- Canada

- /

- Aerospace & Defense

- /

- CNSX:DPRO

Draganfly (CNSX:DPRO) Is Up 18.2% After Securing Major U.S. Defense Partnerships and Army Drone Order – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Draganfly Inc. recently announced a formal partnership with Global Ordnance, a U.S. Defense Logistics Agency contractor, to accelerate U.S. defense adoption of its unmanned aerial systems, alongside its earlier selection by the U.S. Army to supply Flex FPV drone systems and establish on-site manufacturing for these drones.

- This collaboration signals Draganfly's expanded penetration into the U.S. defense market, while supporting the military's shift to decentralized innovation and enhanced supply chain resilience.

- We'll explore how Draganfly's defense sector expansion and technology integration shape its evolving investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Draganfly's Investment Narrative?

To be a shareholder in Draganfly right now, it’s fair to say you need to believe in the continued migration of U.S. defense and security budgets toward unmanned systems and sovereign manufacturing. The new partnership with Global Ordnance, and Draganfly’s expanded Army collaboration, directly address two of the most important short-term catalysts for the company: rapid U.S. defense adoption of its drones and improved supply chain resilience. These moves could help sustain the recent surge in market enthusiasm, as shown by substantial price gains. That said, the recently filed $200 million shelf registration could be a double-edged sword: while providing financial flexibility for future growth and defense ramp-up, it also increases the risk of further share dilution, an ongoing concern for current investors. The overall risk profile may have shifted, with greater near-term opportunity now coupled with heightened dilution risk and the company’s persistent lack of profitability, even as revenue forecasts remain strong and partnerships expand.

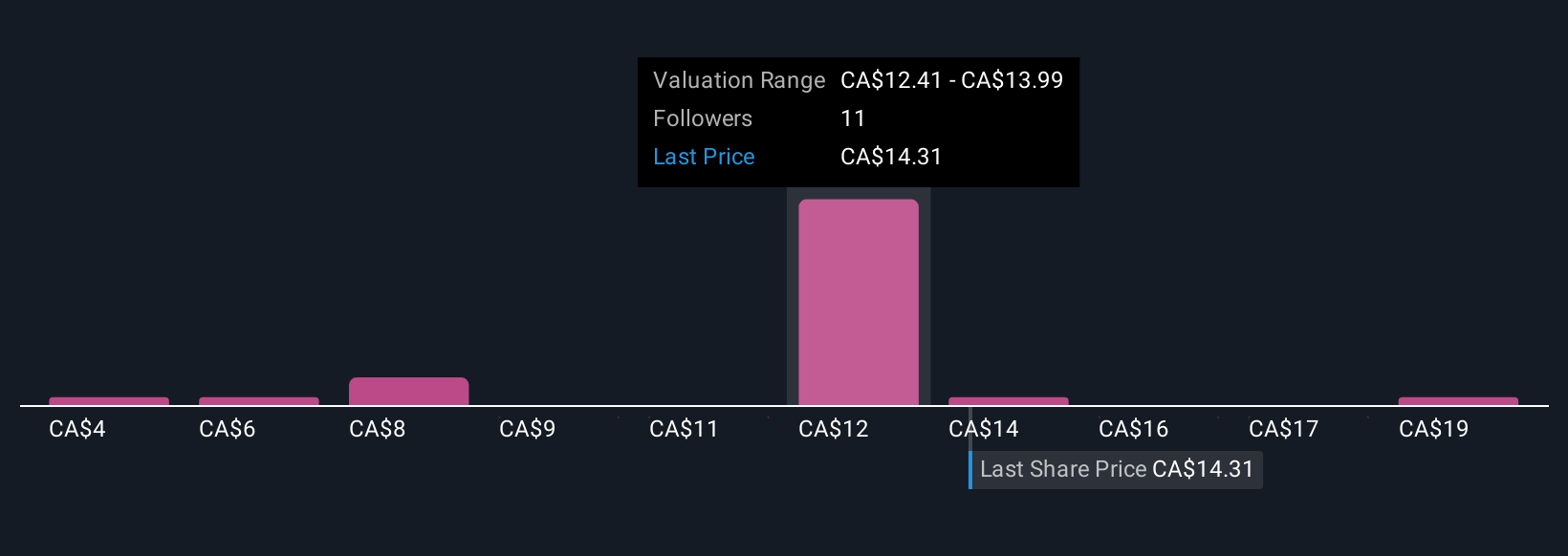

But dilution risk remains an important concern that investors should keep top of mind. The analysis detailed in our Draganfly valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore 7 other fair value estimates on Draganfly - why the stock might be worth less than half the current price!

Build Your Own Draganfly Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Draganfly research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Draganfly research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Draganfly's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:DPRO

Draganfly

Develops, manufactures, and sells cutting-edge unmanned and remote data collection and analysis platforms and systems in the United States and Canada.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)