Biomm (BVMF:BIOM3) shareholder returns have been decent, earning 33% in 1 year

The simplest way to invest in stocks is to buy exchange traded funds. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Biomm S.A. (BVMF:BIOM3) share price is 33% higher than it was a year ago, much better than the market decline of around 7.4% (not including dividends) in the same period. That's a solid performance by our standards! Zooming out, the stock is actually down 23% in the last three years.

The past week has proven to be lucrative for Biomm investors, so let's see if fundamentals drove the company's one-year performance.

Check out our latest analysis for Biomm

Because Biomm made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Biomm actually shrunk its revenue over the last year, with a reduction of 1.3%. Despite the lack of revenue growth, the stock has returned a solid 33% the last twelve months. We can correlate the share price rise with revenue or profit growth, but it seems the market had previously expected weaker results, and sentiment around the stock is improving.

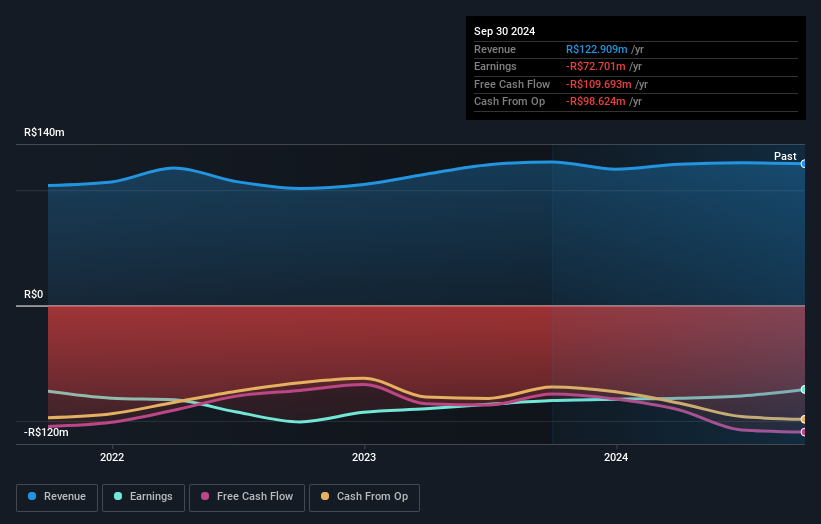

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's good to see that Biomm has rewarded shareholders with a total shareholder return of 33% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 4% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Biomm (at least 2 which are significant) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Biomm might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:BIOM3

Adequate balance sheet with low risk.

Market Insights

Community Narratives