- Brazil

- /

- Specialty Stores

- /

- BOVESPA:LREN3

Investors in Lojas Renner (BVMF:LREN3) have unfortunately lost 70% over the last five years

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. It hits us in the gut when we see fellow investors suffer a loss. For example, we sympathize with anyone who was caught holding Lojas Renner S.A. (BVMF:LREN3) during the five years that saw its share price drop a whopping 74%. Furthermore, it's down 25% in about a quarter. That's not much fun for holders. But this could be related to the weak market, which is down 11% in the same period.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for Lojas Renner

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

While the share price declined over five years, Lojas Renner actually managed to increase EPS by an average of 1.5% per year. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

Based on these numbers, we'd venture that the market may have been over-optimistic about forecast growth, half a decade ago. Looking to other metrics might better explain the share price change.

We note that the dividend has remained healthy, so that wouldn't really explain the share price drop. While it's not completely obvious why the share price is down, a closer look at the company's history might help explain it.

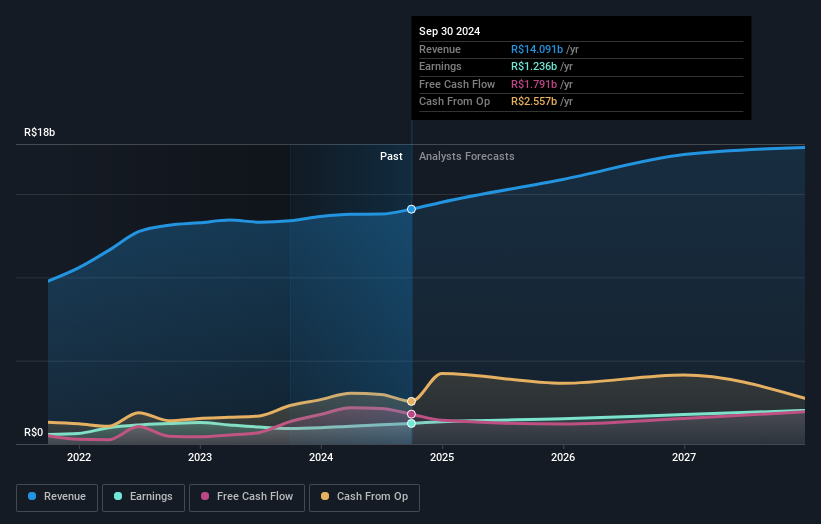

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Lojas Renner is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. You can see what analysts are predicting for Lojas Renner in this interactive graph of future profit estimates.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Lojas Renner, it has a TSR of -70% for the last 5 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We regret to report that Lojas Renner shareholders are down 13% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 8.3%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, longer term shareholders are suffering worse, given the loss of 11% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Lojas Renner better, we need to consider many other factors. For instance, we've identified 1 warning sign for Lojas Renner that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:LREN3

Lojas Renner

Operates as a fashion and lifestyle company in Brazil, Argentina, and Uruguay.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives