- Brazil

- /

- Metals and Mining

- /

- BOVESPA:CBAV3

Even With A 27% Surge, Cautious Investors Are Not Rewarding Companhia Brasileira de Alumínio's (BVMF:CBAV3) Performance Completely

Those holding Companhia Brasileira de Alumínio (BVMF:CBAV3) shares would be relieved that the share price has rebounded 27% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking back a bit further, it's encouraging to see the stock is up 47% in the last year.

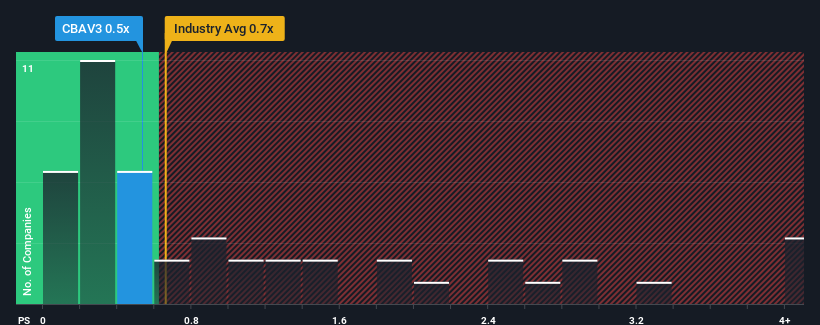

Even after such a large jump in price, it's still not a stretch to say that Companhia Brasileira de Alumínio's price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Metals and Mining industry in Brazil, where the median P/S ratio is around 0.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Companhia Brasileira de Alumínio

What Does Companhia Brasileira de Alumínio's P/S Mean For Shareholders?

Companhia Brasileira de Alumínio could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Companhia Brasileira de Alumínio's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Companhia Brasileira de Alumínio would need to produce growth that's similar to the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.3%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 11% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 8.7% per year as estimated by the seven analysts watching the company. That's shaping up to be materially higher than the 2.3% per year growth forecast for the broader industry.

With this in consideration, we find it intriguing that Companhia Brasileira de Alumínio's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Its shares have lifted substantially and now Companhia Brasileira de Alumínio's P/S is back within range of the industry median. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Companhia Brasileira de Alumínio currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Companhia Brasileira de Alumínio you should be aware of, and 2 of them are a bit concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:CBAV3

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives