Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Grupo SBF S.A. (BVMF:SBFG3) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Grupo SBF

How Much Debt Does Grupo SBF Carry?

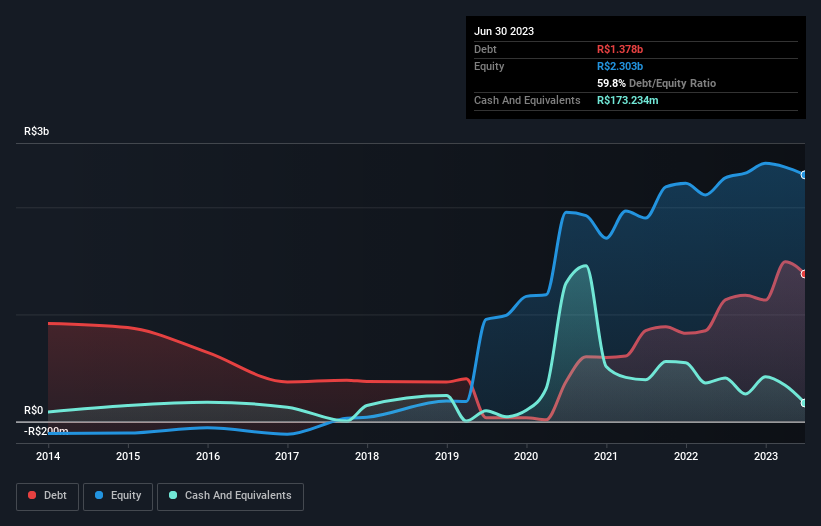

As you can see below, at the end of June 2023, Grupo SBF had R$1.38b of debt, up from R$1.14b a year ago. Click the image for more detail. However, it does have R$173.2m in cash offsetting this, leading to net debt of about R$1.20b.

A Look At Grupo SBF's Liabilities

We can see from the most recent balance sheet that Grupo SBF had liabilities of R$2.66b falling due within a year, and liabilities of R$3.16b due beyond that. Offsetting these obligations, it had cash of R$173.2m as well as receivables valued at R$1.82b due within 12 months. So its liabilities total R$3.83b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the R$1.87b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. At the end of the day, Grupo SBF would probably need a major re-capitalization if its creditors were to demand repayment.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Even though Grupo SBF's debt is only 2.4, its interest cover is really very low at 1.2. This does suggest the company is paying fairly high interest rates. In any case, it's safe to say the company has meaningful debt. Shareholders should be aware that Grupo SBF's EBIT was down 24% last year. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Grupo SBF's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Grupo SBF burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

On the face of it, Grupo SBF's EBIT growth rate left us tentative about the stock, and its level of total liabilities was no more enticing than the one empty restaurant on the busiest night of the year. But at least its net debt to EBITDA is not so bad. Considering everything we've mentioned above, it's fair to say that Grupo SBF is carrying heavy debt load. If you harvest honey without a bee suit, you risk getting stung, so we'd probably stay away from this particular stock. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for Grupo SBF (1 doesn't sit too well with us!) that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:SBFG3

Grupo SBF

Engages in the retail and wholesale of sports and leisure products in Brazil.

Very undervalued with proven track record.

Market Insights

Community Narratives