- Brazil

- /

- Marine and Shipping

- /

- BOVESPA:LOGN3

The five-year decline in earnings might be taking its toll on Log-In Logística Intermodal (BVMF:LOGN3) shareholders as stock falls 7.3% over the past week

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And the truth is, you can make significant gains if you buy good quality businesses at the right price. For example, the Log-In Logística Intermodal S.A. (BVMF:LOGN3) share price is up 70% in the last 5 years, clearly besting the market return of around 2.3% (ignoring dividends).

While the stock has fallen 7.3% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

View our latest analysis for Log-In Logística Intermodal

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Log-In Logística Intermodal's earnings per share are down 26% per year, despite strong share price performance over five years.

Essentially, it doesn't seem likely that investors are focused on EPS. Because earnings per share don't seem to match up with the share price, we'll take a look at other metrics instead.

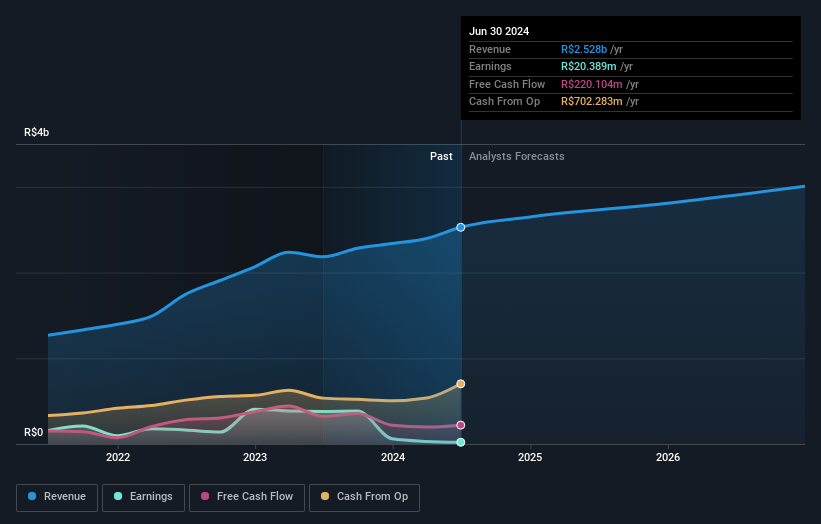

On the other hand, Log-In Logística Intermodal's revenue is growing nicely, at a compound rate of 21% over the last five years. It's quite possible that management are prioritizing revenue growth over EPS growth at the moment.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Log-In Logística Intermodal's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Log-In Logística Intermodal had a tough year, with a total loss of 25%, against a market gain of about 15%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 11% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Log-In Logística Intermodal (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:LOGN3

Log-In Logística Intermodal

Log-in Logística Intermodal S.A. provides integrated logistics solutions for moving and transporting door-to-door containers and cargo in Brazil, Austria, and internationally.

Good value with adequate balance sheet.