- Canada

- /

- Food and Staples Retail

- /

- TSX:NWC

Undiscovered Gems in Canada to Watch This December 2024

Reviewed by Simply Wall St

As the Canadian market benefits from easing monetary policies and robust household spending, investor sentiment has been buoyed by strong performances in key sectors like financials and materials. In this environment, identifying promising small-cap stocks involves looking for companies with solid fundamentals that can capitalize on these favorable economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Maxim Power | 25.01% | 12.79% | 17.14% | ★★★★★☆ |

| Mako Mining | 10.21% | 38.44% | 58.78% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Corby Spirit and Wine | 65.79% | 7.46% | -5.76% | ★★★★☆☆ |

| Petrus Resources | 19.44% | 17.20% | 46.03% | ★★★★☆☆ |

| Queen's Road Capital Investment | 12.65% | 16.00% | 17.29% | ★★★★☆☆ |

| Genesis Land Development | 47.40% | 28.61% | 52.30% | ★★★★☆☆ |

| DIRTT Environmental Solutions | 58.73% | -5.34% | -5.43% | ★★★★☆☆ |

| Dundee | 3.76% | -37.57% | 44.64% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Héroux-Devtek (TSX:HRX)

Simply Wall St Value Rating: ★★★★★★

Overview: Héroux-Devtek Inc. specializes in the design, development, manufacture, and repair of aircraft landing gears and related components with a market cap of CA$1.07 billion.

Operations: Héroux-Devtek generates revenue primarily from its aerospace segment, totaling CA$694.73 million. The company's financial performance includes a focus on managing its cost structure to optimize profitability.

Héroux-Devtek, a notable player in the Aerospace & Defense sector, has demonstrated an impressive earnings growth of 213.2% over the past year, significantly outpacing the industry's 24.2%. This small-cap company reported net income for Q2 at C$9.96 million, up from C$4.63 million a year ago, with basic earnings per share rising to C$0.3 from C$0.14. The firm's net debt to equity ratio is satisfactory at 26.5%, and interest payments are well covered by EBIT at 5.4 times coverage, indicating strong financial health despite recent news of potential delisting from TSX following an arrangement agreement approval process.

- Click here and access our complete health analysis report to understand the dynamics of Héroux-Devtek.

Assess Héroux-Devtek's past performance with our detailed historical performance reports.

North West (TSX:NWC)

Simply Wall St Value Rating: ★★★★★★

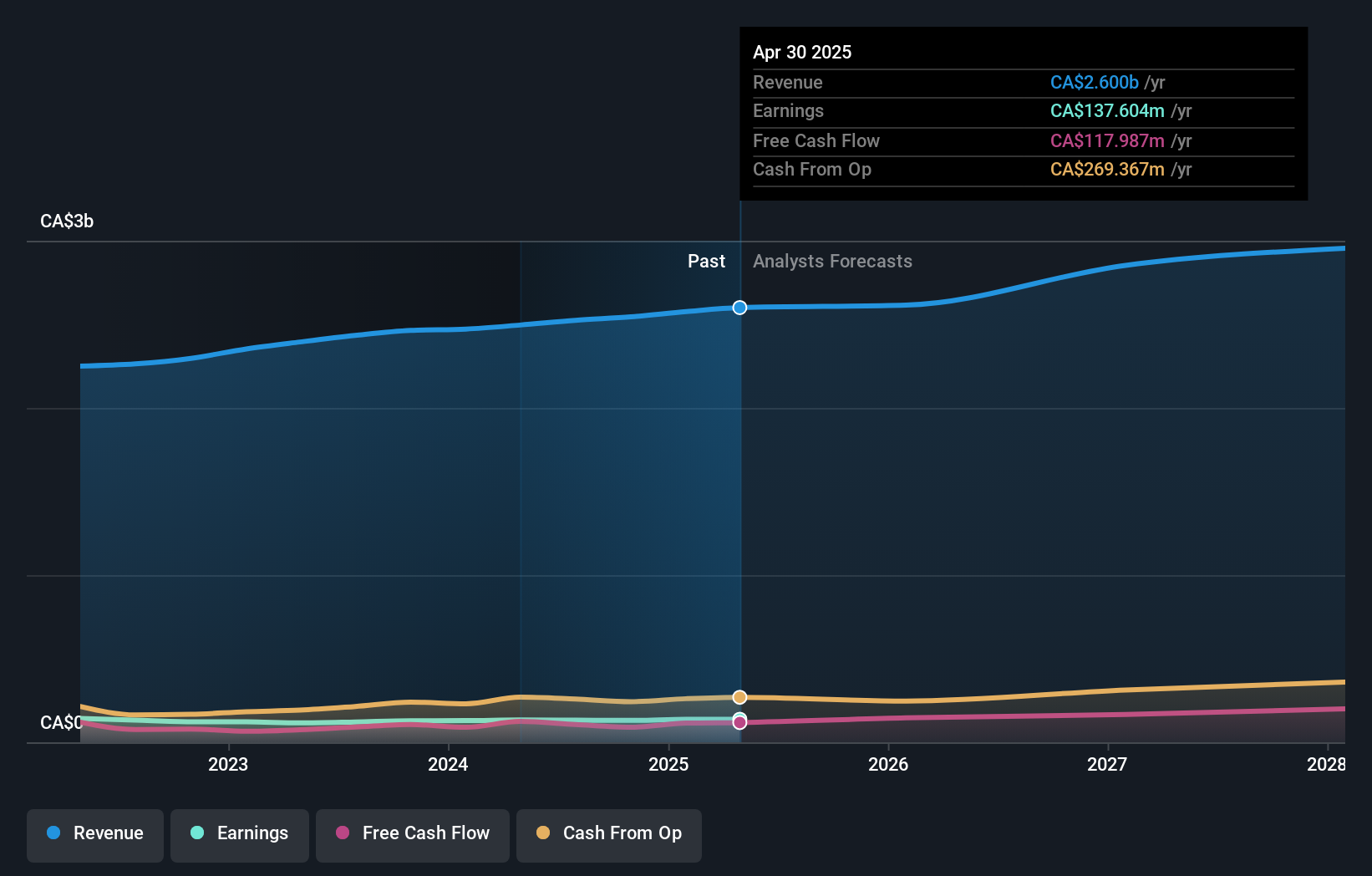

Overview: The North West Company Inc. operates as a retailer of food and everyday products and services, serving rural communities and urban neighborhood markets in northern Canada, rural Alaska, the South Pacific, and the Caribbean with a market cap of CA$2.47 billion.

Operations: North West generates revenue primarily from its retail operations, totaling CA$2.52 billion. The company's financial performance includes a focus on managing costs to impact profitability effectively.

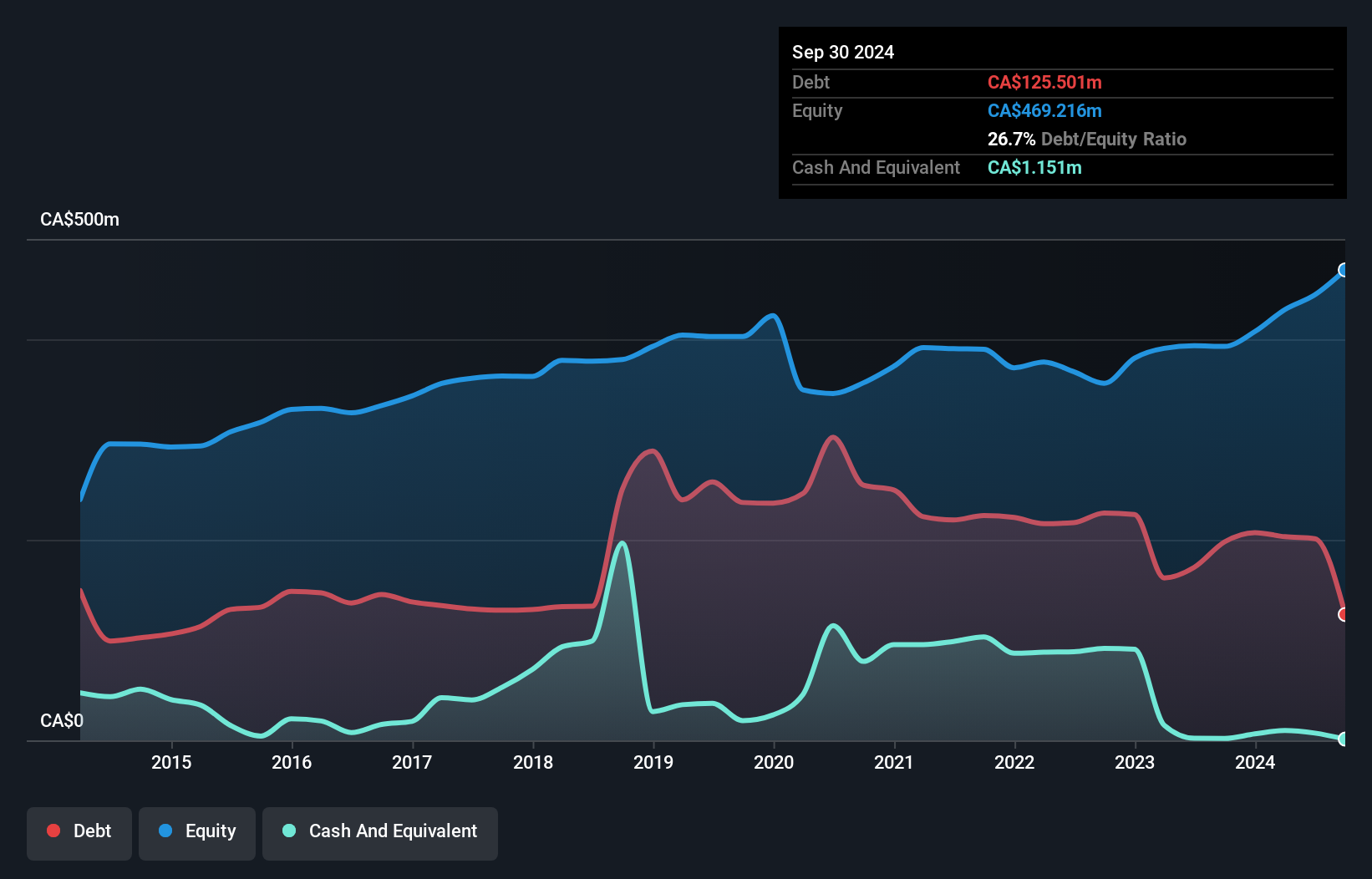

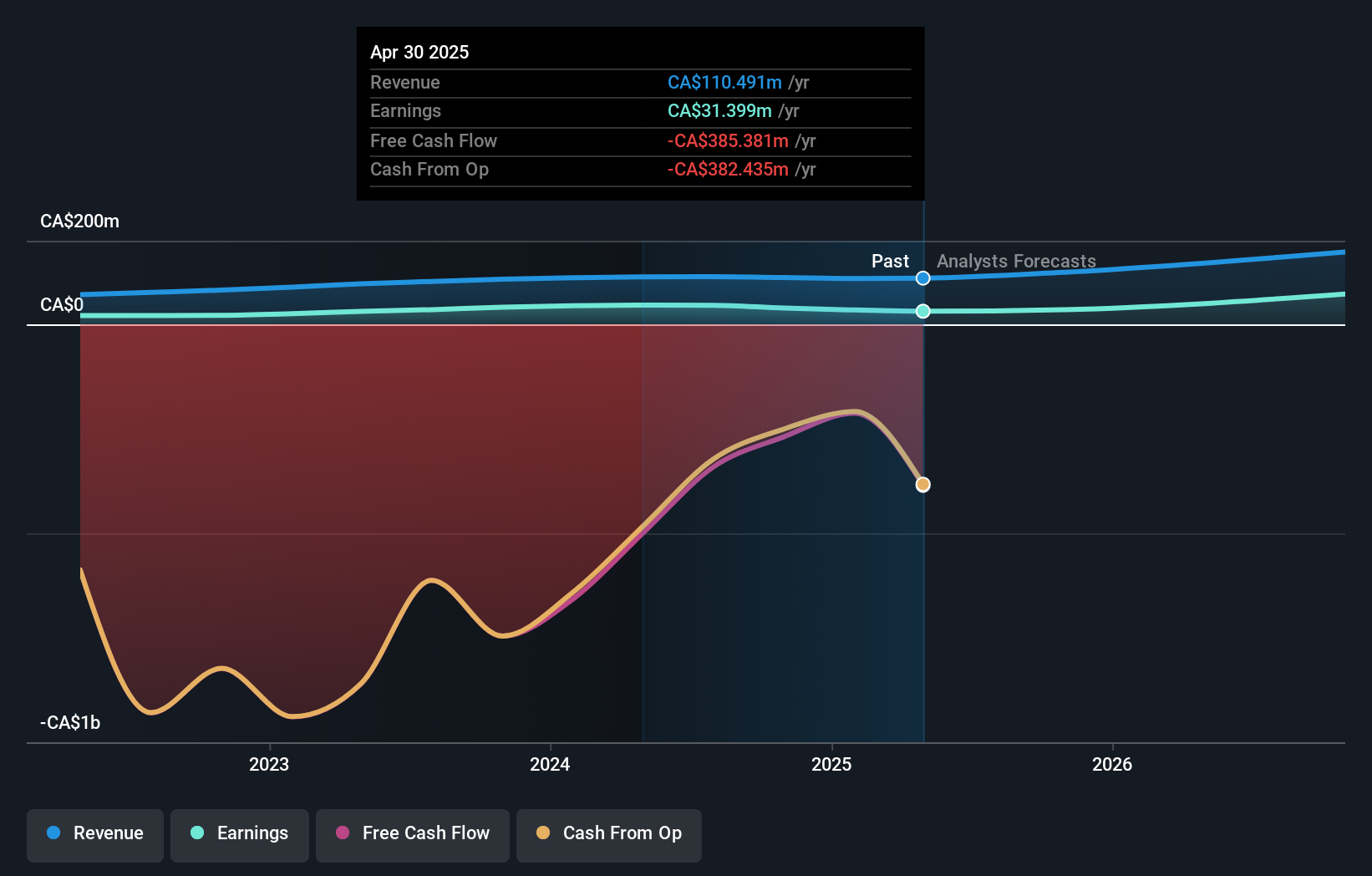

North West Company, a player in the Canadian retail landscape, shows promising financial health. Over the past year, earnings have grown by 9.5%, outpacing the Consumer Retailing industry’s -11.3%. The company's debt to equity ratio has impressively decreased from 96.7% to 43.2% over five years, indicating effective debt management with a satisfactory net debt to equity ratio of 31.4%. Despite recent insider selling activities being significant, North West trades at an attractive valuation—52.9% below its estimated fair value—suggesting potential upside for investors seeking undervalued opportunities in retail markets.

VersaBank (TSX:VBNK)

Simply Wall St Value Rating: ★★★★★★

Overview: VersaBank is a financial institution offering diverse banking products and services across Canada and the United States, with a market capitalization of CA$650.06 million.

Operations: VersaBank generates revenue primarily from its Digital Banking segment, contributing CA$105.16 million, and its DRTC segment, which adds CA$10.75 million. The company faces a deduction of CA$2.10 million due to eliminations and adjustments in its financial reporting.

VersaBank, a small player in the Canadian banking scene, has been making waves with its impressive earnings growth of 30.2% over the past year, outpacing the industry average of 11.2%. With total assets at CA$4.5 billion and equity standing at CA$409 million, it shows robust financial health. The bank's total deposits are CA$3.8 billion against loans of CA$4 billion, reflecting a solid balance between liabilities and lending activities. A price-to-earnings ratio of 14.2x suggests it's valued attractively compared to peers in Canada (14.8x). Notably, VersaBank maintains an allowance for bad loans at zero percent, indicating prudent risk management practices.

- Delve into the full analysis health report here for a deeper understanding of VersaBank.

Review our historical performance report to gain insights into VersaBank's's past performance.

Summing It All Up

- Discover the full array of 44 TSX Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if North West might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWC

North West

Through its subsidiaries, engages in the retail of food and everyday products and services to rural communities and urban neighborhood markets in northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives