Will ATS' (TSX:ATS) New CEO Hire Shift Its Automation and M&A-Driven Growth Narrative?

Reviewed by Sasha Jovanovic

- ATS Corporation has announced that Doug Wright, former CEO of Indicor and senior leader at Honeywell, will become its Chief Executive Officer and join the Board on or before January 14, 2026, with interim CEO Ryan McLeod returning to his Chief Financial Officer role once the transition occurs.

- For investors, Wright’s long history of driving organic growth, margin improvement and acquisition-led expansion across industrial and technology businesses could mark a meaningful shift in how ATS pursues its automation and services ambitions.

- Next, we’ll consider how Wright’s acquisition-focused leadership background could reshape ATS’s existing investment narrative around automation growth, margins and balance-sheet risk.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

ATS Investment Narrative Recap

To own ATS today, you need to believe that demand for complex automation and higher value services can offset current earnings weakness, order softness and leverage. The CEO appointment of Doug Wright looks directionally aligned with this thesis but does not immediately change the most important near term swing factors, which remain execution on the existing backlog and managing acquisition driven integration and balance sheet risk.

The most relevant recent announcement alongside this CEO news is ATS’s Q2 2026 result, with CAD 1,465.18 million in sales and CAD 57.8 million in net income. This print, together with Q3 fiscal 2026 revenue guidance of CAD 700–740 million, keeps the focus on how quickly ATS can translate automation demand and prior acquisitions into more consistent earnings and cash generation under incoming leadership.

Yet while the leadership change may increase confidence, investors should still be aware of the elevated leverage and the risk that...

Read the full narrative on ATS (it's free!)

ATS' narrative projects CA$3.5 billion revenue and CA$580.2 million earnings by 2028. This requires 10.5% yearly revenue growth and about a CA$619 million earnings increase from CA$-39.2 million today.

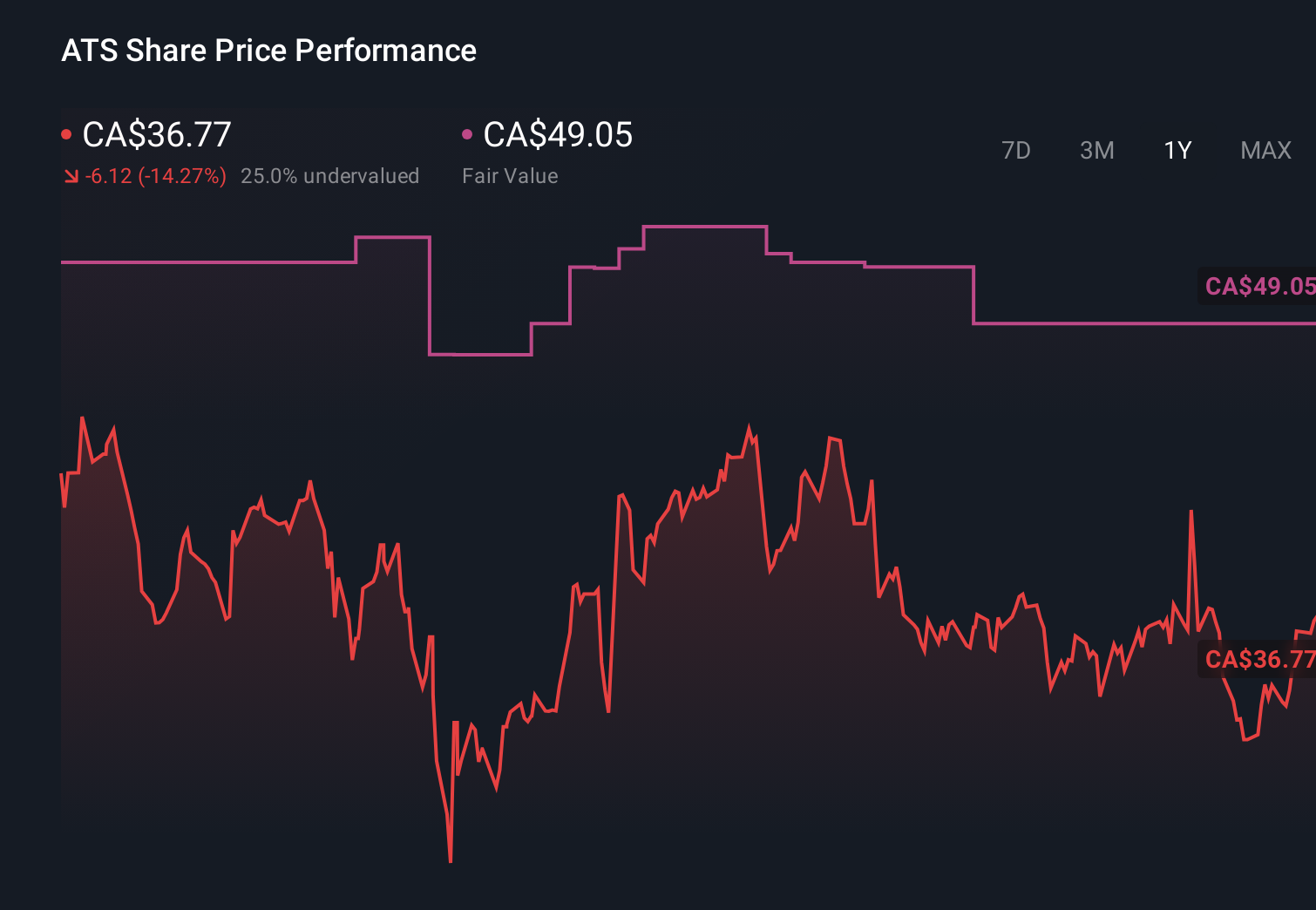

Uncover how ATS' forecasts yield a CA$49.05 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Three fair value estimates from the Simply Wall St Community span about CA$37.07 to CA$49.05, underlining how differently individual investors are viewing ATS today. You can weigh those views against the current reliance on acquisitions at a time of elevated net debt and think carefully about what that might mean for future growth and financial flexibility.

Explore 3 other fair value estimates on ATS - why the stock might be worth just CA$37.07!

Build Your Own ATS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ATS research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ATS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ATS' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATS

Reasonable growth potential and fair value.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)