- Brazil

- /

- Real Estate

- /

- BOVESPA:HBRE3

Investors who have held HBR Realty Empreendimentos Imobiliários (BVMF:HBRE3) over the last year have watched its earnings decline along with their investment

HBR Realty Empreendimentos Imobiliários S.A. (BVMF:HBRE3) shareholders should be happy to see the share price up 16% in the last month. But that doesn't change the reality of under-performance over the last twelve months. After all, the share price is down 32% in the last year, significantly under-performing the market.

Although the past week has been more reassuring for shareholders, they're still in the red over the last year, so let's see if the underlying business has been responsible for the decline.

Check out our latest analysis for HBR Realty Empreendimentos Imobiliários

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

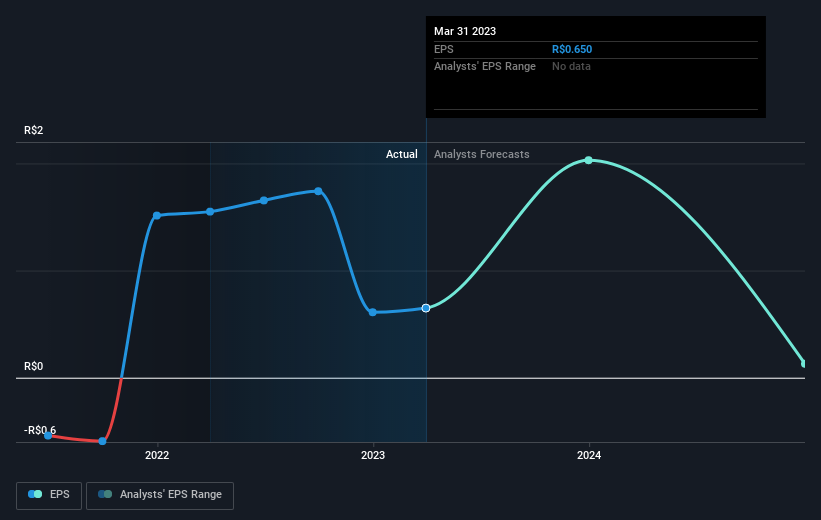

Unhappily, HBR Realty Empreendimentos Imobiliários had to report a 58% decline in EPS over the last year. The share price fall of 32% isn't as bad as the reduction in earnings per share. It may have been that the weak EPS was not as bad as some had feared.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into HBR Realty Empreendimentos Imobiliários' key metrics by checking this interactive graph of HBR Realty Empreendimentos Imobiliários's earnings, revenue and cash flow.

A Different Perspective

We doubt HBR Realty Empreendimentos Imobiliários shareholders are happy with the loss of 32% over twelve months. That falls short of the market, which lost 1.0%. There's no doubt that's a disappointment, but the stock may well have fared better in a stronger market. It's great to see a nice little 3.6% rebound in the last three months. Let's just hope this isn't the widely-feared 'dead cat bounce' (which would indicate further declines to come). It's always interesting to track share price performance over the longer term. But to understand HBR Realty Empreendimentos Imobiliários better, we need to consider many other factors. Take risks, for example - HBR Realty Empreendimentos Imobiliários has 4 warning signs (and 1 which is potentially serious) we think you should know about.

But note: HBR Realty Empreendimentos Imobiliários may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if HBR Realty Empreendimentos Imobiliários might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:HBRE3

HBR Realty Empreendimentos Imobiliários

HBR Realty Empreendimentos Imobiliários S.A.

Medium-low with limited growth.

Market Insights

Community Narratives