What National Bank of Canada (TSX:NA)'s Distributed Ledger Partnership Means for Shareholders

Reviewed by Sasha Jovanovic

- Earlier this month, EquiLend announced that The Bank of New York Mellon Corporation and National Bank of Canada began executing trades using EquiLend's 1Source distributed ledger technology platform, aiming to enhance efficiency and reduce reconciliation breaks in securities finance.

- This move marks National Bank of Canada's commitment to modernizing its operational processes and positions it at the forefront of financial market innovation as additional counterparties are expected to join the initiative.

- We'll explore how National Bank of Canada's adoption of distributed ledger technology could influence its operational efficiency and earnings outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

National Bank of Canada Investment Narrative Recap

Owning shares in National Bank of Canada means believing in the bank’s ability to grow earnings through execution in its core Quebec market, successful integration of Canadian Western Bank, and disciplined cost management as it invests in digital innovation. The adoption of EquiLend’s 1Source distributed ledger technology is directionally positive for operational efficiency but is unlikely to materially move the needle in the short term compared to ongoing pressure on net interest margins, a key driver of near-term earnings and a persistent risk for the sector.

Among recent announcements, the board’s authorization of a share repurchase program of up to 8,000,000 common shares stands out. This supports the bank’s commitment to returning capital to shareholders, but its impact on immediate catalysts such as loan growth, margin improvement, and the pace of CWB integration may be limited since the primary earnings challenge remains margin compression driven by asset and deposit mix.

However, before assuming the impact of digital investments will outweigh all headwinds, investors should be aware that…

Read the full narrative on National Bank of Canada (it's free!)

National Bank of Canada's narrative projects CA$16.2 billion revenue and CA$4.2 billion earnings by 2028. This requires 10.3% yearly revenue growth and a CA$0.5 billion earnings increase from CA$3.7 billion.

Uncover how National Bank of Canada's forecasts yield a CA$148.46 fair value, in line with its current price.

Exploring Other Perspectives

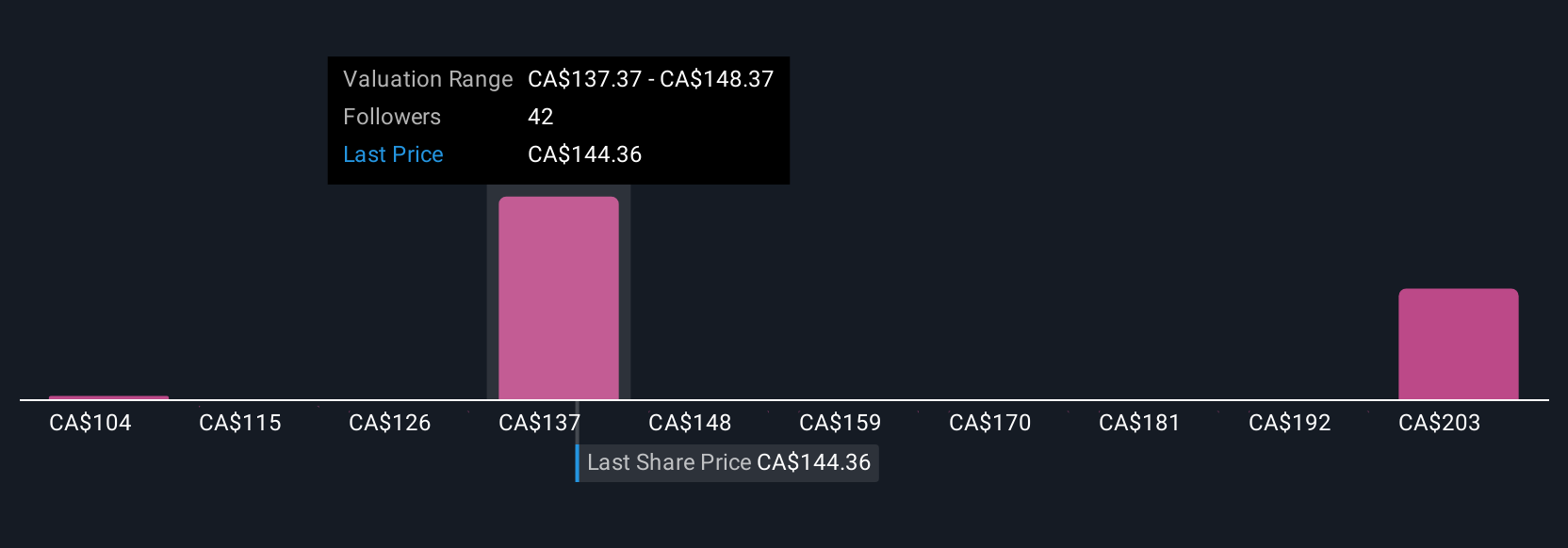

Simply Wall St Community members have posted fair value estimates for National Bank of Canada ranging from CA$104.36 to CA$214.33, with 7 different opinions. While this shows a wide spectrum of expectations, the ongoing risk of net interest margin pressure remains important for anyone weighing future prospects.

Explore 7 other fair value estimates on National Bank of Canada - why the stock might be worth 31% less than the current price!

Build Your Own National Bank of Canada Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your National Bank of Canada research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free National Bank of Canada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate National Bank of Canada's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if National Bank of Canada might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NA

National Bank of Canada

Provides financial services to individuals, businesses, institutional clients, and governments in Canada and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Community Narratives