- Brazil

- /

- Personal Products

- /

- BOVESPA:NTCO3

Investors Continue Waiting On Sidelines For Natura &Co Holding S.A. (BVMF:NTCO3)

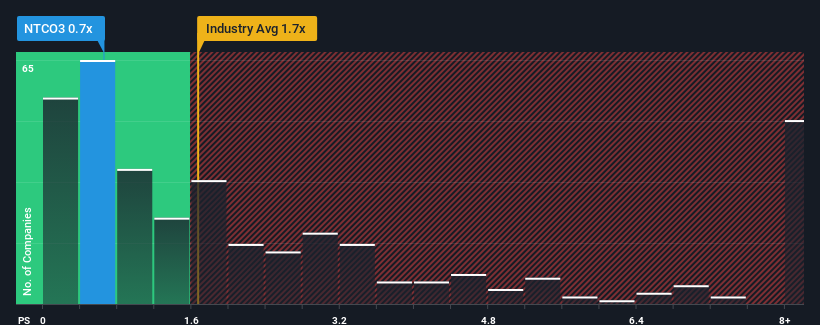

With a price-to-sales (or "P/S") ratio of 0.7x Natura &Co Holding S.A. (BVMF:NTCO3) may be sending bullish signals at the moment, given that almost half of all the Personal Products companies in Brazil have P/S ratios greater than 1.7x and even P/S higher than 4x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Natura &Co Holding

How Natura &Co Holding Has Been Performing

Natura &Co Holding could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Natura &Co Holding.How Is Natura &Co Holding's Revenue Growth Trending?

Natura &Co Holding's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.6%. Regardless, revenue has managed to lift by a handy 18% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to climb by 4.2% per annum during the coming three years according to the eleven analysts following the company. With the industry predicted to deliver 5.8% growth per annum, the company is positioned for a comparable revenue result.

With this information, we find it odd that Natura &Co Holding is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can achieve future growth expectations.

What We Can Learn From Natura &Co Holding's P/S?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It looks to us like the P/S figures for Natura &Co Holding remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Many other vital risk factors can be found on the company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Natura &Co Holding with six simple checks.

If these risks are making you reconsider your opinion on Natura &Co Holding, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Natura &Co Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:NTCO3

Natura &Co Holding

Engages in the manufacturing, distribution, and sale of cosmetics, fragrances, and personal care products in Brazil, Asia, Europe, North America, South America, the Middle East, Africa, and Oceania.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives