The board of VersaBank (TSE:VB) has announced that it will pay a dividend on the 31st of July, with investors receiving CA$0.025 per share. This means the annual payment will be 0.8% of the current stock price, which is lower than the industry average.

See our latest analysis for VersaBank

VersaBank's Payment Has Solid Earnings Coverage

If it is predictable over a long period, even low dividend yields can be attractive. Based on the last payment, VersaBank was earning enough to cover the dividend, but free cash flows weren't positive. We think that cash flows should take priority over earnings, so this is definitely a worry for the dividend going forward.

Looking forward, earnings per share could rise by 21.9% over the next year if the trend from the last few years continues. If the dividend continues along recent trends, we estimate the payout ratio will be 14%, which is in the range that makes us comfortable with the sustainability of the dividend.

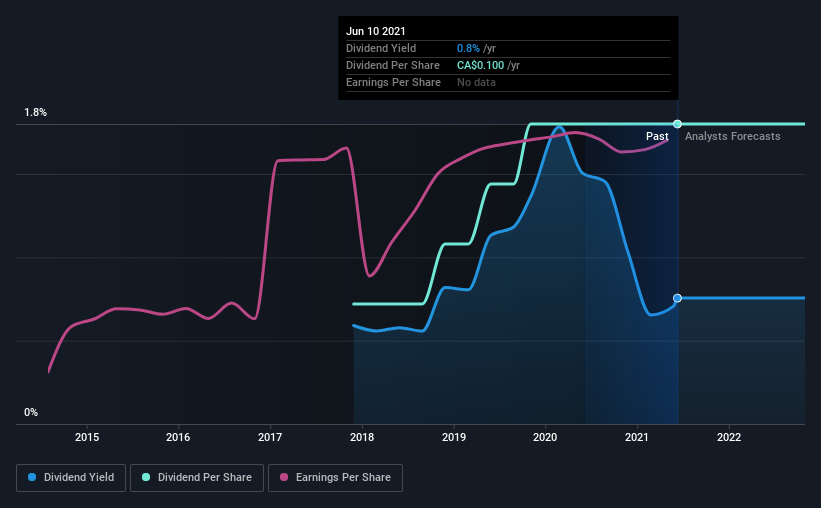

VersaBank Doesn't Have A Long Payment History

Looking back, the dividend has been stable, but the company hasn't been paying a dividend for very long so we can't be confident that the dividend will remain stable through all economic environments. Since 2017, the first annual payment was CA$0.04, compared to the most recent full-year payment of CA$0.10. This works out to be a compound annual growth rate (CAGR) of approximately 26% a year over that time. It is always nice to see strong dividend growth, but with such a short payment history we wouldn't be inclined to rely on it until a longer track record can be developed.

The Dividend Looks Likely To Grow

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. It's encouraging to see VersaBank has been growing its earnings per share at 22% a year over the past five years. Earnings have been growing rapidly, and with a low payout ratio we think that the company could turn out to be a great dividend stock.

In Summary

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. While the low payout ratio is redeeming feature, this is offset by the minimal cash to cover the payments. This company is not in the top tier of income providing stocks.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. Are management backing themselves to deliver performance? Check their shareholdings in VersaBank in our latest insider ownership analysis. Looking for more high-yielding dividend ideas? Try our curated list of strong dividend payers.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:VBNK

VersaBank

Provides various banking products and services in Canada and the United States.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)