- Brazil

- /

- Metals and Mining

- /

- BOVESPA:CSNA3

With Companhia Siderúrgica Nacional (BVMF:CSNA3) It Looks Like You'll Get What You Pay For

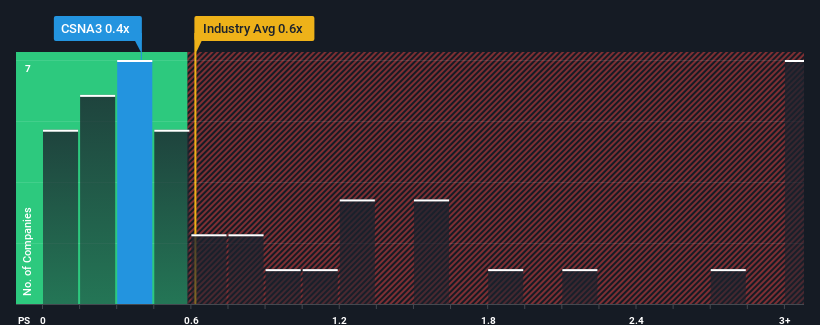

There wouldn't be many who think Companhia Siderúrgica Nacional's (BVMF:CSNA3) price-to-sales (or "P/S") ratio of 0.4x is worth a mention when the median P/S for the Metals and Mining industry in Brazil is similar at about 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Companhia Siderúrgica Nacional

How Has Companhia Siderúrgica Nacional Performed Recently?

Companhia Siderúrgica Nacional has been doing a reasonable job lately as its revenue hasn't declined as much as most other companies. One possibility is that the P/S ratio is moderate because investors think this relatively better revenue performance might be about to evaporate. You'd much rather the company continue improving its revenue if you still believe in the business. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues outplaying the industry.

Want the full picture on analyst estimates for the company? Then our free report on Companhia Siderúrgica Nacional will help you uncover what's on the horizon.How Is Companhia Siderúrgica Nacional's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Companhia Siderúrgica Nacional's to be considered reasonable.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Still, the latest three year period was better as it's delivered a decent 20% overall rise in revenue. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 0.1% each year as estimated by the eight analysts watching the company. With the industry predicted to deliver 1.0% growth per annum, the company is positioned for a comparable revenue result.

With this in mind, it makes sense that Companhia Siderúrgica Nacional's P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Companhia Siderúrgica Nacional maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Companhia Siderúrgica Nacional (of which 2 make us uncomfortable!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:CSNA3

Companhia Siderúrgica Nacional

Operates as an integrated steel producer in Brazil and Latin America.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives