Can CIBC's Digital Banking Success Reinforce Its Competitive Edge and Stability Story (TSX:CM)?

Reviewed by Sasha Jovanovic

- In recent weeks, Canadian Imperial Bank of Commerce (CIBC) completed several fixed-income offerings and received top honors in the 2025 Surviscor Mobile Banking Awards for best mobile banking experience among Canada's big banks.

- Recognition for digital banking innovation and a series of fresh bond issuances have spotlighted CIBC's operational momentum and strengthened its reputation for both technological leadership and financial stability.

- We'll explore how CIBC's leadership in mobile banking and enhanced digital experience influence the company's long-term investment outlook.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Canadian Imperial Bank of Commerce Investment Narrative Recap

To be a shareholder in Canadian Imperial Bank of Commerce (CIBC), you need to believe that the bank can grow its retail and wealth businesses, leverage digital leadership, and manage credit quality in a shifting Canadian economy. The recent recognition for mobile banking excellence and new fixed-income offerings reinforce operational momentum, but do not fundamentally shift the near-term outlook, the most important catalyst remains stable asset quality, while the biggest risk is still tied to the Canadian housing market and consumer credit performance.

Among the recent announcements, CIBC’s completion of several fixed-income offerings, including a $3.223 million 4.20 percent senior unsecured note due 2030, stands out, supporting the bank’s liquidity and capital position. While this helps buffer against future regulatory and macroeconomic pressures, the impact on the main risk, which is elevated mortgage delinquencies if economic weakness materializes, is limited.

In contrast, one signal that investors should be aware of is a rise in 90-plus day mortgage delinquencies in key markets like ...

Read the full narrative on Canadian Imperial Bank of Commerce (it's free!)

Canadian Imperial Bank of Commerce is projected to reach CA$29.7 billion in revenue and CA$8.8 billion in earnings by 2028. This outlook assumes a 4.5% annual revenue growth rate and a CA$1.0 billion increase in earnings from the current CA$7.8 billion.

Uncover how Canadian Imperial Bank of Commerce's forecasts yield a CA$108.41 fair value, a 4% downside to its current price.

Exploring Other Perspectives

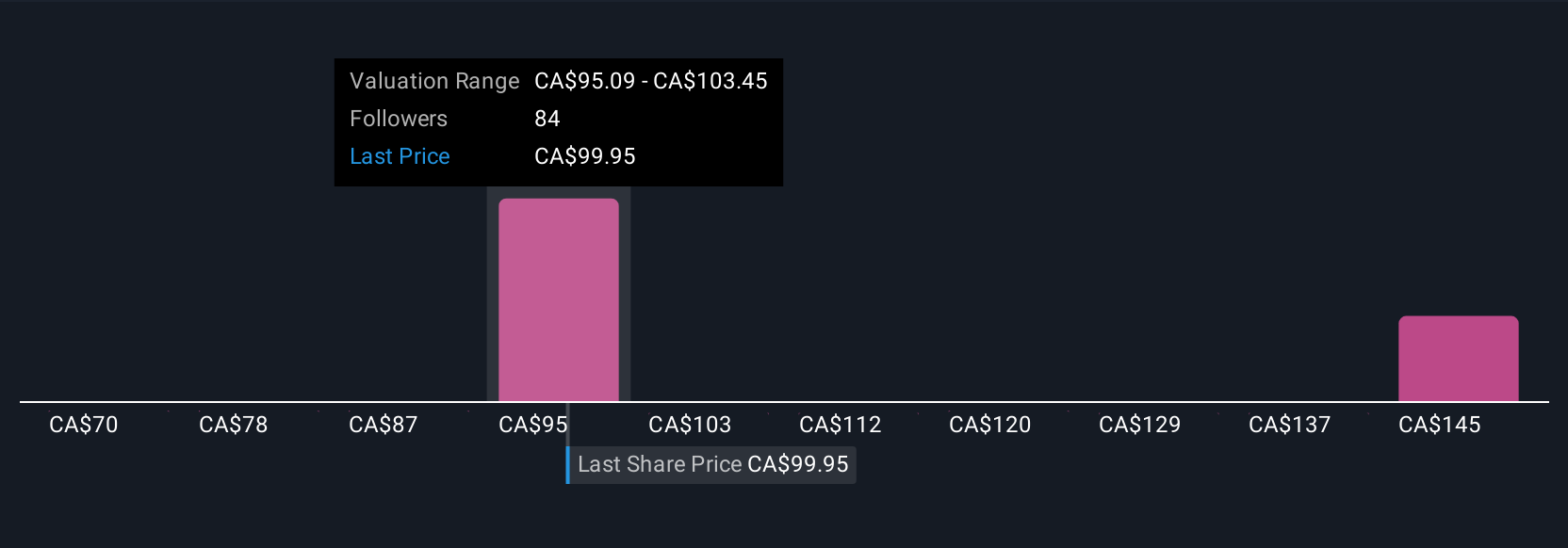

Seven members of the Simply Wall St Community offered fair value estimates for CIBC ranging from CA$70 to CA$164.55 per share. While opinions differ, the ongoing risk of Canadian housing market weakness remains a focal point for long-term performance and is worth weighing alongside these varied perspectives.

Explore 7 other fair value estimates on Canadian Imperial Bank of Commerce - why the stock might be worth 38% less than the current price!

Build Your Own Canadian Imperial Bank of Commerce Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Canadian Imperial Bank of Commerce research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Canadian Imperial Bank of Commerce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Canadian Imperial Bank of Commerce's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CM

Canadian Imperial Bank of Commerce

A diversified financial institution, provides various financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives