Laurentian Bank (TSX:LB): Examining Valuation After a 28% One-Year Shareholder Return

Reviewed by Kshitija Bhandaru

See our latest analysis for Laurentian Bank of Canada.

Laurentian Bank’s share price has pulled back very slightly in recent weeks, but the bigger story is how it has gathered real momentum over the past year, with a robust 1-year total shareholder return of 28%. This suggests improving sentiment and renewed investor confidence.

If you are looking for more opportunities with similar strong trajectories, now is a perfect moment to see what you could find among fast growing stocks with high insider ownership.

But with shares trading near analyst targets despite recent gains, investors may be asking themselves whether Laurentian Bank’s stock is still undervalued or if the market has already priced in all the expected upside.

Most Popular Narrative: 7.3% Overvalued

Laurentian Bank’s narrative fair value sits below the latest closing price, suggesting analysts currently see the stock trading above their projected target. The setup is ripe for deeper debate on what is driving the divergence between market optimism and consensus forecasts.

The bank's ongoing technology modernization, particularly migrating from on-premise to cloud systems and simplifying its tech stack, should drive significant operational efficiency and cost reductions over time. This supports higher net margins even if revenue growth remains muted in the near term. Expanding its dealer network in inventory financing and targeted growth in commercial real estate lending position Laurentian to directly benefit from a rebound in loan demand. This could be aided by a potential easing of North American interest rates, supporting above-average revenue growth and loan portfolio expansion when macroeconomic conditions improve.

What hidden driver could turn cautious estimates into an upside surprise? There are bold assumptions buried in the numbers about margin expansion, loan growth, and the impact of digital initiatives. The real test is which projections shape fair value and whether they could tip the scales.

Result: Fair Value of $29.89 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently high transformation costs and declining revenue could present challenges for the bank's ability to deliver the projected margin improvements and earnings growth.

Find out about the key risks to this Laurentian Bank of Canada narrative.

Another View: What Do Earnings Ratios Say?

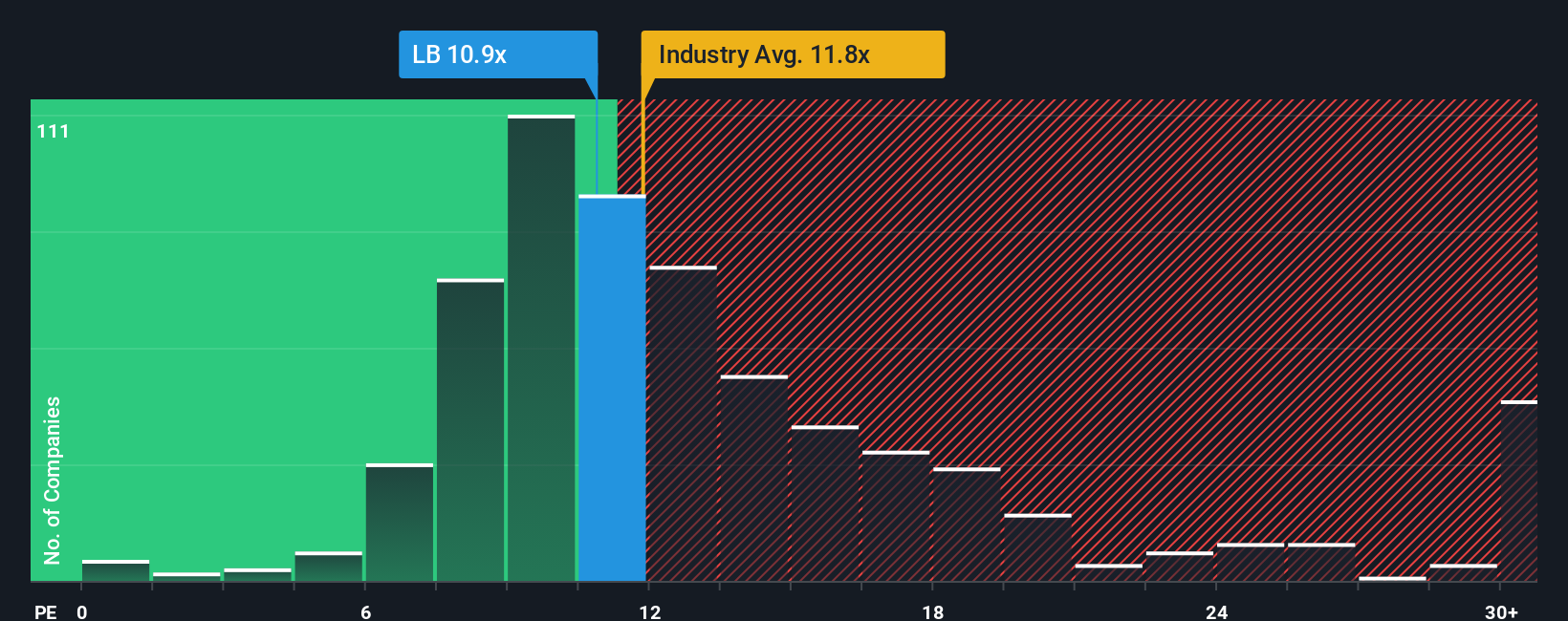

Taking a closer look at value through the lens of earnings, Laurentian Bank trades at a 10.6x ratio, which is lower than the industry average of 11.6x and the peer average of 15.2x. Interestingly, it is also just under the fair ratio of 10.8x, hinting at a potential value opportunity if the market shifts. The big question is, will the market keep rewarding these numbers or could it quickly change direction?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Laurentian Bank of Canada Narrative

If you want to dig deeper or think your perspective brings new angles not covered here, you can build your own view in just a few minutes. Do it your way.

A great starting point for your Laurentian Bank of Canada research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let uncertainty hold you back. There is a whole world of major opportunities waiting for those who want to get ahead of the crowd. Look beyond a single stock to strategies that could unlock your next smart move.

- Tap into the potential for reliable payouts by scanning these 19 dividend stocks with yields > 3%. These offerings provide yields that can add real power to your portfolio’s long-term growth.

- Find companies at the forefront of artificial intelligence with these 24 AI penny stocks. This connects you directly to the innovators transforming every corner of the market.

- Catch value before others do and stay ahead of Wall Street by tracking these 898 undervalued stocks based on cash flows that are primed for a re-rating based on hidden cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LB

Laurentian Bank of Canada

Provides various financial services to personal, business, and institutional customers in Canada and the United States.

Good value with adequate balance sheet.

Market Insights

Community Narratives