In 2025, the Canadian stock market has experienced volatility amid softened growth outlooks and ongoing global uncertainties, highlighting the importance of diversification in investment portfolios. Amidst this backdrop, dividend stocks on the TSX can offer a reliable income stream and potential stability, making them attractive options for investors seeking to navigate these unpredictable market conditions.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 8.10% | ★★★★★★ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 4.78% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.29% | ★★★★★☆ |

| Savaria (TSX:SIS) | 3.28% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 6.67% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.68% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 5.13% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.45% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 4.58% | ★★★★★☆ |

| Acadian Timber (TSX:ADN) | 6.65% | ★★★★★☆ |

Click here to see the full list of 25 stocks from our Top TSX Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Royal Bank of Canada (TSX:RY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Royal Bank of Canada operates as a diversified financial service company worldwide, with a market cap of approximately CA$227.46 billion.

Operations: Royal Bank of Canada's revenue segments include Insurance (CA$1.27 billion), Capital Markets (CA$12.42 billion), Personal Banking (CA$16.30 billion), Wealth Management (CA$20.41 billion), and Commercial Banking (CA$6.75 billion).

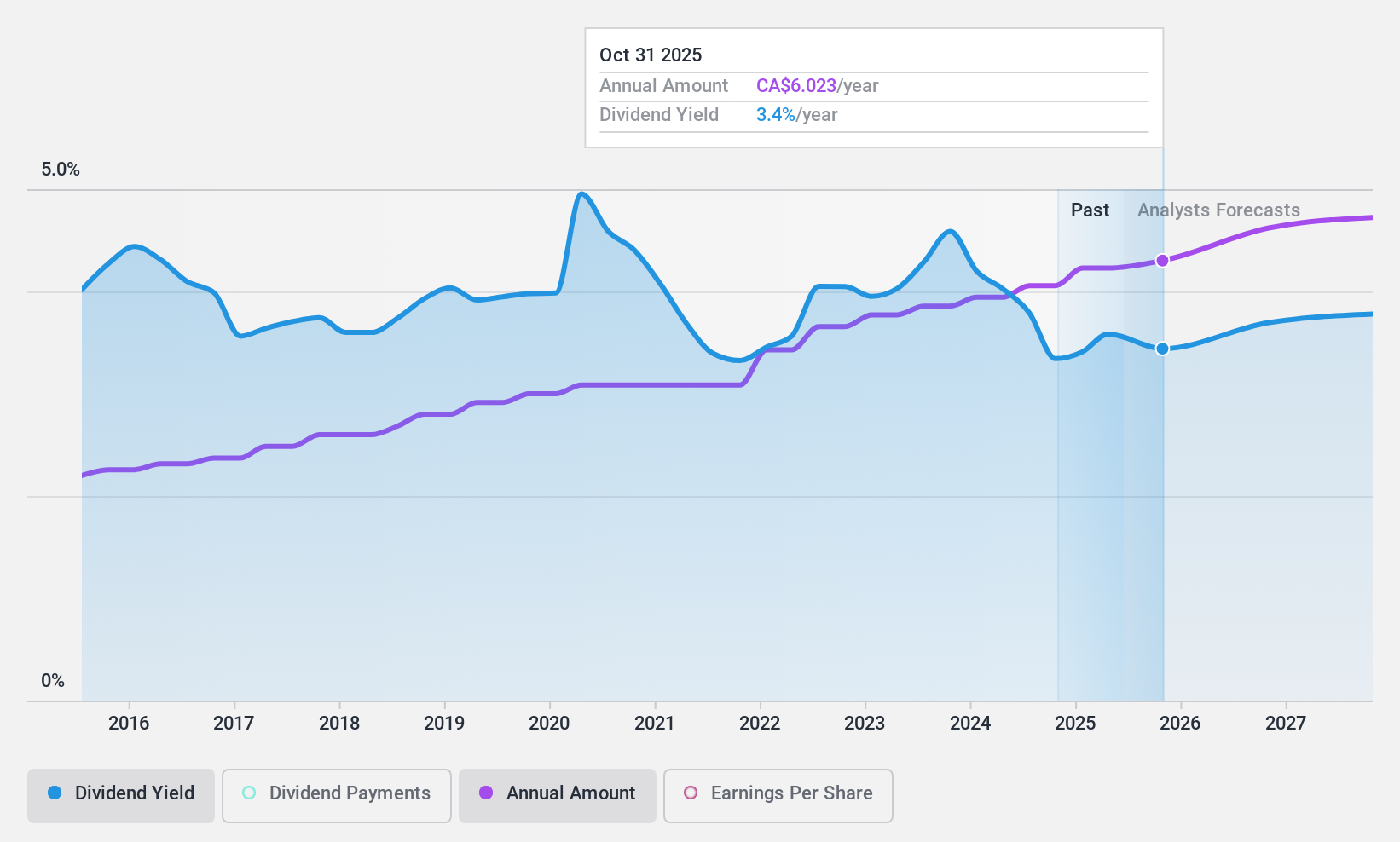

Dividend Yield: 3.7%

Royal Bank of Canada maintains a stable and reliable dividend history, with payments increasing steadily over the past decade. The current payout ratio of 46.3% suggests dividends are well-covered by earnings, and forecasts indicate this will remain consistent in the next three years. Despite its dividend yield being lower than the top Canadian payers, RBC's recent earnings growth and strategic financial maneuvers through fixed-income offerings may bolster its long-term dividend sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of Royal Bank of Canada.

- The analysis detailed in our Royal Bank of Canada valuation report hints at an deflated share price compared to its estimated value.

Savaria (TSX:SIS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Savaria Corporation offers accessibility solutions for the elderly and physically challenged across Canada, the United States, Europe, and internationally with a market cap of CA$1.19 billion.

Operations: Savaria Corporation's revenue is primarily derived from its Accessibility segment, including Adapted Vehicles, at CA$673.88 million and Patient Care at CA$193.88 million.

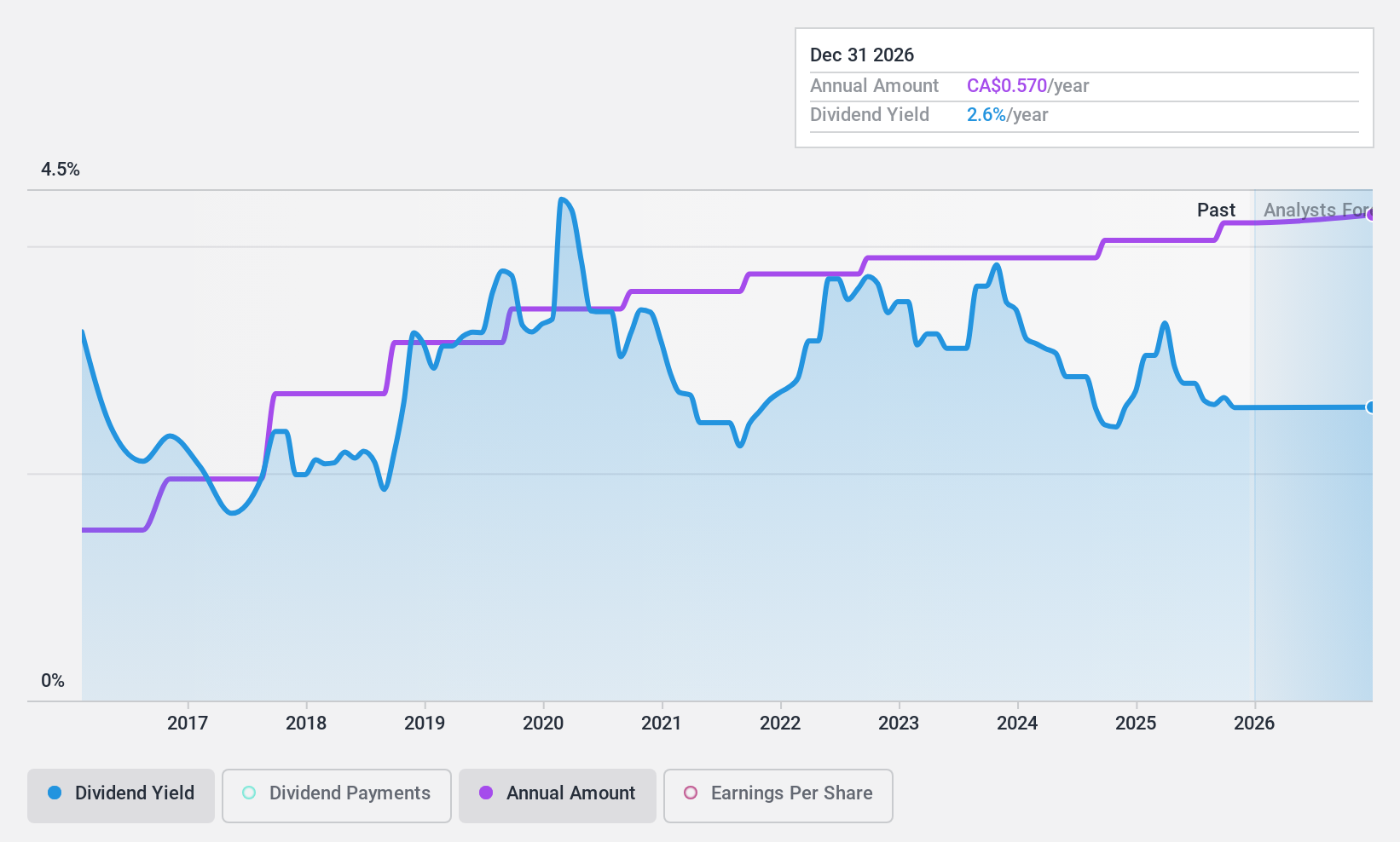

Dividend Yield: 3.3%

Savaria Corporation offers a stable dividend, consistently paying 4.5 cents (CAD) per share monthly. Its dividends are well-covered by earnings and cash flows, with a payout ratio of 77.2% and a cash payout ratio of 38.6%. Recent earnings growth to CAD 48.51 million supports its dividend reliability, despite the yield being lower than top Canadian payers at 3.28%. Analysts see potential upside in stock value given its current undervaluation compared to fair value estimates.

- Unlock comprehensive insights into our analysis of Savaria stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Savaria is priced lower than what may be justified by its financials.

Total Energy Services (TSX:TOT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Total Energy Services Inc. is an energy services company operating in Canada, the United States, and Australia with a market cap of CA$359.58 million.

Operations: Total Energy Services Inc. generates revenue through its four main segments: Well Servicing (CA$94.63 million), Contract Drilling Services (CA$319.61 million), Compression and Process Services (CA$413.94 million), and Rentals and Transportation Services (CA$78.59 million).

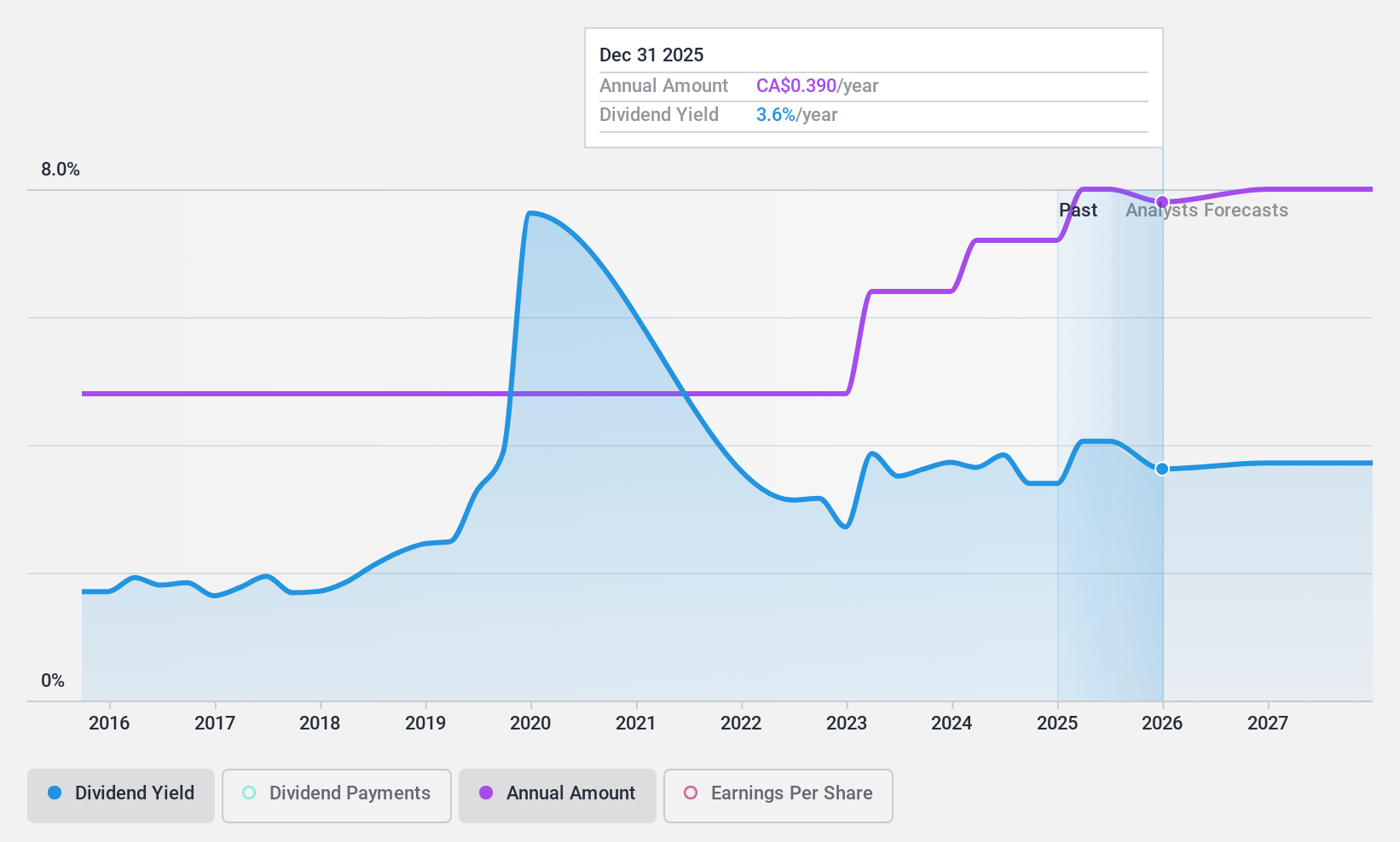

Dividend Yield: 4.3%

Total Energy Services' dividend payments, although historically volatile, are currently well-covered by earnings and cash flows with a payout ratio of 23.1% and cash payout ratio of 20.3%. Recent earnings growth to C$60.8 million enhances its capacity for sustainable dividends despite a yield of 4.3%, which is below top Canadian payers. Trading significantly below estimated fair value, the company announced an 11% dividend increase for Q1 2025, signaling confidence in future performance.

- Dive into the specifics of Total Energy Services here with our thorough dividend report.

- Our valuation report unveils the possibility Total Energy Services' shares may be trading at a discount.

Key Takeaways

- Reveal the 25 hidden gems among our Top TSX Dividend Stocks screener with a single click here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Royal Bank of Canada, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RY

Royal Bank of Canada

Operates as a diversified financial service company worldwide.

Solid track record with excellent balance sheet and pays a dividend.