- Canada

- /

- Capital Markets

- /

- TSX:IGM

3 TSX Dividend Stocks Yielding Up To 4.3% For Your Portfolio

Reviewed by Simply Wall St

As the U.S. government shutdown creates uncertainty south of the border, Canadian markets remain relatively stable, buoyed by strong consumer spending and significant investments in artificial intelligence. In this environment, dividend stocks can offer a reliable income stream and potential stability for investors looking to navigate these uncertain times.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Sun Life Financial (TSX:SLF) | 4.13% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.16% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.02% | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | 13.39% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 3.92% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 6.35% | ★★★★★☆ |

| National Bank of Canada (TSX:NA) | 3.14% | ★★★★★☆ |

| Magna International (TSX:MG) | 4.35% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.46% | ★★★★★☆ |

| Bank of Montreal (TSX:BMO) | 3.67% | ★★★★★☆ |

Click here to see the full list of 23 stocks from our Top TSX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

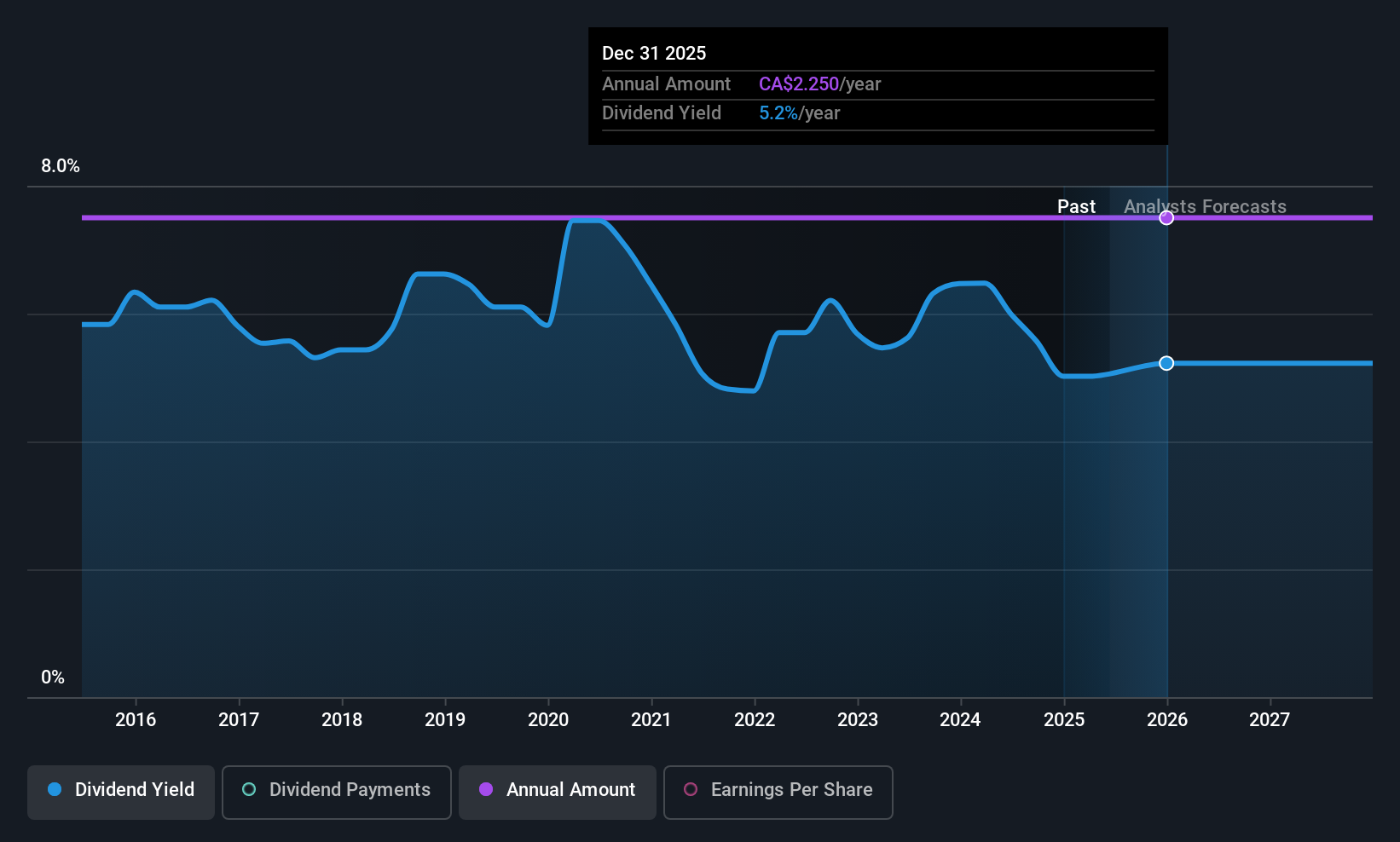

Bank of Montreal (TSX:BMO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Montreal provides diversified financial services primarily in North America and has a market cap of approximately CA$127.12 billion.

Operations: Bank of Montreal's revenue is generated from several key segments, including Canadian Personal and Commercial Banking at CA$9.78 billion, U.S. Personal and Commercial Banking at CA$8.60 billion, BMO Capital Markets at CA$6.81 billion, and BMO Wealth Management at CA$6.19 billion.

Dividend Yield: 3.7%

Bank of Montreal's dividend payments are well-supported by earnings, with a current payout ratio of 55.6% and forecasted to improve to 48.4% in three years. Despite being lower than the top Canadian dividend payers, its yield remains reliable and stable over the past decade. Recent fixed-income offerings totaling millions suggest robust capital management, while branch sales in the U.S. indicate strategic market adjustments for sustained financial health and shareholder returns.

- Click here and access our complete dividend analysis report to understand the dynamics of Bank of Montreal.

- In light of our recent valuation report, it seems possible that Bank of Montreal is trading beyond its estimated value.

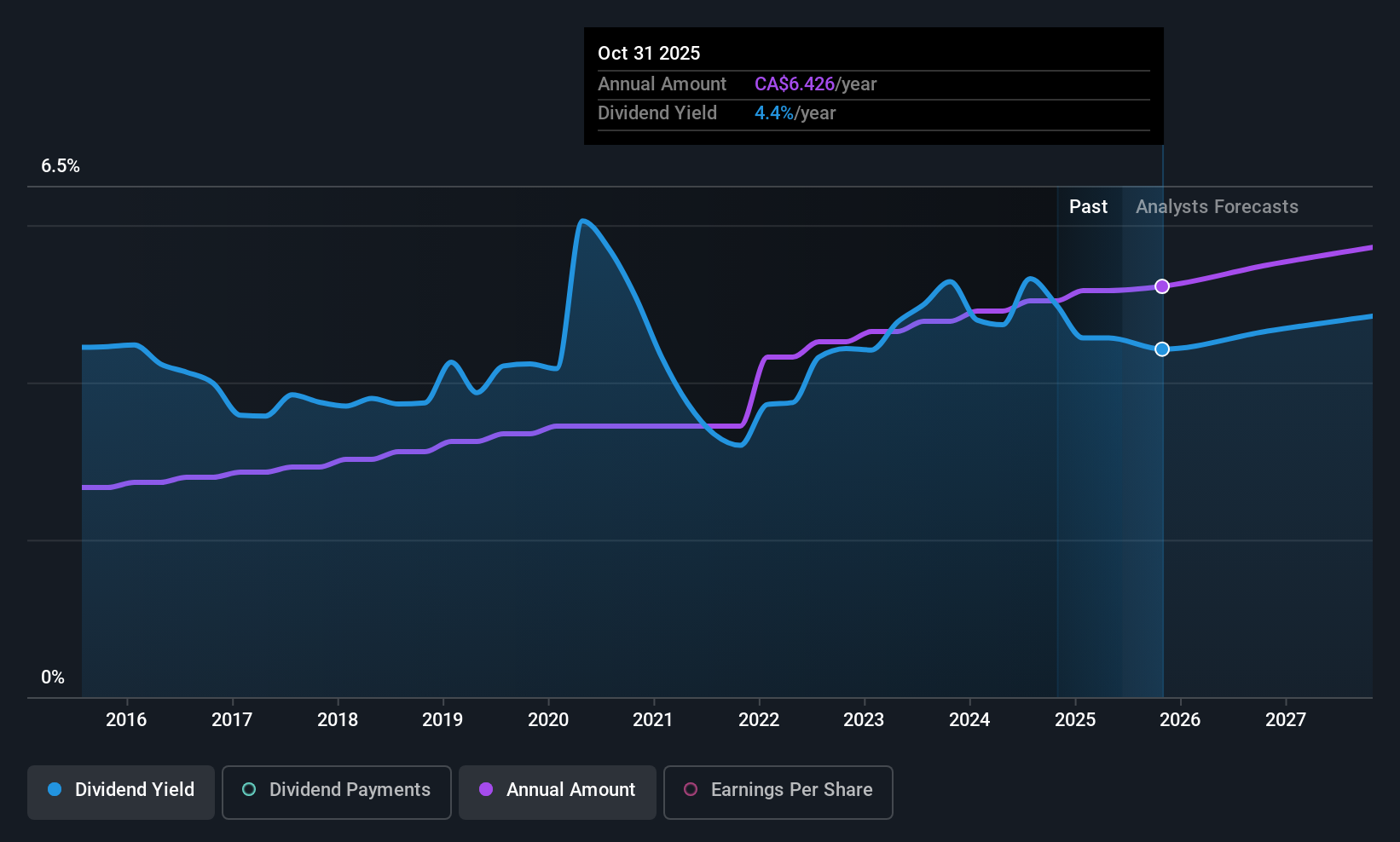

IGM Financial (TSX:IGM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IGM Financial Inc. operates in the asset management sector in Canada, with a market capitalization of approximately CA$12.28 billion.

Operations: IGM Financial Inc. generates revenue from its primary segments, with CA$1.30 billion from Asset Management and CA$2.57 billion from Wealth Management.

Dividend Yield: 4.4%

IGM Financial offers a stable dividend yield of 4.36%, supported by a sustainable payout ratio of 54.7% and cash coverage of 56.7%. Despite not being among the top Canadian dividend payers, its dividends have remained consistent over the past decade. Recent earnings growth and share buybacks highlight solid financial performance, with Q2 revenue reaching C$892.72 million and net income at C$246.71 million, reflecting effective capital management strategies amidst insider selling activities.

- Unlock comprehensive insights into our analysis of IGM Financial stock in this dividend report.

- According our valuation report, there's an indication that IGM Financial's share price might be on the cheaper side.

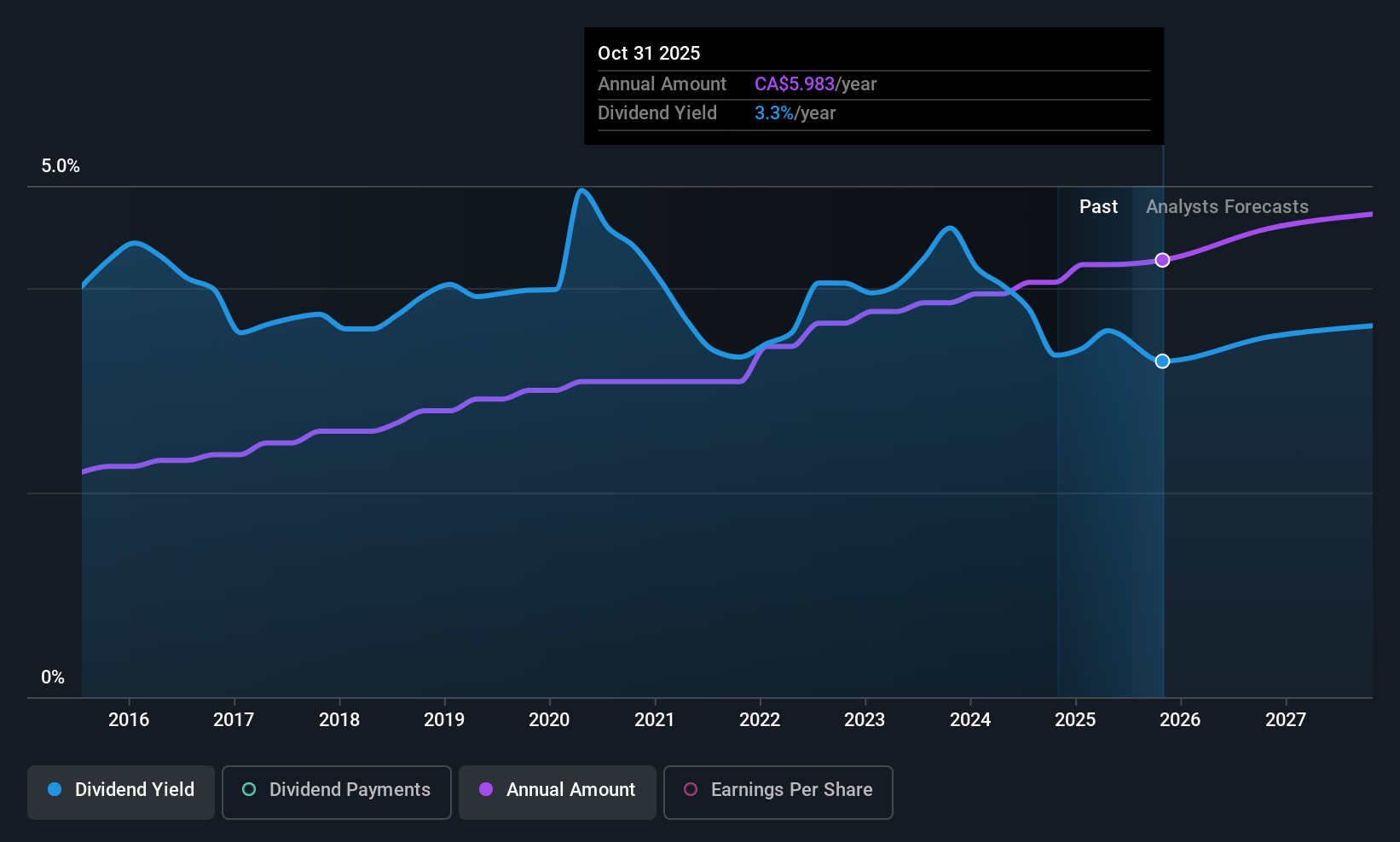

Royal Bank of Canada (TSX:RY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Royal Bank of Canada operates as a diversified financial services company worldwide with a market cap of approximately CA$284.52 billion.

Operations: Royal Bank of Canada's revenue segments include Insurance (CA$1.39 billion), Capital Markets (CA$13.17 billion), Personal Banking (CA$17.27 billion), Wealth Management (CA$21.57 billion), and Commercial Banking (CA$6.94 billion).

Dividend Yield: 3%

Royal Bank of Canada maintains a stable dividend, with a payout ratio of 44.7%, ensuring dividends are well covered by earnings. Despite its yield being lower than top Canadian payers at 3.02%, its dividends have been reliable and growing over the past decade. Recent fixed-income offerings, including $580 million in floating rate notes, bolster its financial position, supporting ongoing dividend sustainability amidst robust earnings growth and strategic capital management initiatives.

- Get an in-depth perspective on Royal Bank of Canada's performance by reading our dividend report here.

- Our valuation report unveils the possibility Royal Bank of Canada's shares may be trading at a premium.

Where To Now?

- Reveal the 23 hidden gems among our Top TSX Dividend Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IGM

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)