Last Update 04 Sep 25

With no change in both the Future P/E (9.94x) and Discount Rate (7.92%), the consensus analyst price target for ATS also remained steady at CA$47.80.

What's in the News

- ATS issued Q2 FY26 revenue guidance of $700 million to $740 million.

- The company completed a share repurchase of 547,379 shares (0.56%) for CAD 19.6 million.

- Anne Cybulski was appointed Interim CFO; she has 16 years of experience at ATS and most recently served as VP and Corporate Controller.

- CEO Andrew Hider will step down by the end of August; CFO Ryan McLeod will serve as interim CEO while a search is conducted.

Valuation Changes

Summary of Valuation Changes for ATS

- The Consensus Analyst Price Target remained effectively unchanged, at CA$47.80.

- The Future P/E for ATS remained effectively unchanged, at 9.94x.

- The Discount Rate for ATS remained effectively unchanged, at 7.92%.

Key Takeaways

- Automation growth, innovation, and digital services position ATS for stronger recurring revenues, margin expansion, and predictable cash flow amid evolving industry demands.

- Strategic acquisitions and solutions tailored to ESG and regulated markets drive cross-selling, operating efficiencies, and sustained improvements in net and gross margins.

- Heavy reliance on acquisitions, high leverage, weakening order bookings, and concentrated backlog exposure create risks for revenue stability, margin growth, and future expansion prospects.

Catalysts

About ATS- Provides automation solutions worldwide.

- Robust demand from labor shortages and onshoring by customers is expected to increase automation spending, especially in North America where companies are addressing workforce gaps and supply chain risk-this will drive sustained top-line growth and long-term revenue visibility reflected in ATS's expanding order backlog.

- The accelerating complexity in life sciences manufacturing (e.g., novel drug approvals, radiopharma, and diabetes wearables) is pushing customers toward more advanced, automated solutions, positioning ATS to capture higher-margin, recurring revenues from regulated markets and lifecycle services, which should enhance both revenue and net margins over time.

- Rising ESG and sustainability pressures are prompting clients across industries (including energy/nuclear and food processing) to adopt more efficient, automated systems; ATS's innovation in areas like modular assembly and precision waste handling aligns well with these trends and is likely to support continued gross margin improvement.

- The shift toward services, digital solutions, and aftermarket consumables (as seen with products like Connected Care Hub and virtual reality training) is expanding ATS's recurring revenue base, offering more predictable cash flows and contributing to gradual gross margin and adjusted earnings growth.

- Integration of strategic acquisitions in high-growth sectors (life sciences, packaging, nuclear energy) is unlocking cross-selling opportunities and supply chain efficiencies-this, combined with a focus on operating leverage and ABM-driven margin expansion, is expected to drive medium-term net margin and operating earnings improvement.

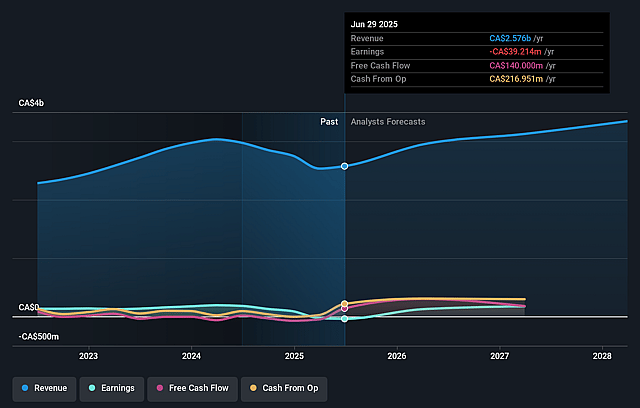

ATS Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ATS's revenue will grow by 10.5% annually over the next 3 years.

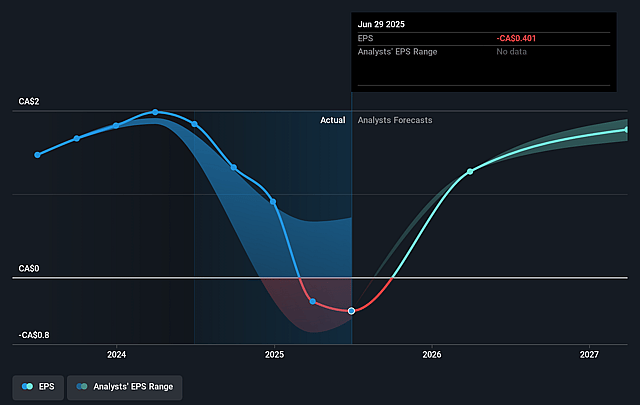

- Analysts assume that profit margins will increase from -1.5% today to 16.7% in 3 years time.

- Analysts expect earnings to reach CA$580.2 million (and earnings per share of CA$5.89) by about September 2028, up from CA$-39.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.9x on those 2028 earnings, up from -92.6x today. This future PE is lower than the current PE for the CA Machinery industry at 26.9x.

- Analysts expect the number of shares outstanding to decline by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.92%, as per the Simply Wall St company report.

ATS Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- ATS's recent growth is heavily dependent on inorganic expansion-acquisitions contributed 4.1% to recent revenue growth while organic growth was negative (−1.2%) this quarter, raising the risk that slower M&A activity or difficulties integrating acquired companies could impair future revenue and net margin expansion.

- ATS's leverage remains elevated (net debt to adjusted EBITDA of 3.6x), and management has prioritized deleveraging over large acquisitions near-term, limiting its ability to aggressively pursue high-growth opportunities and potentially constraining both future top-line growth and earnings.

- The company's order bookings fell 15% year-over-year and transportation segment demand remains weak, suggesting exposure to cyclical swings in customer capital spending could hinder revenue stability and free cash flow as macroeconomic conditions fluctuate.

- With a significant portion of Life Sciences backlog concentrated in GLP-1-related auto-injectors and variability due to lumpy large projects, ATS risks future revenue volatility and margin compression if growth in this niche slows or customers reduce orders.

- Persistent increases in SG&A expenses driven by integration costs, acquired company overhead, and personnel, alongside ongoing restructuring costs, may pressure net margins if expected operating leverage and synergy realization do not materialize as anticipated.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$47.803 for ATS based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$54.0, and the most bearish reporting a price target of just CA$42.62.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$3.5 billion, earnings will come to CA$580.2 million, and it would be trading on a PE ratio of 9.9x, assuming you use a discount rate of 7.9%.

- Given the current share price of CA$37.17, the analyst price target of CA$47.8 is 22.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.