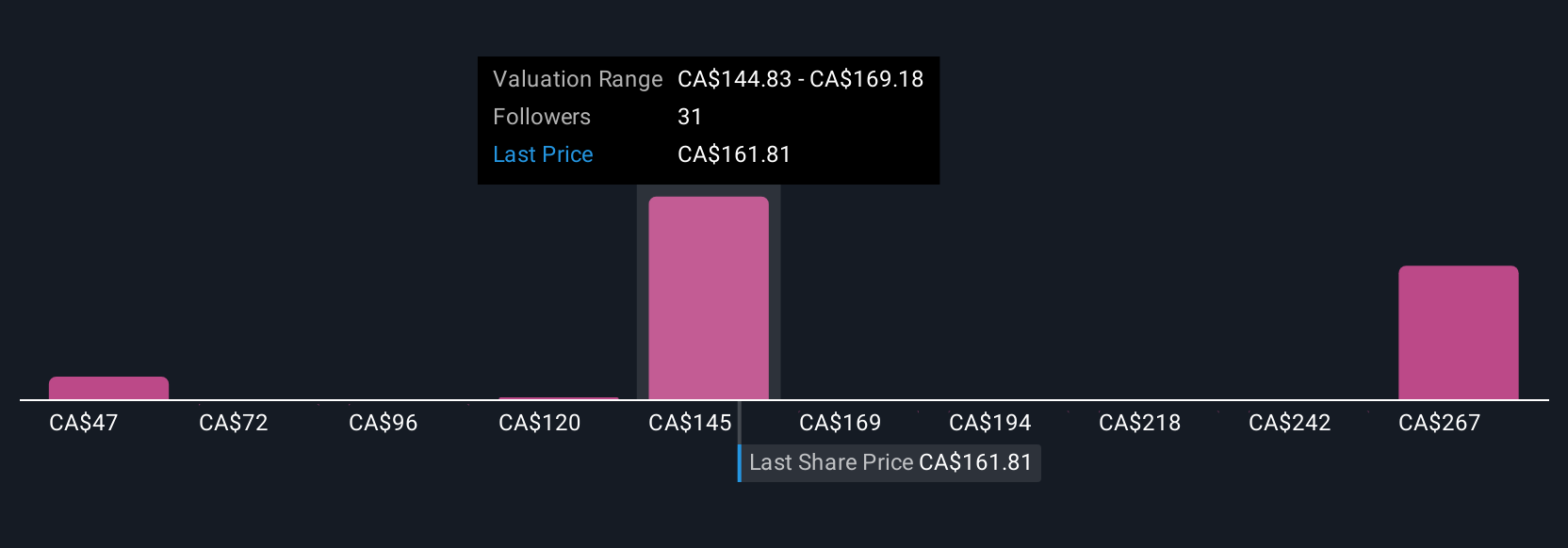

For example, some investors currently see Bombardier as a long-term winner, forecasting future price targets as high as CA$200.75 based on factors like aftermarket growth and global demand. On the other hand, more cautious investors set targets as low as CA$120.05 due to concerns about supply constraints and market risks. Narratives let you transparently track and refine your own convictions alongside the broader community, making it a smarter, more personal way to invest.

Do you think there's more to the story for Bombardier? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bombardier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BBD.B

Bombardier

Engages in the design, manufacture, and sale of business aircraft and aircraft structural components worldwide.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives