Taking Stock of TD Bank (TSX:TD) Valuation After Strong Q4 2025 Earnings and Upbeat Outlook

Reviewed by Simply Wall St

Toronto-Dominion Bank (TSX:TD) is back on investors’ radar after a strong fiscal Q4 2025 earnings release, where broad based revenue growth and upbeat guidance sparked fresh interest in the stock.

See our latest analysis for Toronto-Dominion Bank.

The earnings surprise and stepped up capital returns, including a larger buyback and a move to semi annual dividend decisions, have contributed to an 18.3% 3 month share price return and a 73.7% 1 year total shareholder return, suggesting momentum is still building rather than fading.

If TD’s run has you rethinking where the next leg of growth could come from, it is worth exploring fast growing stocks with high insider ownership as another source of strong, shareholder aligned ideas.

With TD now trading near analyst targets after a stellar year and visible earnings momentum, the key question is whether shares remain undervalued on an intrinsic basis or if the market is already pricing in the next leg of growth.

Most Popular Narrative: 6.5% Overvalued

Toronto Dominion Bank's most followed narrative pegs fair value below the CA$125.80 last close, implying the recent rally has pulled the share price ahead of fundamentals.

The analysts have a consensus price target of CA$106.0 for Toronto Dominion Bank based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$120.0, and the most bearish reporting a price target of just CA$93.0.

Want to know why a mature bank is being valued on a richer future earnings multiple, even as profits and margins are projected to shrink meaningfully? The answer sits inside this narrative's revenue, margin, and buyback assumptions, and it upends what most investors think drives TD's fair value today.

Result: Fair Value of $118.13 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, TD’s digital execution and disciplined restructuring could preserve margins and unlock faster growth, which may challenge assumptions of prolonged earnings pressure and muted loan expansion.

Find out about the key risks to this Toronto-Dominion Bank narrative.

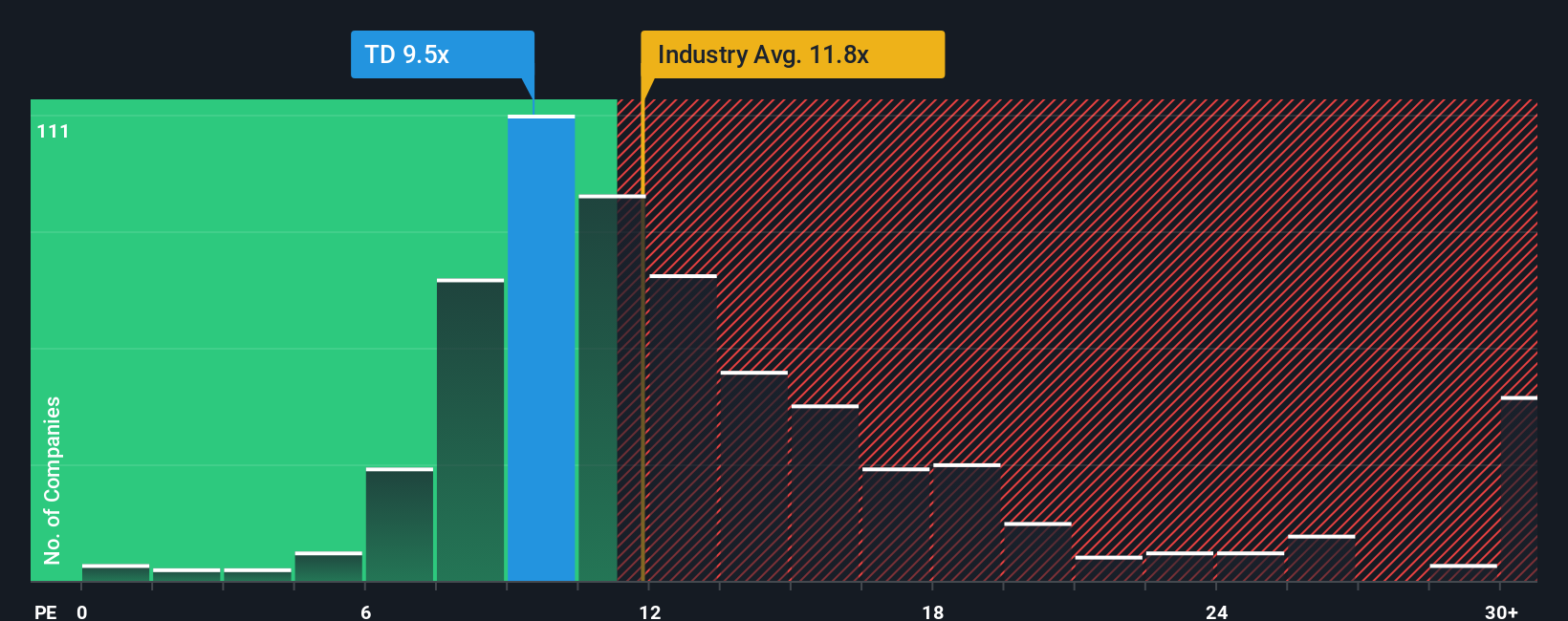

Another Lens on Value: Earnings Multiple Signals Opportunity

While the consensus narrative calls TD 6.5% overvalued, its current price to earnings ratio of 10.6 times sits below both its fair ratio of 11.5 times and the North American banks average of 12 times, suggesting the market still applies a discount rather than a premium.

If sentiment or earnings expectations shift, that discount could narrow, offering upside. It also means any negative surprise might erase the gap quickly. How much weight should you put on today’s multiple when deciding whether to add or trim?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Toronto-Dominion Bank Narrative

If you see things differently or want to stress test the assumptions yourself, you can build a custom, data-driven view of TD in under three minutes: Do it your way.

A great starting point for your Toronto-Dominion Bank research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for your next investing move?

If TD feels fully priced, do not sit on the sidelines. Use the Simply Wall St Screener to uncover your next high conviction opportunity in minutes.

- Capture upside in early stage names by targeting quality using these 3606 penny stocks with strong financials with stronger balance sheets and fundamentals than the typical speculative small cap.

- Position your portfolio for structural growth by focusing on these 30 healthcare AI stocks at the intersection of medicine, data, and automation, where adoption is only just beginning.

- Explore income potential by reviewing these 13 dividend stocks with yields > 3% that combine yields above 3 percent with fundamental support instead of stretching for risky payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Toronto-Dominion Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TD

Toronto-Dominion Bank

Provides various financial products and services in Canada, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)