The Canadian market has shown resilience, with the TSX rebounding by over 5% amid easing inflation and positive economic data. As central banks navigate potential rate cuts, investors are increasingly looking at dividend stocks for stable returns in a fluctuating environment. In such conditions, selecting dividend stocks that offer consistent yields can be a prudent strategy for maintaining income and capital growth.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.55% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.20% | ★★★★★★ |

| Secure Energy Services (TSX:SES) | 3.36% | ★★★★★☆ |

| Labrador Iron Ore Royalty (TSX:LIF) | 8.68% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.48% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.42% | ★★★★★☆ |

| iA Financial (TSX:IAG) | 3.27% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.74% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.32% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.70% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top TSX Dividend Stocks screener.

We'll examine a selection from our screener results.

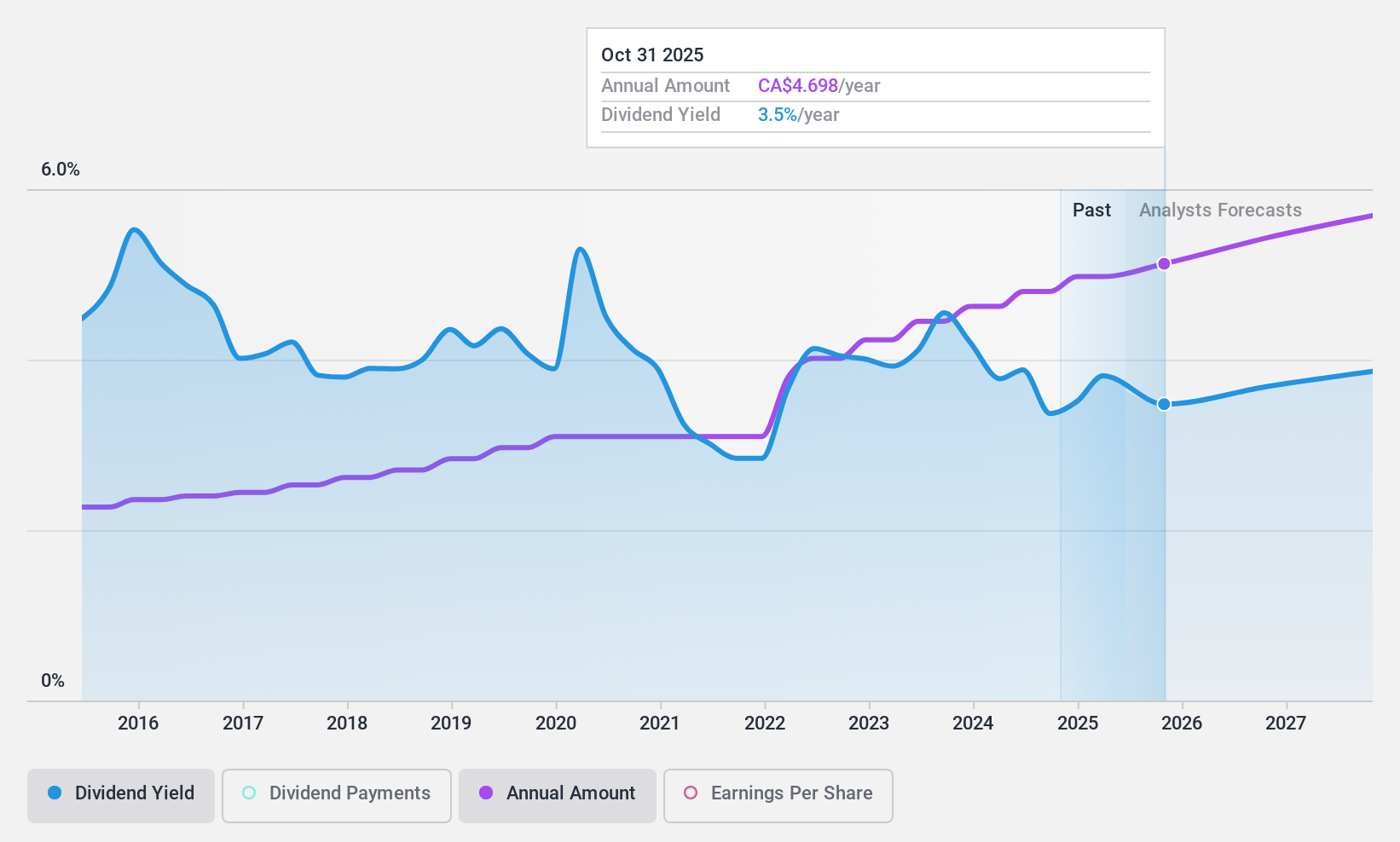

National Bank of Canada (TSX:NA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Bank of Canada provides financial services to individuals, businesses, institutional clients, and governments in Canada and internationally, with a market cap of CA$40.12 billion.

Operations: National Bank of Canada's revenue segments include Wealth Management (CA$2.61 billion), Personal and Commercial (CA$4.33 billion), Financial Markets excluding USSF&I (CA$2.76 billion), and U.S. Specialty Finance and International (USSF&I) (CA$1.16 billion).

Dividend Yield: 3.7%

National Bank of Canada offers a reliable dividend yield of 3.74%, supported by a low payout ratio of 42.5%. Recent earnings growth and stable dividend payments over the past decade enhance its appeal for income-focused investors. The bank's recent fixed-income offerings, including CNY 198 million and $350 million notes, reflect robust financial health. Additionally, the appointment of Scott Burrows to the Board strengthens governance with his extensive financial expertise.

- Dive into the specifics of National Bank of Canada here with our thorough dividend report.

- The valuation report we've compiled suggests that National Bank of Canada's current price could be quite moderate.

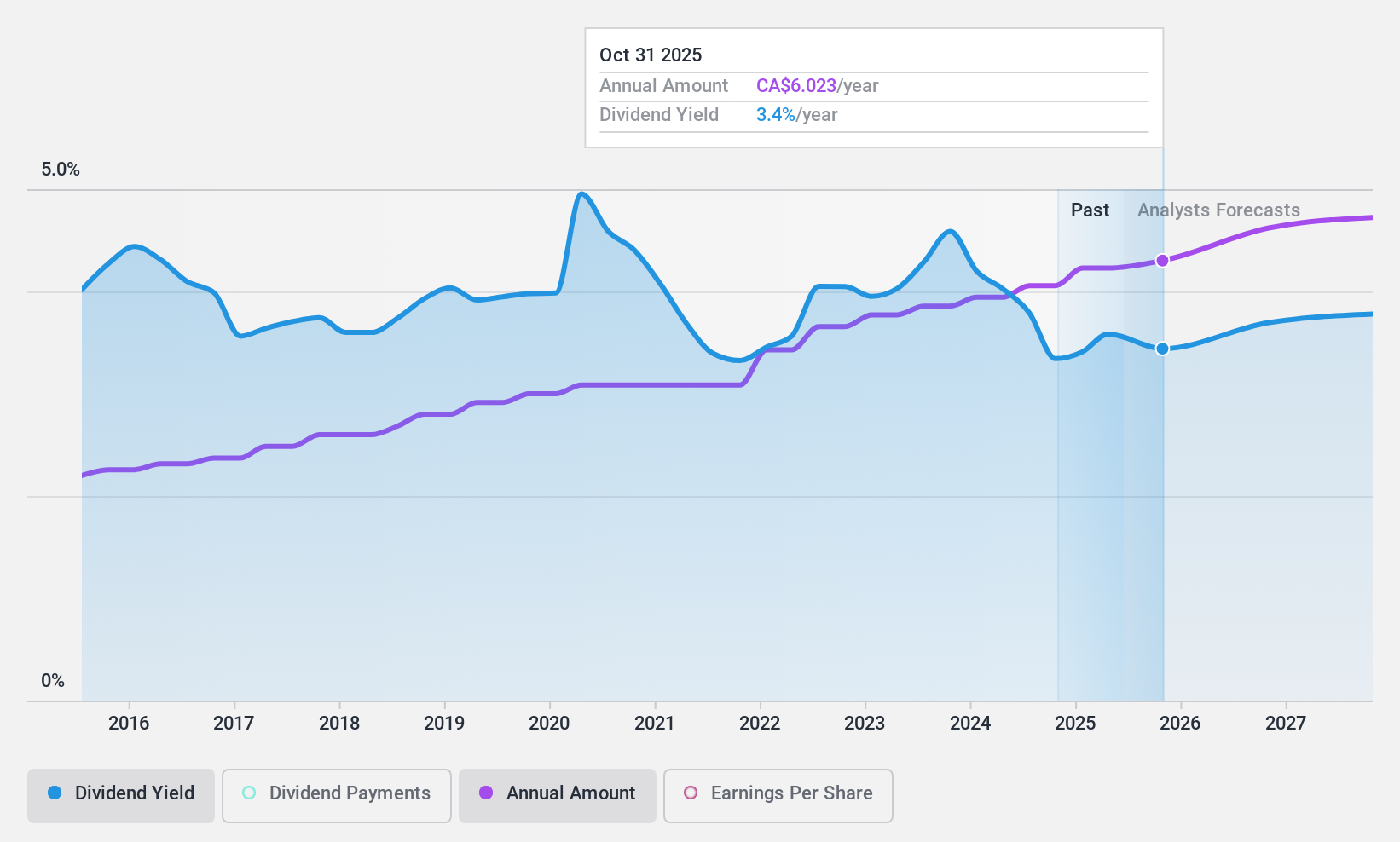

Royal Bank of Canada (TSX:RY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Royal Bank of Canada operates as a diversified financial service company worldwide with a market cap of CA$217.43 billion.

Operations: Royal Bank of Canada's revenue segments include Insurance (CA$5.91 billion), Capital Markets (CA$10.70 billion), Wealth Management (CA$17.47 billion), and Personal & Commercial Banking (CA$20.92 billion).

Dividend Yield: 3.7%

Royal Bank of Canada maintains a stable dividend yield supported by a low payout ratio, ensuring reliability for income-focused investors. Recent earnings growth and consistent dividend increases over the past decade further bolster its appeal. The bank's numerous fixed-income offerings, including a $6.35 million issuance, indicate strong financial health and capital management. Additionally, strategic executive appointments following the HSBC Bank Canada acquisition aim to enhance client focus and operational efficiency.

- Click here to discover the nuances of Royal Bank of Canada with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Royal Bank of Canada's share price might be too optimistic.

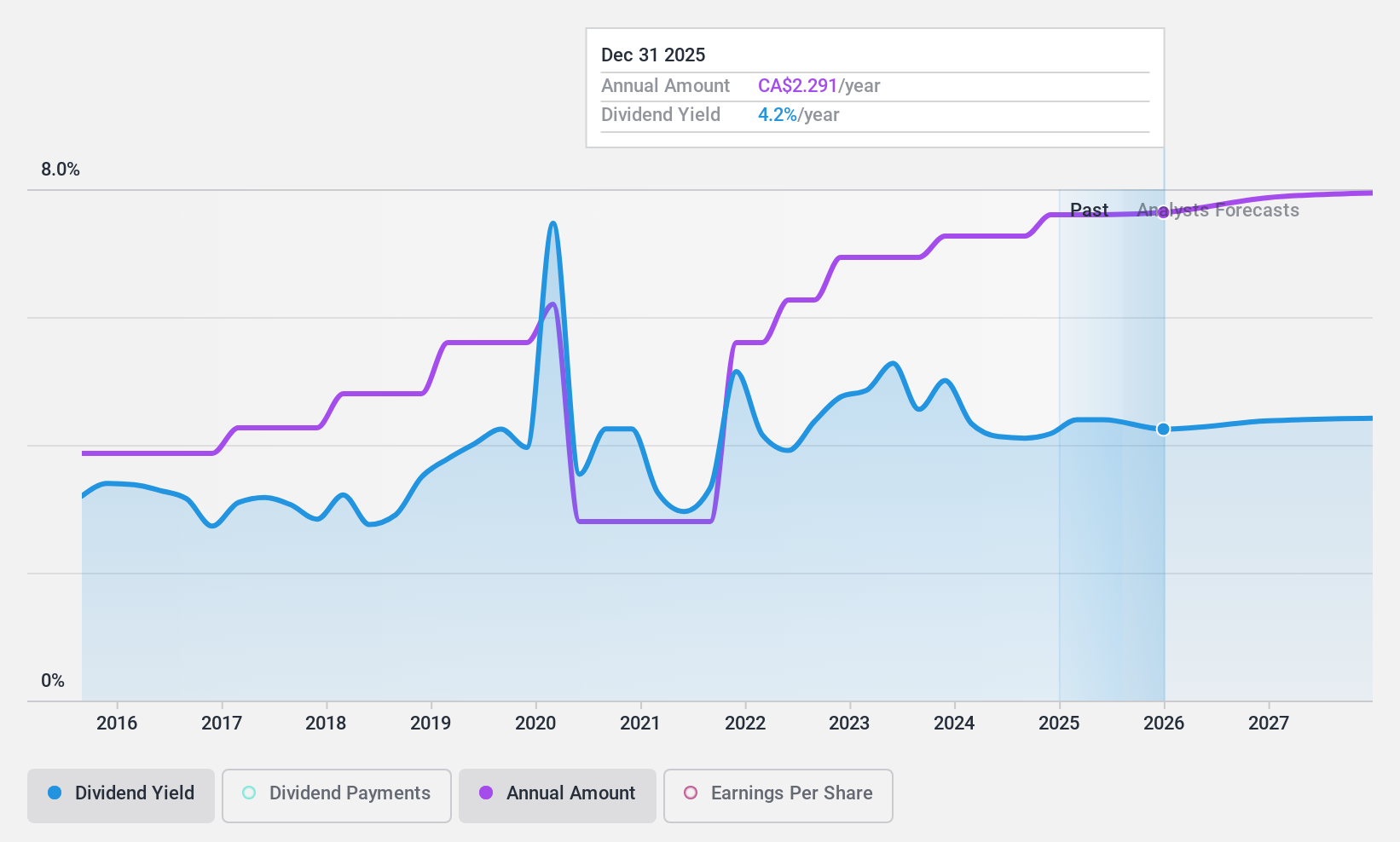

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company operating in Canada, the United States, and internationally with a market cap of CA$71.65 billion.

Operations: Suncor Energy Inc.'s revenue segments include CA$24.61 billion from Oil Sands, CA$32.29 billion from Refining and Marketing, and CA$2.03 billion from Exploration and Production.

Dividend Yield: 4%

Suncor Energy's dividend payments have been volatile over the past decade, but are well covered by earnings (36.9% payout ratio) and cash flows (32.1% cash payout ratio). Despite a recent decline in net income to C$1.57 billion for Q2 2024, the company announced a quarterly dividend of C$0.545 per share payable on September 25, 2024. Trading at good value compared to peers, Suncor offers potential despite its unstable dividend history.

- Navigate through the intricacies of Suncor Energy with our comprehensive dividend report here.

- According our valuation report, there's an indication that Suncor Energy's share price might be on the cheaper side.

Next Steps

- Reveal the 34 hidden gems among our Top TSX Dividend Stocks screener with a single click here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Bank of Canada might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NA

National Bank of Canada

Provides financial services to individuals, businesses, institutional clients, and governments in Canada and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives