- Canada

- /

- Food and Staples Retail

- /

- TSX:NWC

3 Canadian Dividend Stocks On The TSX Yielding Up To 6.3%

Reviewed by Simply Wall St

As the Canadian market navigates the implications of new U.S. policy directions, particularly concerning tariffs and energy reforms, the TSX index has shown resilience with a positive trajectory since Inauguration Day. Amidst this backdrop of economic uncertainty and evolving policies, dividend stocks remain an attractive option for investors seeking steady income and potential growth, especially those yielding up to 6.3%.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.33% | ★★★★★★ |

| Acadian Timber (TSX:ADN) | 6.71% | ★★★★★★ |

| Russel Metals (TSX:RUS) | 3.93% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.19% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.67% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.36% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 5.29% | ★★★★★☆ |

| IGM Financial (TSX:IGM) | 4.89% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.16% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.00% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top TSX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

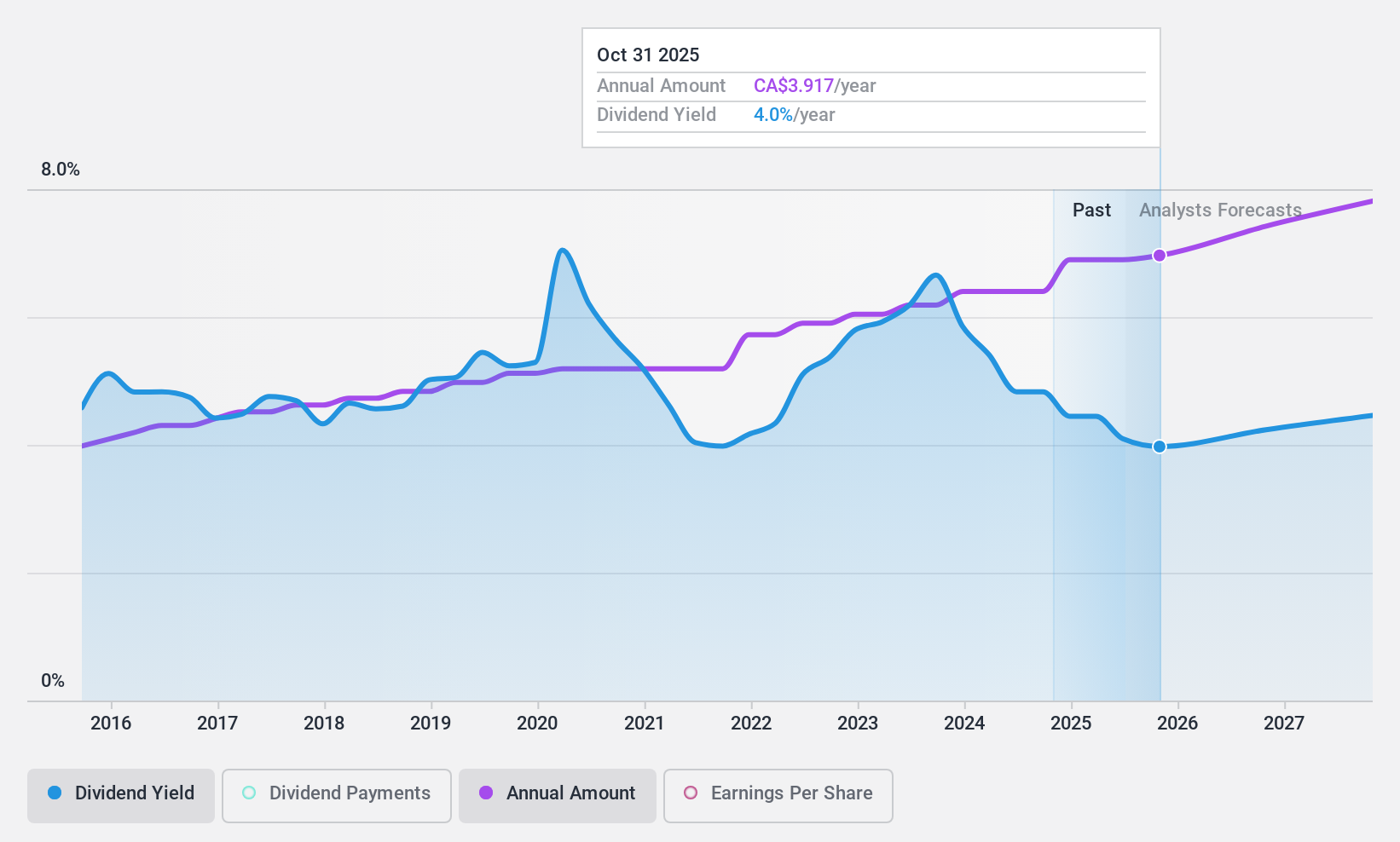

Canadian Imperial Bank of Commerce (TSX:CM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Imperial Bank of Commerce is a diversified financial institution offering a range of financial products and services to personal, business, public sector, and institutional clients in Canada, the United States, and internationally with a market cap of CA$85.94 billion.

Operations: Canadian Imperial Bank of Commerce generates revenue from several segments, including Canadian Personal and Business Banking (CA$9.04 billion), Capital Markets and Direct Financial Services (CA$5.69 billion), Canadian Commercial Banking and Wealth Management (CA$5.61 billion), and U.S. Commercial Banking and Wealth Management (CA$2.25 billion).

Dividend Yield: 4.3%

Canadian Imperial Bank of Commerce has demonstrated consistent dividend growth over the past decade, supported by a low payout ratio of 49.4%, ensuring dividends are well-covered by earnings. Recent earnings growth and strategic debt management, including redemption of debentures and new fixed-income offerings, bolster its financial stability. However, with a dividend yield of 4.25%, it lags behind the top Canadian dividend payers but remains attractive for those seeking reliable income streams in their portfolio.

- Unlock comprehensive insights into our analysis of Canadian Imperial Bank of Commerce stock in this dividend report.

- According our valuation report, there's an indication that Canadian Imperial Bank of Commerce's share price might be on the cheaper side.

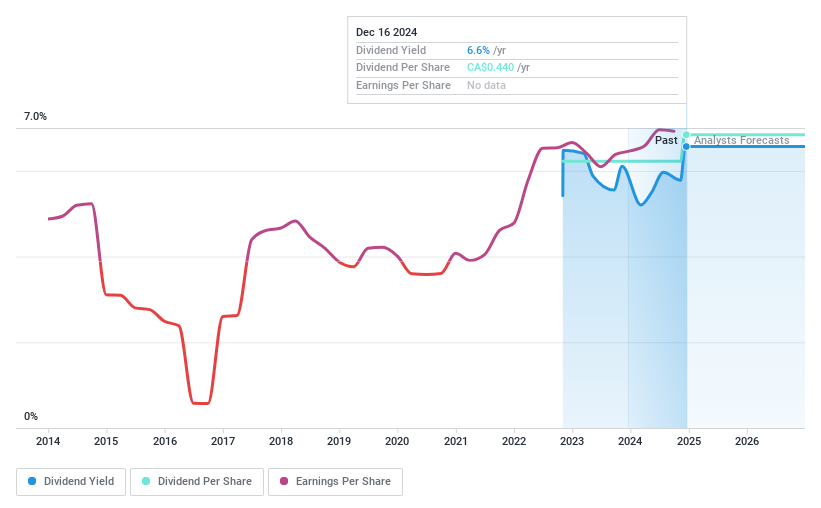

Headwater Exploration (TSX:HWX)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Headwater Exploration Inc. is involved in the exploration, development, and production of petroleum and natural gas in Canada, with a market cap of CA$1.66 billion.

Operations: Headwater Exploration Inc. generates revenue of CA$490.27 million from its activities in the petroleum and natural gas sectors.

Dividend Yield: 6.3%

Headwater Exploration's dividends are well-supported by earnings, with a payout ratio of 51.2%, and cash flows, despite a higher cash payout ratio of 86.5%. The company recently increased its quarterly dividend by 10% to C$0.11 per share, offering a yield of 6.3% at a C$7.00 share price, placing it among the top Canadian dividend payers. However, anticipated earnings decline poses potential risks for future dividend sustainability amidst ongoing business expansions and exploration investments.

- Click here to discover the nuances of Headwater Exploration with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Headwater Exploration's share price might be too pessimistic.

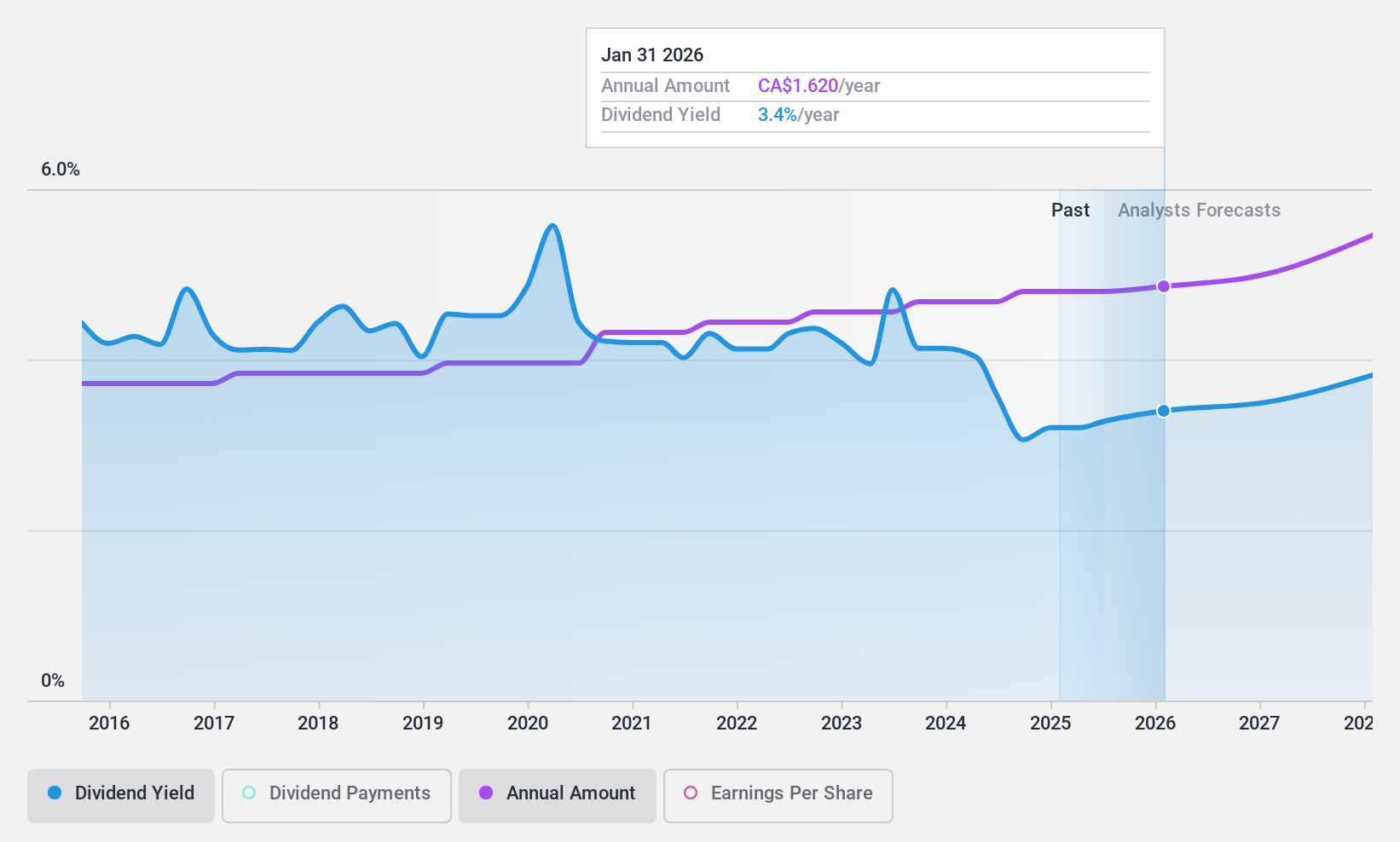

North West (TSX:NWC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The North West Company Inc. operates as a retailer of food and everyday products and services in rural communities and urban neighborhood markets across northern Canada, rural Alaska, the South Pacific, and the Caribbean, with a market cap of CA$2.26 billion.

Operations: The North West Company Inc. generates revenue of CA$2.54 billion from its operations as a retailer of food and everyday products and services in various regions, including northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Dividend Yield: 3.4%

North West Company offers a stable dividend, supported by a payout ratio of 57.4% from earnings and an 84.9% cash payout ratio. Recent quarterly results show modest revenue growth, though net income slightly declined. The company declared a quarterly dividend of C$0.40 per share, maintaining its reliable 10-year dividend history despite yielding below the top Canadian payers at 3.38%. A new buyback program aims to repurchase up to 9.96% of shares outstanding, potentially enhancing shareholder value.

- Navigate through the intricacies of North West with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of North West shares in the market.

Key Takeaways

- Unlock our comprehensive list of 28 Top TSX Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if North West might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NWC

North West

Through its subsidiaries, engages in the retail of food and everyday products and services to rural communities and urban neighborhood markets in northern Canada, rural Alaska, the South Pacific, and the Caribbean.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives