- Canada

- /

- Metals and Mining

- /

- TSX:IVN

3 TSX Growth Stocks Insiders Are Betting On

Reviewed by Simply Wall St

As the Canadian market navigates ongoing trade negotiations and economic uncertainties, investors are keenly observing sectors that offer resilience and growth potential. In such an environment, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| VersaBank (TSX:VBNK) | 10.4% | 61.8% |

| Tenaz Energy (TSX:TNZ) | 10.3% | 151.2% |

| Robex Resources (TSXV:RBX) | 24.4% | 90.3% |

| Propel Holdings (TSX:PRL) | 36.2% | 33% |

| goeasy (TSX:GSY) | 21.9% | 18.2% |

| Enterprise Group (TSX:E) | 32.2% | 24.8% |

| Discovery Silver (TSX:DSV) | 15.1% | 39.3% |

| Burcon NutraScience (TSX:BU) | 15.1% | 125.9% |

| Aritzia (TSX:ATZ) | 17.4% | 24.7% |

| Almonty Industries (TSX:AII) | 11.2% | 56.2% |

Let's uncover some gems from our specialized screener.

CI Financial (TSX:CIX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CI Financial Corp. is a publicly owned asset management holding company with a market cap of CA$4.56 billion.

Operations: The company's revenue is derived from three main segments: Asset Management (CA$1.90 billion), U.S. Wealth Management (CA$1.18 billion), and Canada Wealth Management (CA$1.00 billion).

Insider Ownership: 10.1%

Earnings Growth Forecast: 42.7% p.a.

CI Financial's recent earnings report shows a significant reduction in net loss, with revenue increasing to C$787.74 million from C$645.68 million year-over-year. Despite this, the company faces challenges as its revenue growth is expected to lag behind the market average at 0.07% annually. Insider activity has seen substantial selling recently, and while CI Financial is forecasted to achieve profitability within three years, its dividend sustainability remains questionable due to insufficient earnings coverage.

- Navigate through the intricacies of CI Financial with our comprehensive analyst estimates report here.

- The analysis detailed in our CI Financial valuation report hints at an deflated share price compared to its estimated value.

Ivanhoe Mines (TSX:IVN)

Simply Wall St Growth Rating: ★★★★★☆

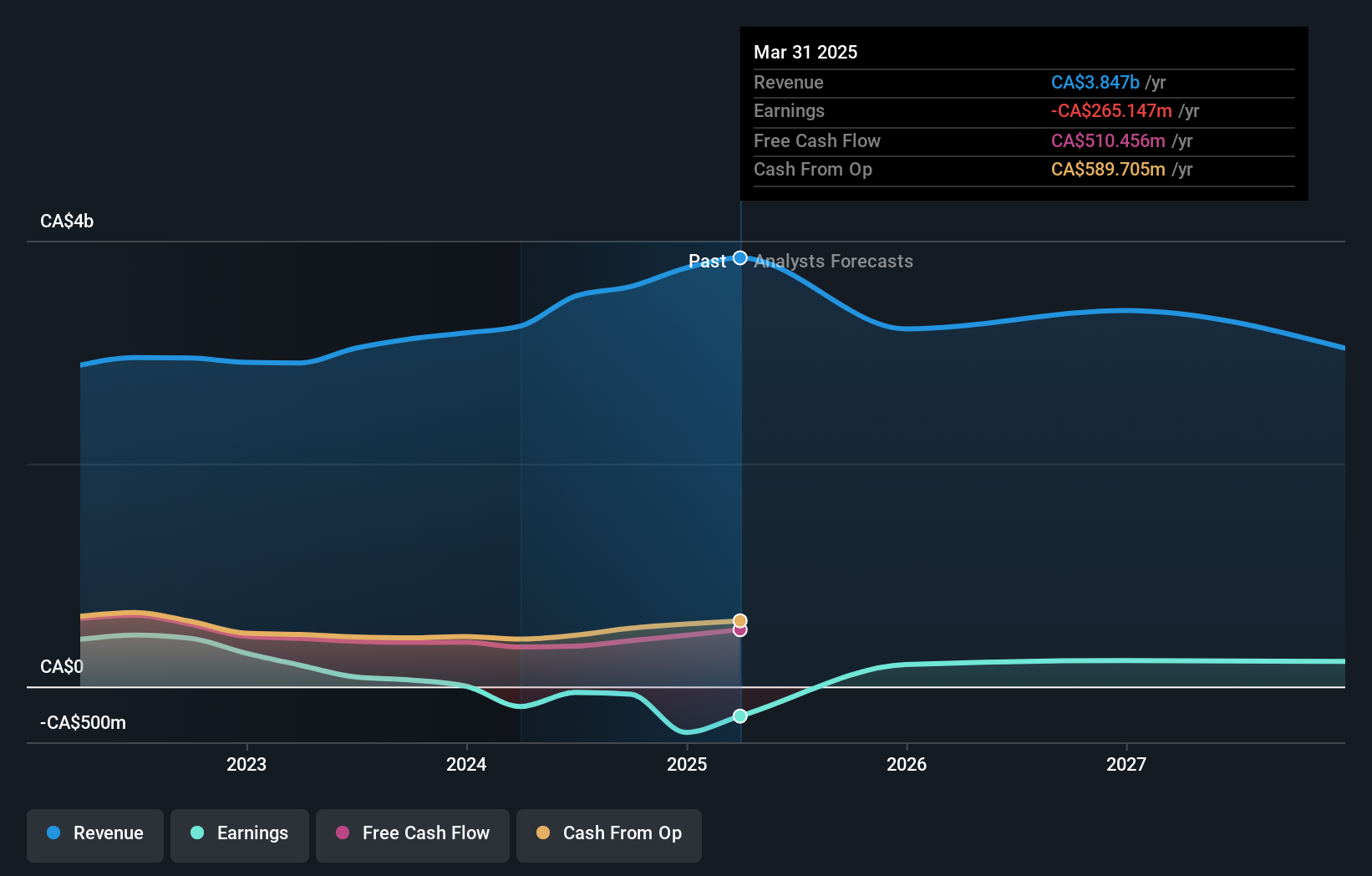

Overview: Ivanhoe Mines Ltd., with a market cap of CA$13.63 billion, is involved in the mining, development, and exploration of minerals and precious metals in Africa through its subsidiaries.

Operations: Ivanhoe Mines Ltd. operates in the mining, development, and exploration of minerals and precious metals across Africa through its subsidiaries.

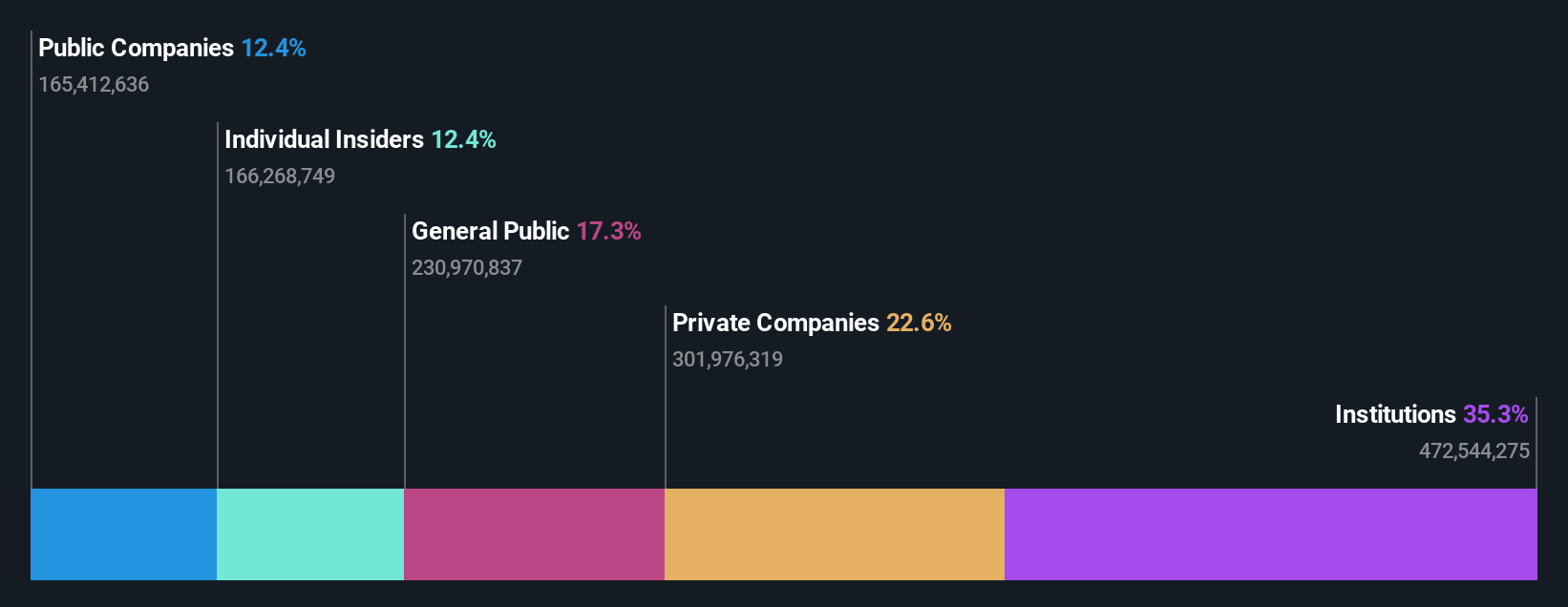

Insider Ownership: 12.5%

Earnings Growth Forecast: 22.6% p.a.

Ivanhoe Mines demonstrates strong growth potential with forecasted earnings and revenue growth rates significantly outpacing the Canadian market. Despite recent seismic challenges at its Kakula Mine, operations have resumed safely, and production guidance for 2025 remains intact. Insider activity shows more buying than selling recently, though not in large volumes. The appointment of Ms. Iman Naguib as an Independent Director underscores Ivanhoe's commitment to enhancing board expertise amid its substantial mining ventures in Africa and Canada.

- Take a closer look at Ivanhoe Mines' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Ivanhoe Mines is trading behind its estimated value.

VersaBank (TSX:VBNK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VersaBank offers a range of banking products and services in Canada and the United States, with a market capitalization of CA$506.64 million.

Operations: VersaBank's revenue is primarily generated from Digital Banking Canada, contributing CA$96.26 million, and DRTC, which encompasses cybersecurity services and banking and financial technology development, adding CA$9.24 million.

Insider Ownership: 10.4%

Earnings Growth Forecast: 61.8% p.a.

VersaBank's earnings and revenue are forecast to grow significantly, outpacing the Canadian market. Recent insider activity shows more buying than selling, indicating confidence in its growth trajectory. Despite a recent decline in net income for Q2 2025, the bank is trading below its estimated fair value and has announced a share repurchase program. Leadership changes include Susan McGovern as interim CEO amid structural realignment efforts, reflecting strategic shifts within the organization.

- Click to explore a detailed breakdown of our findings in VersaBank's earnings growth report.

- Our expertly prepared valuation report VersaBank implies its share price may be lower than expected.

Make It Happen

- Access the full spectrum of 45 Fast Growing TSX Companies With High Insider Ownership by clicking on this link.

- Ready For A Different Approach? The latest GPUs need a type of rare earth metal called Neodymium and there are only 24 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals in Africa.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives