- Canada

- /

- Aerospace & Defense

- /

- TSX:BBD.B

Bombardier (TSX:BBD.B): Valuation Check After $400 Million Canadian Government Jet Order and Growth Boost

Reviewed by Simply Wall St

Bombardier (TSX:BBD.B) just landed a headline government contract, with Canada ordering six Global 6500 jets worth about $400 million USD. For investors, this is really about visibility, defense exposure, and long term backlog.

See our latest analysis for Bombardier.

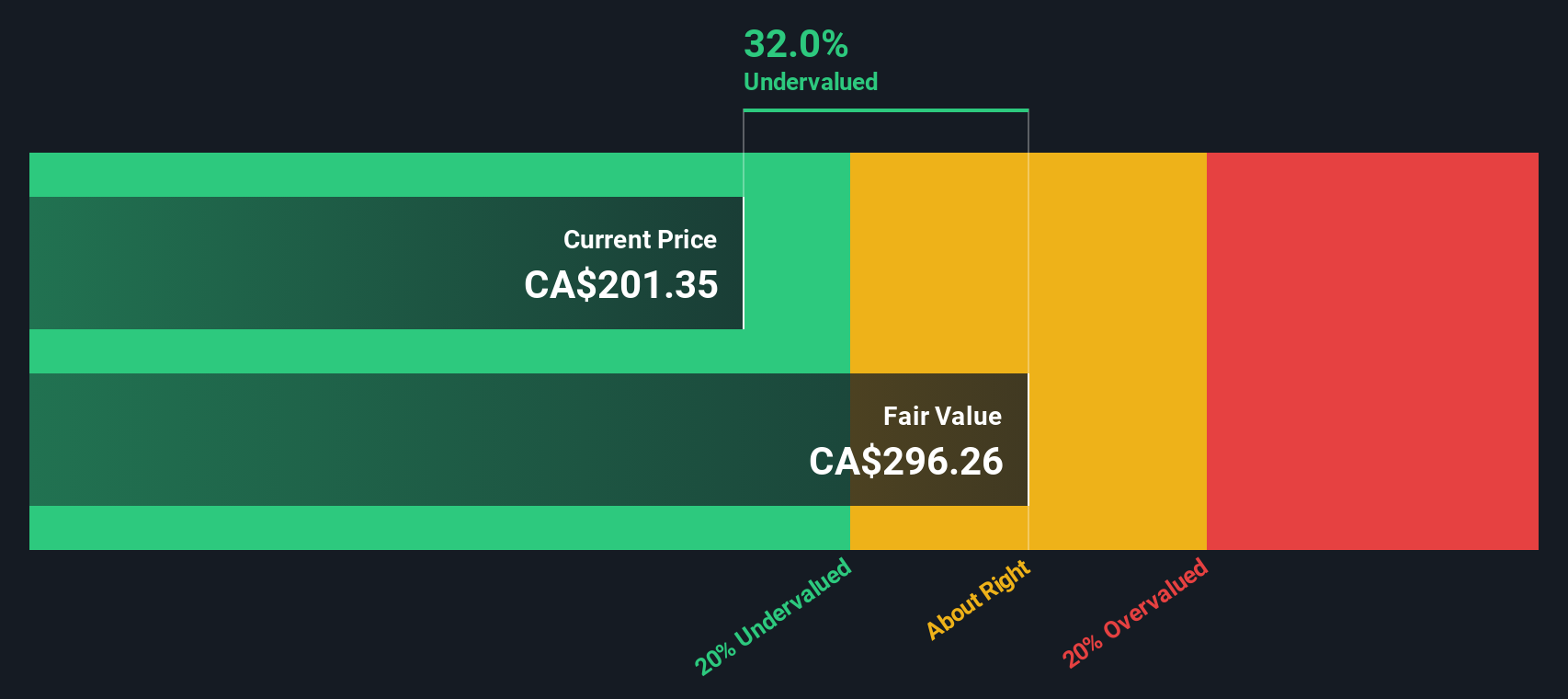

That backdrop helps explain why, even after a small wobble this week, Bombardier’s 90 day share price return of about 32 percent and five year total shareholder return near 1,773 percent signal momentum that is still very much alive.

If this defense win has you thinking more broadly about aerospace exposure, it could be a good moment to explore aerospace and defense stocks for other names riding similar tailwinds.

Yet with the share price already far above consensus targets, but trading at a sizable discount to some intrinsic value estimates, investors have to ask: Is Bombardier still a buy, or is the market already pricing in tomorrow’s growth?

Most Popular Narrative: 2.9% Overvalued

With Bombardier last closing at CA$224.73 against a narrative fair value of CA$218.48, the valuation gap is now narrow and execution focused.

Upside revisions toward the mid C$200s suggest that, despite the stock's run, valuation can still expand if management continues to execute on backlog conversion and cost discipline.

Want to see what kind of revenue runway, margin lift, and future earnings multiple are baked into that price? The narrative reveals a surprisingly ambitious profit path, backed by long dated backlog and a premium valuation framework that looks more like a secular growth story than a cyclical industrial.

Result: Fair Value of $218.48 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering concerns around business jet cyclicality and persistent supply chain bottlenecks could quickly challenge today’s ambitious growth and margin assumptions.

Find out about the key risks to this Bombardier narrative.

Another Take on Value: Cash Flows Tell a Different Story

While the narrative fair value implies Bombardier is about 2.9 percent overvalued, our DCF model paints a very different picture, suggesting fair value closer to CA$341.70, well above today’s CA$224.73 price. If cash flows are right, the question is whether the market is still underestimating this run.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bombardier for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bombardier Narrative

If you see the story differently or simply prefer to test your own assumptions using the numbers, you can build a complete view in just a few minutes: Do it your way.

A great starting point for your Bombardier research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at Bombardier when you can scan powerful new opportunities tailored to your style using Simply Wall St’s most popular stock screeners today.

- Capture potential multi baggers early by targeting high risk, high reward plays through these 3612 penny stocks with strong financials before the crowd notices them.

- Position yourself at the heart of the AI transformation by filtering for companies using these 26 AI penny stocks to power real world breakthroughs.

- Strengthen your portfolio’s income stream by zeroing in on dependable payers via these 13 dividend stocks with yields > 3% that can keep returns flowing even when markets turn.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Bombardier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BBD.B

Bombardier

Engages in the design, manufacture, and sale of business aircraft and aircraft structural components worldwide.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)