- Canada

- /

- Metals and Mining

- /

- TSX:DPM

TSX Stocks That May Be Trading Below Estimated Value In December 2025

Reviewed by Simply Wall St

As the Canadian market navigates through policy shifts and global uncertainties, investors have found reasons to be thankful for strong equity gains, with the TSX on track for its most robust calendar-year return since 2009. In this context of gratitude and resilience, identifying stocks that may be trading below their estimated value can provide opportunities for investors looking to capitalize on potential growth as markets continue to evolve.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Torex Gold Resources (TSX:TXG) | CA$65.63 | CA$126.52 | 48.1% |

| Topicus.com (TSXV:TOI) | CA$131.57 | CA$228.13 | 42.3% |

| Neo Performance Materials (TSX:NEO) | CA$17.00 | CA$31.67 | 46.3% |

| Montage Gold (TSX:MAU) | CA$8.49 | CA$15.16 | 44% |

| Kinaxis (TSX:KXS) | CA$174.61 | CA$291.01 | 40% |

| Haivision Systems (TSX:HAI) | CA$5.17 | CA$8.65 | 40.2% |

| GURU Organic Energy (TSX:GURU) | CA$4.87 | CA$8.91 | 45.3% |

| Dexterra Group (TSX:DXT) | CA$11.99 | CA$22.86 | 47.5% |

| Decisive Dividend (TSXV:DE) | CA$7.21 | CA$14.18 | 49.2% |

| Constellation Software (TSX:CSU) | CA$3382.25 | CA$5943.10 | 43.1% |

We'll examine a selection from our screener results.

DPM Metals (TSX:DPM)

Overview: DPM Metals Inc., a gold mining company, focuses on acquiring, exploring, developing, mining, and processing precious metals with a market cap of CA$8.65 billion.

Operations: The company's revenue primarily comes from its operations at Chelopech, generating $508.73 million, and Ada Tepe, contributing $226.60 million.

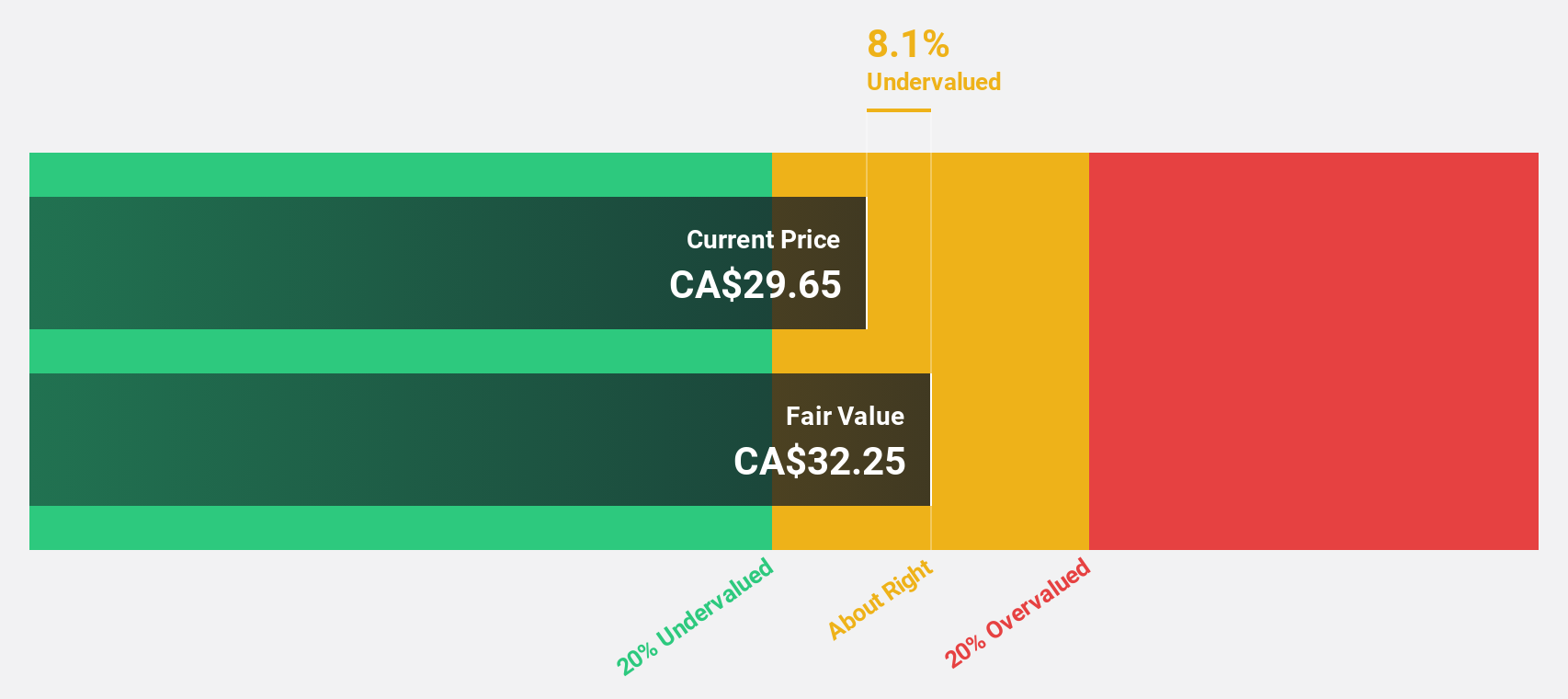

Estimated Discount To Fair Value: 29.0%

DPM Metals is trading at a significant discount to its estimated fair value, with earnings projected to grow substantially above the market average. Despite shareholder dilution over the past year, DPM's recent feasibility study for the Coka Rakita project in Serbia highlights strong economic potential and aligns with their mining expertise. Continued exploration success at Chelopech further supports growth prospects. These factors suggest that DPM may present an undervalued opportunity based on cash flow analysis.

- According our earnings growth report, there's an indication that DPM Metals might be ready to expand.

- Get an in-depth perspective on DPM Metals' balance sheet by reading our health report here.

Montage Gold (TSX:MAU)

Overview: Montage Gold Corp. focuses on the acquisition, exploration, and development of mineral properties in Africa with a market cap of CA$3.08 billion.

Operations: Montage Gold Corp. does not currently report any revenue segments.

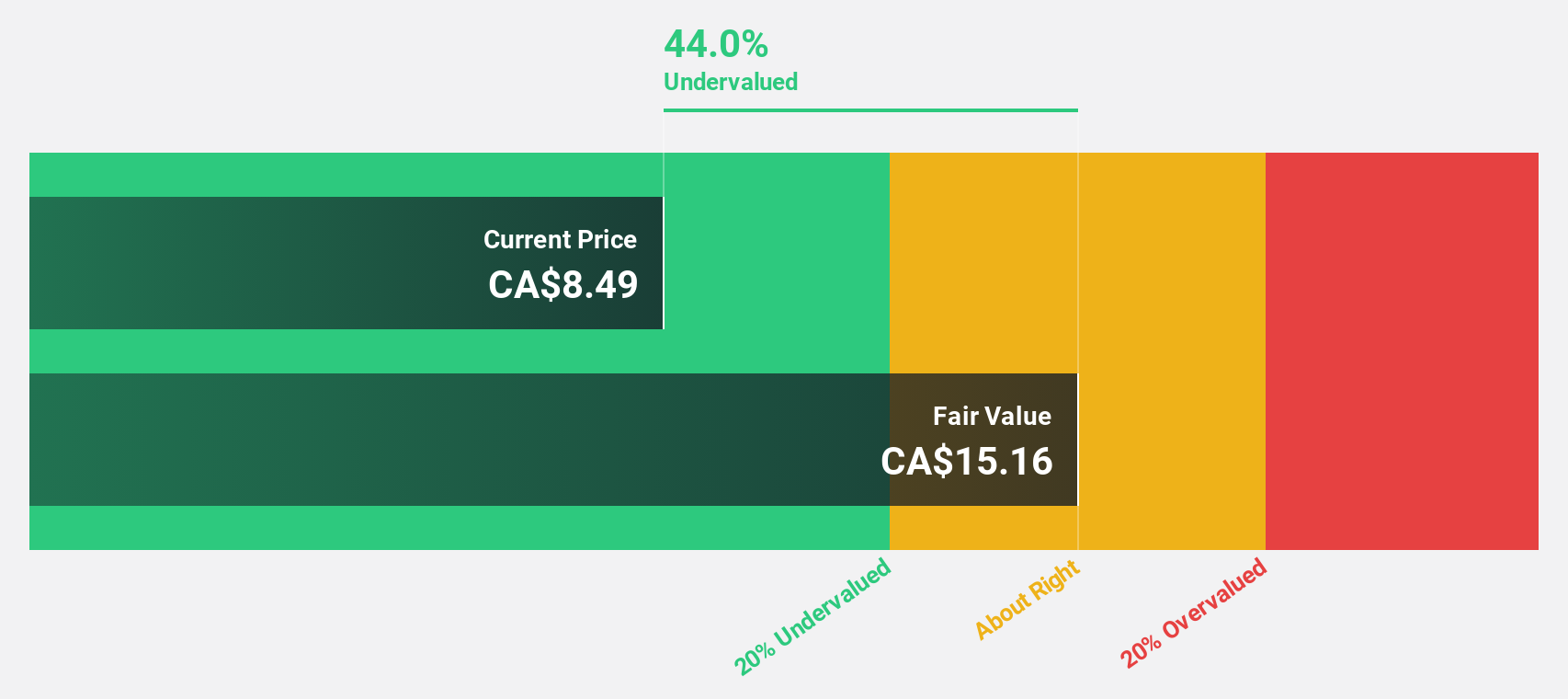

Estimated Discount To Fair Value: 44%

Montage Gold, trading at CA$8.49, is undervalued with a fair value estimate of CA$15.16, supported by rapid exploration progress at its Kone project in Cote d'Ivoire. Despite current low revenue, the company forecasts robust annual revenue growth of 62.7%, outpacing the Canadian market's 4.8%. Recent high-grade drill results from the Petit Yao target enhance potential resource expansion, while ongoing efforts to integrate higher-grade materials could optimize future cash flows and profitability within three years.

- Our comprehensive growth report raises the possibility that Montage Gold is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Montage Gold.

VersaBank (TSX:VBNK)

Overview: VersaBank offers a range of banking products and services in Canada and the United States, with a market cap of CA$532.05 million.

Operations: The company's revenue segments include CA$96.56 million from Digital Banking Canada and CA$8.83 million from DRTC, which encompasses cybersecurity services and banking and financial technology development.

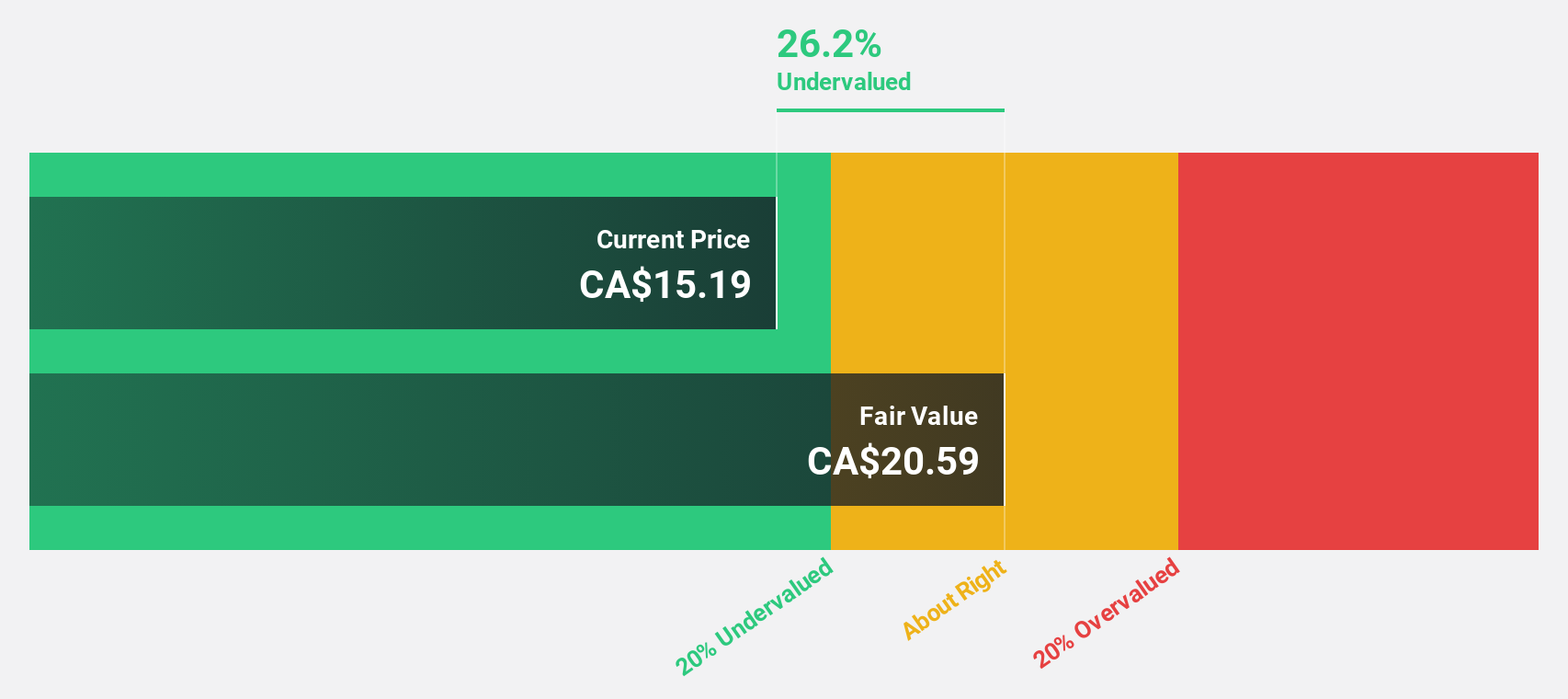

Estimated Discount To Fair Value: 18.1%

VersaBank, trading at CA$16.54, is undervalued with a fair value estimate of CA$20.2, reflecting its potential for significant earnings growth of 71.7% annually over the next three years. Despite a decline in net income to CA$6.58 million from CA$9.71 million year-over-year, revenue growth remains strong at 26.5% per year, surpassing the Canadian market average of 4.8%. Recent share buybacks and inclusion in the S&P Global BMI Index underscore investor confidence despite reduced profit margins and recent shareholder dilution concerns.

- Insights from our recent growth report point to a promising forecast for VersaBank's business outlook.

- Click here to discover the nuances of VersaBank with our detailed financial health report.

Taking Advantage

- Gain an insight into the universe of 29 Undervalued TSX Stocks Based On Cash Flows by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DPM

DPM Metals

A gold mining company, engages in the acquisition, exploration, development, mining, and processing of precious metals.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026