RBC (TSX:RY) Q3 Cost Discipline Lifts Margins, Reinforcing Bullish Efficiency Narrative

Reviewed by Simply Wall St

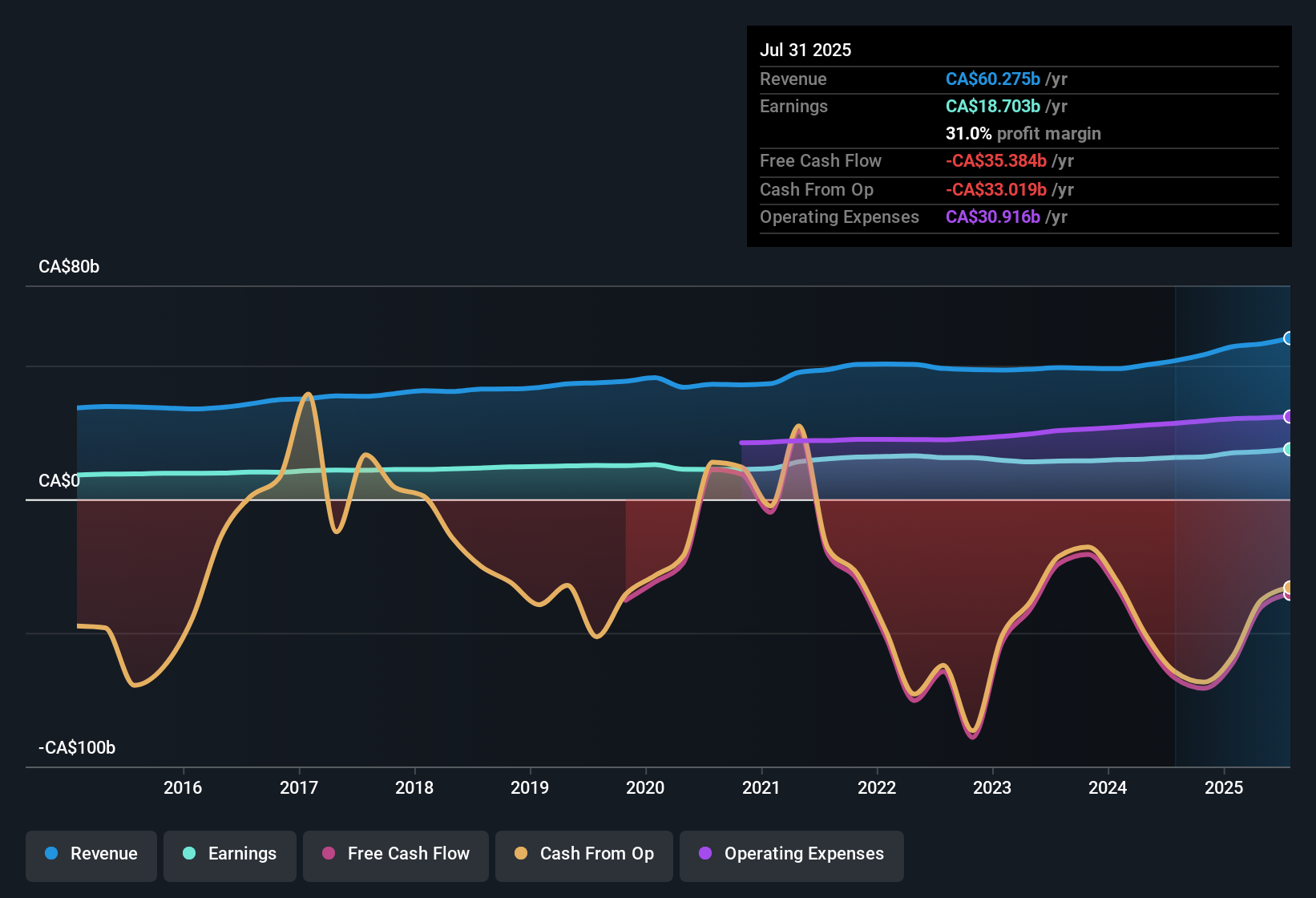

Royal Bank of Canada (TSX:RY) just posted another solid print for FY 2025 Q3, with revenue of about CA$16.1 billion and EPS of CA$3.76 underpinned by net income of CA$5.3 billion. The bank has seen revenue move from roughly CA$13.2 billion in Q2 2024 to CA$14.2 billion in Q4 2024 and then to CA$16.1 billion this quarter, while trailing twelve month EPS climbed from CA$10.74 in Q2 2024 to CA$13.25 by Q3 2025, setting up a results season in which margins and earnings power are firmly in focus for investors.

See our full analysis for Royal Bank of Canada.With the latest scorecard on the table, the next step is to see how these numbers line up against the dominant narratives around Royal Bank of Canada to reveal which stories hold up and which ones the data now calls into question.

See what the community is saying about Royal Bank of Canada

Cost discipline supports 31% net margin

- RBC kept its cost to income ratio near the low 50s, improving from 54.5% in Q2 2025 to 53.5% in Q3, alongside a trailing 12 month net profit margin of 31% compared with 30.2% a year earlier.

- Analysts' consensus narrative highlights cost management and digital efficiency as key profit drivers, and these numbers largely back that up:

- The steady move down from a 57.1% cost to income ratio on a trailing basis in FY 2024 Q4 to the low 50s in 2025 mirrors the story of AI and digitalization lifting efficiency.

- With trailing net income at about CA$18.7 billion on CA$60.3 billion of revenue, the 31% margin gives some numerical weight to the view that RBC is turning those tech and integration investments into real operating leverage.

As margins hold near 31% while costs inch lower, bulls see a bank quietly tightening efficiency behind the scenes and positioning for stronger long term profitability when revenue growth improves. 🐂 Royal Bank of Canada Bull Case

Non performing loans rise to CA$8.8 billion

- Non performing loans have climbed from CA$5.3 billion in Q2 2024 to CA$8.8 billion in Q3 2025, while the allowance for bad loans is described as low at 83%.

- Bears focus on credit cycle risks, and the recent data gives them specific pressure points to watch:

- The step up in non performing loans from CA$5.9 billion at FY 2024 Q4 to CA$8.8 billion now lines up with concerns about elevated credit losses and softer Canadian consumer and commercial credit.

- With trailing 12 month earnings at CA$18.7 billion, RBC still has a large profit buffer, but the combination of higher problem loans and a relatively low allowance percentage supports the cautious view that credit costs could eat into those profits if conditions worsen.

As credit quality softens and allowances stay relatively lean, skeptics see more scope for loan losses to nibble at that strong profit base. 🐻 Royal Bank of Canada Bear Case

DCF upside, but earnings growth slows

- Over the last year, earnings grew 19.5% and TTM EPS reached CA$13.25, yet forecasts point to about a 0.3% annual decline in earnings over the next three years, even as the current CA$218.64 share price sits well below a DCF fair value of CA$297.93.

- The consensus narrative talks about strategic growth and U.S. expansion, and the numbers create an interesting tension with that story:

- Trailing revenue of about CA$60.3 billion grew modestly at 0.9% per year, which is slower than the Canadian market expectation of 4.6% annual growth, so topline momentum is not yet matching the ambitious expansion theme.

- At the same time, the stock trades at 16.4 times earnings, above the 11.7 times industry average, which means investors are already paying a premium multiple despite forecasts for slightly declining earnings and only modest revenue growth.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Royal Bank of Canada on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently, and want to test your own thesis? Shape your view into a full narrative in just a few minutes, Do it your way

A great starting point for your Royal Bank of Canada research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite robust profitability, Royal Bank of Canada faces rising non performing loans, modest revenue growth, and a premium valuation that could constrain future risk adjusted returns.

If stretched credit quality and a rich price tag leave you uneasy, use our these 916 undervalued stocks based on cash flows to quickly hunt for stronger value and better downside protection.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RY

Royal Bank of Canada

Operates as a diversified financial service company worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026