Canadian Imperial Bank of Commerce (TSX:CM) Launches Generative AI Platform To Enhance Productivity

Reviewed by Simply Wall St

Canadian Imperial Bank of Commerce (TSX:CM) recently saw its share price rise by 11.62% over the past month, a move that aligns with broader market gains, given the market's 11% rise over the last year. The launch of CIBC AI (CAI), which aims to enhance productivity with significant time-saving capabilities, may have bolstered investor confidence. Additionally, the introduction of the CIBC Adapta Mastercard, which features a unique reward system while offering accessibility benefits, likely added further momentum. Despite subdued movements in major U.S. stock indexes amidst broader economic news and corporate updates, CIBC's initiatives potentially reinforced its positive price trajectory.

Find companies with promising cash flow potential yet trading below their fair value.

The introduction of CIBC AI and the CIBC Adapta Mastercard could positively impact revenue and earnings forecasts by enhancing productivity and improving client retention with innovative services. This aligns with the company's focus on digital banking and high-margin revenue growth, suggesting potential benefits despite macroeconomic uncertainties. These developments may inspire greater investor confidence, reinforcing Canadian Imperial Bank of Commerce’s growth narrative.

Over the past five years, Canadian Imperial Bank of Commerce's total return, including share price growth and dividends, was 165.19%. This substantial long-term appreciation contrasts with its one-year performance, where it surpassed both the broader Canadian market’s 13.9% return and the Canadian Banks industry’s 21.7% return. The recent share price uptick of 11.62% also places the current share price at a 9.6% discount from the consensus price target of CA$95.64, reflecting a potentially attractive valuation in light of advanced revenue and earnings projections.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CM

Canadian Imperial Bank of Commerce

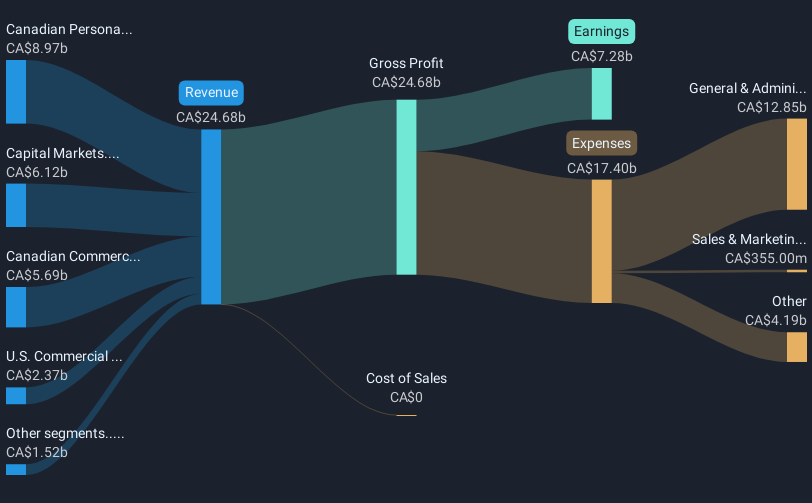

A diversified financial institution, provides various financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives