- Canada

- /

- Aerospace & Defense

- /

- TSX:BBD.B

Bombardier (TSX:BBD.B): Evaluating Value After a Strong Year of Share Price Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for Bombardier.

Bombardier’s latest surge builds on a powerful run this year, with its 30-day share price return of 14.2% and a remarkable year-to-date climb of 101.1%. This momentum is turning heads. Despite recent shifts in fundamentals, the long-term picture remains compelling, as shown by the company’s 76.7% total shareholder return over the past year and an enormous 510.7% total return over three years.

If Bombardier’s recent momentum has you thinking bigger, now is the perfect moment to broaden your outlook and discover See the full list for free.

Given Bombardier’s sizzling returns, the key question now is whether the current share price still holds hidden value or if the recent rally has already accounted for all of the company’s future growth prospects.

Most Popular Narrative: 2.7% Overvalued

Bombardier’s narrative fair value recently nudged higher, now just barely below its last close of CA$194.46. This suggests short-term optimism has caught up with long-term expectations. The market’s enthusiasm is nearing the upper bounds analysts see as justified; any upside now would need to be backed by bold execution and beats on growth.

"Robust growth in Bombardier's services and aftermarket business, including expanded service facilities and high utilization rates across a growing fleet, points to a durable, high-margin recurring revenue stream that should support long-term improvements in earnings stability and free cash flow."

Want to know what’s driving this high-stakes valuation? The under-the-radar assumptions include game-changing margin improvements and ambitious forecasts for earnings and revenue. But the numbers behind this outlook might surprise you. Get the real story and see if the case stacks up.

Result: Fair Value of $189.29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain issues or a downturn in corporate jet demand could quickly undermine Bombardier’s upbeat outlook and consensus forecasts.

Find out about the key risks to this Bombardier narrative.

Another View: What Does Our DCF Model Say?

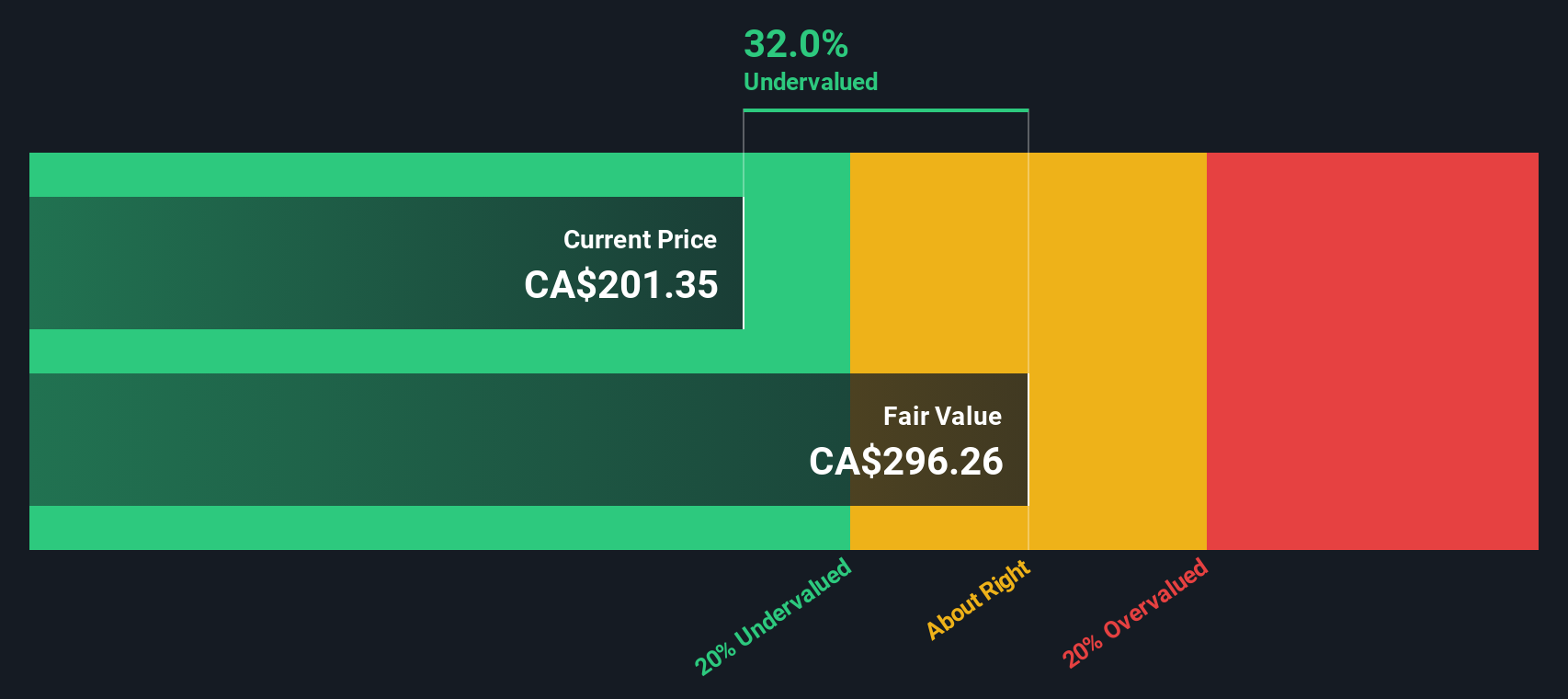

While the most popular narrative considers analyst targets and market optimism, our DCF model paints a different picture. According to this approach, Bombardier appears undervalued and is trading about 30% below our DCF-based fair value estimate. Such a gap raises the question: is the market underestimating potential long-term returns?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Bombardier Narrative

If you want to challenge the prevailing view or dig into the numbers your own way, you can build a fresh narrative in under three minutes. Do it your way

A great starting point for your Bombardier research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Ready to outpace the market? Handpicked strategies unlock opportunities you do not want to overlook. Use these screeners and set your portfolio apart.

- Target rapid growth potential by scanning these 24 AI penny stocks that are set to benefit from the AI revolution, automation breakthroughs, and relentless innovation.

- Collect reliable cash flow from these 18 dividend stocks with yields > 3% which offer attractive yields, financial resilience, and a record of steady returns even in uncertain markets.

- Capitalize on emerging technologies by checking out these 26 quantum computing stocks poised for leadership in quantum computing and next-level problem-solving.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bombardier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BBD.B

Bombardier

Engages in the design, manufacture, and sale of business aircraft and aircraft structural components worldwide.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives