- Brazil

- /

- Consumer Durables

- /

- BOVESPA:MRVE3

Strong week for MRV Engenharia e Participações (BVMF:MRVE3) shareholders doesn't alleviate pain of five-year loss

It's nice to see the MRV Engenharia e Participações S.A. (BVMF:MRVE3) share price up 10% in a week. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. Like a ship taking on water, the share price has sunk 75% in that time. The recent bounce might mean the long decline is over, but we are not confident. The fundamental business performance will ultimately determine if the turnaround can be sustained.

The recent uptick of 10% could be a positive sign of things to come, so let's take a look at historical fundamentals.

View our latest analysis for MRV Engenharia e Participações

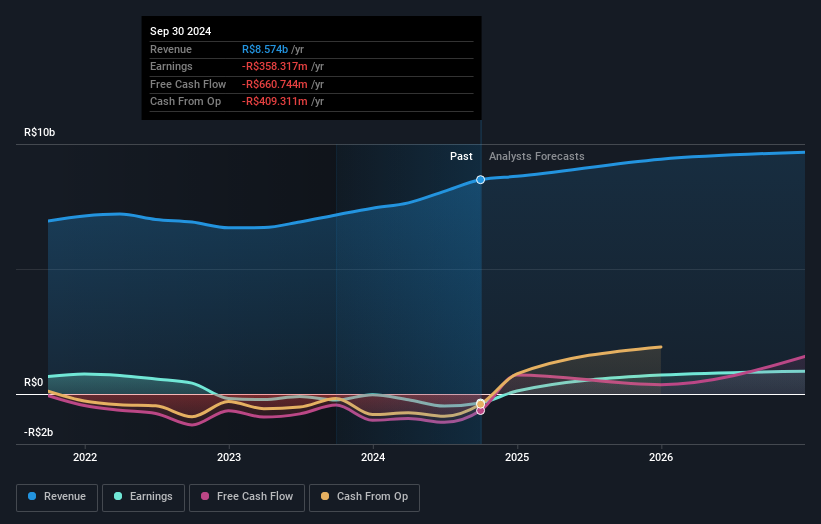

MRV Engenharia e Participações wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

In the last half decade, MRV Engenharia e Participações saw its revenue increase by 5.2% per year. That's not a very high growth rate considering it doesn't make profits. Nonetheless, it's fair to say the rapidly declining share price (down 12%, compound, over five years) suggests the market is very disappointed with this level of growth. We'd be pretty cautious about this one, although the sell-off may be too severe. We'd recommend focussing any further research on the likelihood of profitability in the foreseeable future, given the muted revenue growth.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

MRV Engenharia e Participações is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So we recommend checking out this free report showing consensus forecasts

What About The Total Shareholder Return (TSR)?

We've already covered MRV Engenharia e Participações' share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that MRV Engenharia e Participações' TSR, which was a 72% drop over the last 5 years, was not as bad as the share price return.

A Different Perspective

While the broader market lost about 6.0% in the twelve months, MRV Engenharia e Participações shareholders did even worse, losing 48%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should learn about the 2 warning signs we've spotted with MRV Engenharia e Participações (including 1 which is a bit unpleasant) .

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:MRVE3

MRV Engenharia e Participações

Operates as a real estate developer in Brazil and the United States.

Undervalued with moderate growth potential.

Market Insights

Community Narratives