- Brazil

- /

- Consumer Services

- /

- BOVESPA:COGN3

Investors in Cogna Educação (BVMF:COGN3) from five years ago are still down 72%, even after 5.4% gain this past week

It is a pleasure to report that the Cogna Educação S.A. (BVMF:COGN3) is up 45% in the last quarter. But will that heal all the wounds inflicted over 5 years of declines? Unlikely. Like a ship taking on water, the share price has sunk 73% in that time. The recent bounce might mean the long decline is over, but we are not confident. The important question is if the business itself justifies a higher share price in the long term.

The recent uptick of 5.4% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for Cogna Educação

SWOT Analysis for Cogna Educação

- Net debt to equity ratio below 40%.

- Interest payments on debt are not well covered.

- Forecast to reduce losses next year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Good value based on P/S ratio and estimated fair value.

- Debt is not well covered by operating cash flow.

Because Cogna Educação made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Cogna Educação reduced its trailing twelve month revenue by 5.3% for each year. While far from catastrophic that is not good. The share price fall of 12% (per year, over five years) is a stern reminder that money-losing companies are expected to grow revenue. We're generally averse to companies with declining revenues, but we're not alone in that. That is not really what the successful investors we know aim for.

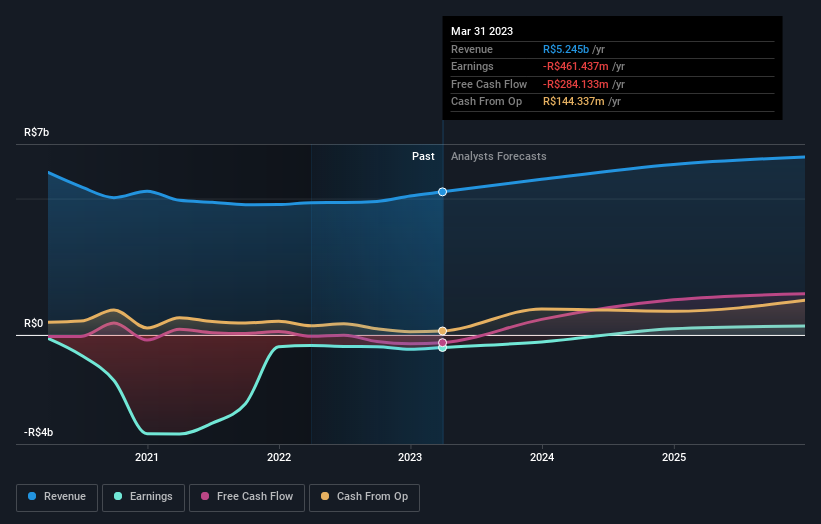

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

We're pleased to report that Cogna Educação shareholders have received a total shareholder return of 12% over one year. There's no doubt those recent returns are much better than the TSR loss of 11% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. You could get a better understanding of Cogna Educação's growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:COGN3

Cogna Educação

Operates as an educational organization in Brazil and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives