- Canada

- /

- Diversified Financial

- /

- TSX:HCG

The Compensation For Home Capital Group Inc.'s (TSE:HCG) CEO Looks Deserved And Here's Why

It would be hard to discount the role that CEO Yousry Bissada has played in delivering the impressive results at Home Capital Group Inc. (TSE:HCG) recently. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 18 May 2021. The focus will probably be on the future company strategy as shareholders cast their votes on resolutions such as executive remuneration and other matters. Here is our take on why we think CEO compensation is not extravagant.

See our latest analysis for Home Capital Group

Comparing Home Capital Group Inc.'s CEO Compensation With the industry

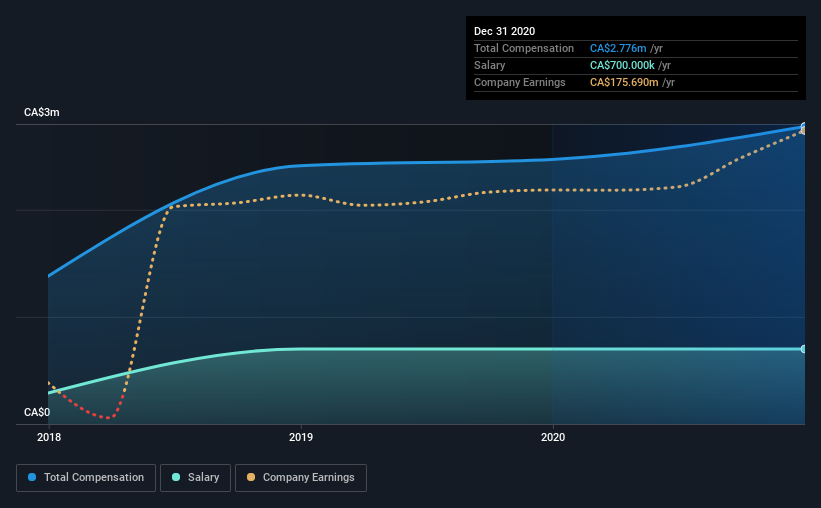

According to our data, Home Capital Group Inc. has a market capitalization of CA$1.8b, and paid its CEO total annual compensation worth CA$2.8m over the year to December 2020. We note that's an increase of 12% above last year. While we always look at total compensation first, our analysis shows that the salary component is less, at CA$700k.

In comparison with other companies in the industry with market capitalizations ranging from CA$1.2b to CA$3.9b, the reported median CEO total compensation was CA$3.1m. This suggests that Home Capital Group remunerates its CEO largely in line with the industry average. Moreover, Yousry Bissada also holds CA$2.5m worth of Home Capital Group stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$700k | CA$700k | 25% |

| Other | CA$2.1m | CA$1.8m | 75% |

| Total Compensation | CA$2.8m | CA$2.5m | 100% |

On an industry level, around 42% of total compensation represents salary and 58% is other remuneration. In Home Capital Group's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

A Look at Home Capital Group Inc.'s Growth Numbers

Home Capital Group Inc.'s earnings per share (EPS) grew 218% per year over the last three years. It achieved revenue growth of 15% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's also good to see decent revenue growth in the last year, suggesting the business is healthy and growing. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Home Capital Group Inc. Been A Good Investment?

We think that the total shareholder return of 142%, over three years, would leave most Home Capital Group Inc. shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

Shareholders may want to check for free if Home Capital Group insiders are buying or selling shares.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Home Capital Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:HCG

Home Capital Group

Home Capital Group Inc., through its subsidiary, Home Trust Company, provides residential and non-residential mortgage lending, securitization of residential mortgage products, consumer lending, and credit card services in Canada.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives