Royal Bank of Canada (TSX:RY) Reports Strong Q3 Earnings and Announces Dividend Amid Rising Noninterest Expenses

Reviewed by Simply Wall St

The Royal Bank of Canada (TSX:RY) is currently experiencing a mix of strong financial performance and emerging challenges. Recent developments include solid third-quarter earnings and significant market share gains, contrasted by rising noninterest expenses and increased impaired loans. In the discussion that follows, we will examine Royal Bank of Canada's strengths, weaknesses, growth opportunities, and potential threats to provide a comprehensive overview of the bank's current business situation.

Click to explore a detailed breakdown of our findings on Royal Bank of Canada.

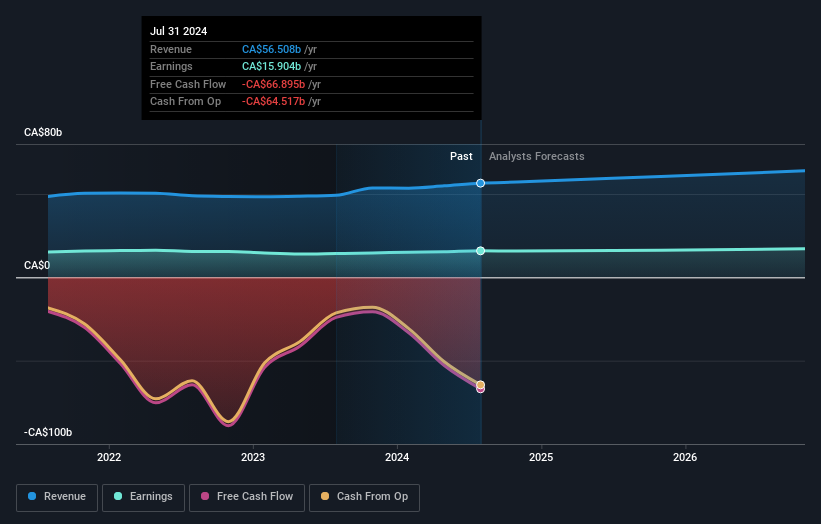

Royal Bank of Canada (RY) demonstrates strong earnings with reported third-quarter earnings of $4.5 billion, underpinned by strength across its largest businesses, as highlighted by CEO Dave McKay. The bank's Canadian Banking net interest income rose by 26% year-over-year, excluding the impact of HSBC Bank Canada. Additionally, RY's capital markets division reported revenue of $3 billion, generating pre-tax, pre-provision earnings of $1.2 billion, indicating significant market share gains. The company's credit quality remains strong, and it boasts a high return on equity of 15.5%, with an adjusted ROE of 16.4%. Furthermore, strong earnings have generated significant capital, with a 70 basis points increase this quarter. The bank's customer satisfaction is noteworthy, ranking #1 in customer satisfaction in both the J.D. Power 2024 Canada banking app mobile satisfaction study and the Canada online banking satisfaction study. Notably, RY is currently trading at CA$167.84, significantly below the estimated fair value of CA$247.12, indicating it may be undervalued.

However it faces several challenges. Noninterest expenses have increased by 11% from last year, excluding HSBC Canada integration costs, as noted by Interim CFO Katherine Gibson. Additionally, the Canadian market's higher interest rates and rising unemployment are impacting consumer spending and business investment, as highlighted by CEO Dave McKay. The bank's gross impaired loans have risen by $353 million, primarily due to increases in Canadian Banking. RY's price-to-earnings ratio (14.9x) is higher compared to the peer average (14.7x) and the North American Banks industry average (11.6x), indicating it may be expensive relative to its peers. Furthermore, the bank's return on equity, forecasted to be 12.7% in three years, is considered low.

The bank is confident in achieving its expense synergy goal of $740 million per year, as stated by CEO Dave McKay. Additionally, there is good mobile adoption and an increase in appointments and renewals, as noted by Neil McLaughlin, Group Head, Personal and Commercial Banking. The upcoming expansion of trade finance and global cash management offerings for combined commercial banking clients presents further growth potential. With a constructive market backdrop, the bank sees continued strength in the coming year, as highlighted by Derek Neldner, Group Head, Capital Markets. RY's earnings are forecast to grow at 2.47% per year, and its revenue is expected to grow at 5.6% per year, albeit slower than the Canadian market average of 7% per year.

Threats: Key Risks and Challenges That Could Impact Royal Bank of Canada's Success

Royal Bank of Canada faces several threats that could impact its success. Economic uncertainty and geopolitical volatility pose significant risks, as highlighted by CEO Dave McKay. The bank also faces intense competition, requiring a disciplined approach to balance growth and spreads. Regulatory challenges present another hurdle, with high bars to clear for synergies, as noted by CEO David McKay. Market volatility could slow the velocity of moving deals from announcement to close, further complicating the bank's operations. Additionally, the bank's earnings growth of 2.5% per year is forecasted to be slower than the Canadian market average of 14.9% per year, potentially impacting its competitive positioning.

To gain deeper insights into Royal Bank of Canada's historical performance, explore our detailed analysis of past performance.To dive deeper into how Royal Bank of Canada's valuation metrics are shaping its market position, check out our detailed analysis of Royal Bank of Canada's Valuation.

Conclusion

Royal Bank of Canada demonstrates strong financial health with significant earnings, solid credit quality, and high customer satisfaction, all of which contribute to a positive outlook for the bank. However, the increase in noninterest expenses, rising gross impaired loans, and higher price-to-earnings ratio relative to peers indicate potential challenges. The bank's growth opportunities, such as achieving expense synergies and expanding trade finance offerings, are promising but must be weighed against economic uncertainties and regulatory hurdles. Given that the company's current trading price of CA$167.84 is significantly below its estimated fair value of CA$247.12, the bank appears to have substantial upside potential, making it an attractive investment despite the slower forecasted earnings growth compared to the Canadian market average.

Have a stake in Royal Bank of Canada? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management .

- Find companies with promising cash flow potential yet trading below their fair value .

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSX:RY

Royal Bank of Canada

Operates as a diversified financial service company worldwide.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives