- Brazil

- /

- Electric Utilities

- /

- BOVESPA:LIGT3

Market Might Still Lack Some Conviction On Light S.A. (BVMF:LIGT3) Even After 32% Share Price Boost

Light S.A. (BVMF:LIGT3) shares have continued their recent momentum with a 32% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 24% is also fairly reasonable.

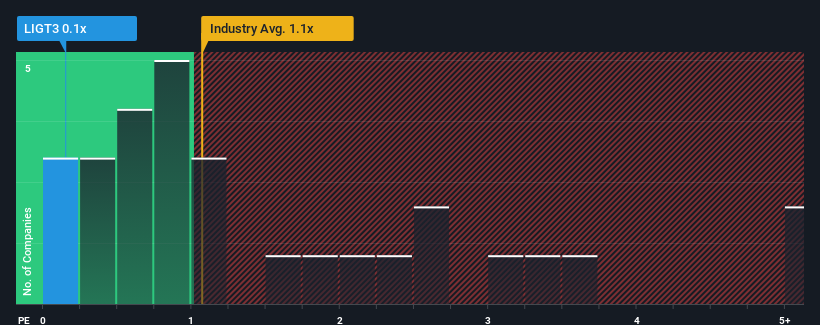

In spite of the firm bounce in price, considering around half the companies operating in Brazil's Electric Utilities industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider Light as an solid investment opportunity with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

We've discovered 2 warning signs about Light. View them for free.See our latest analysis for Light

How Light Has Been Performing

Revenue has risen firmly for Light recently, which is pleasing to see. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Light, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Light's to be considered reasonable.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. Still, revenue has barely risen at all in aggregate from three years ago, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

In contrast to the company, the rest of the industry is expected to decline by 12% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

With this information, we find it very odd that Light is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can maintain its recent positive growth rate in the face of a shrinking broader industry.

The Bottom Line On Light's P/S

The latest share price surge wasn't enough to lift Light's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Upon analysing the past data, we see it is unexpected that Light is currently trading at a lower P/S than the rest of the industry given that its revenue growth in the past three-year years is exceeding expectations in a challenging industry. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this positive performance. Perhaps there is some hesitation about the company's ability to stay its recent course and swim against the current of the broader industry turmoil. It appears many are indeed anticipating revenue instability, because this relative performance should normally provide a boost to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Light (including 1 which is a bit unpleasant).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:LIGT3

Light

Engages in the generation, transmission, distribution, and sale of electric power in Brazil.

Undervalued with acceptable track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026