How Investors Are Reacting To Laurentian Bank (TSX:LB) Earnings Recovery and Dividend Continuity

Reviewed by Simply Wall St

- Laurentian Bank of Canada recently released its third quarter and nine-month earnings, reporting improved net interest income and net income year-over-year, while also affirming a regular quarterly dividend of CA$0.47 per share for November 2025 payout.

- For the nine months ended July 31, 2025, the bank recorded a significant turnaround with net income of CA$108.39 million compared to a net loss in the prior year period.

- We'll explore how Laurentian's third quarter earnings improvement and continued dividend payments may influence its investment outlook.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Laurentian Bank of Canada Investment Narrative Recap

For investors considering Laurentian Bank of Canada, the core belief centers on the bank’s ability to realize returns from its digital transformation and commercial banking focus while controlling costs. The latest earnings report, showing a return to year-over-year net income growth and continued dividend stability, is positive, but these developments have not materially shifted the main short-term catalyst, successful technology modernization, and the biggest risk: persistently high operating expenses that could pressure margins if efficiency gains do not materialize.

Among recent announcements, the ongoing regular quarterly dividend of CA$0.47 per share, affirmed for November, stands out. This steady payout remains important for investors seeking income, but ongoing cost pressures continue to loom over the sustainability of both earnings and future dividend growth, keeping the spotlight on management’s ability to execute on expense control and efficiency targets.

However, investors should also be mindful of the ongoing risk that elevated technology and restructuring costs could...

Read the full narrative on Laurentian Bank of Canada (it's free!)

Laurentian Bank of Canada's outlook anticipates CA$1.1 billion in revenue and CA$157.8 million in earnings by 2028. This is based on an expected 4.9% annual revenue growth rate and a CA$23.1 million increase in earnings from the current CA$134.7 million.

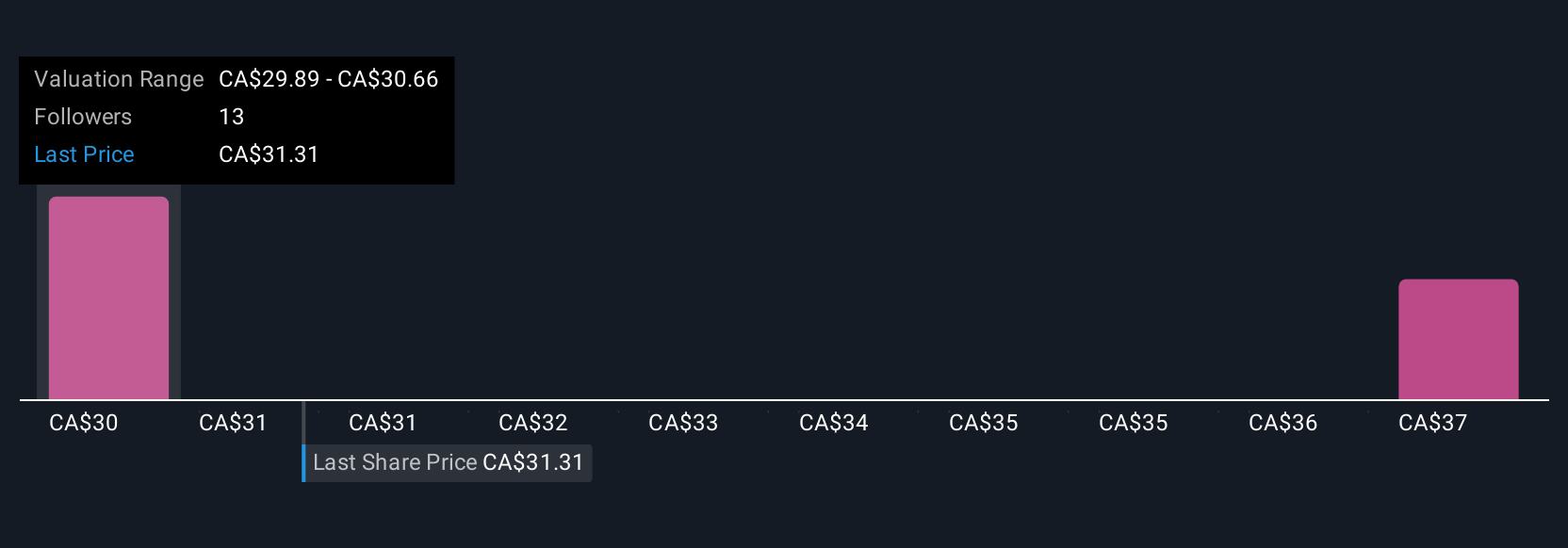

Uncover how Laurentian Bank of Canada's forecasts yield a CA$29.89 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community value Laurentian Bank shares between CA$29.89 and CA$37.54. While these diverse views highlight different growth forecasts, persistently high expenses remain a key issue that could influence future earnings and share performance.

Explore 3 other fair value estimates on Laurentian Bank of Canada - why the stock might be worth as much as 19% more than the current price!

Build Your Own Laurentian Bank of Canada Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Laurentian Bank of Canada research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Laurentian Bank of Canada research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Laurentian Bank of Canada's overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:LB

Laurentian Bank of Canada

Provides various financial services to personal, business, and institutional customers in Canada and the United States.

Adequate balance sheet average dividend payer.

Market Insights

Community Narratives