- Brazil

- /

- Food and Staples Retail

- /

- BOVESPA:RADL3

4.7% earnings growth over 1 year has not materialized into gains for Raia Drogasil (BVMF:RADL3) shareholders over that period

The simplest way to benefit from a rising market is to buy an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Raia Drogasil S.A. (BVMF:RADL3) shareholders over the last year, as the share price declined 22%. That's disappointing when you consider the market declined 2.9%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 8.7% in three years. The share price has dropped 23% in three months.

If the past week is anything to go by, investor sentiment for Raia Drogasil isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Raia Drogasil

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months during which the Raia Drogasil share price fell, it actually saw its earnings per share (EPS) improve by 4.7%. Of course, the situation might betray previous over-optimism about growth.

By glancing at these numbers, we'd posit that the the market had expectations of much higher growth, last year. But looking to other metrics might better explain the share price change.

With a low yield of 1.1% we doubt that the dividend influences the share price much. Raia Drogasil's revenue is actually up 15% over the last year. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

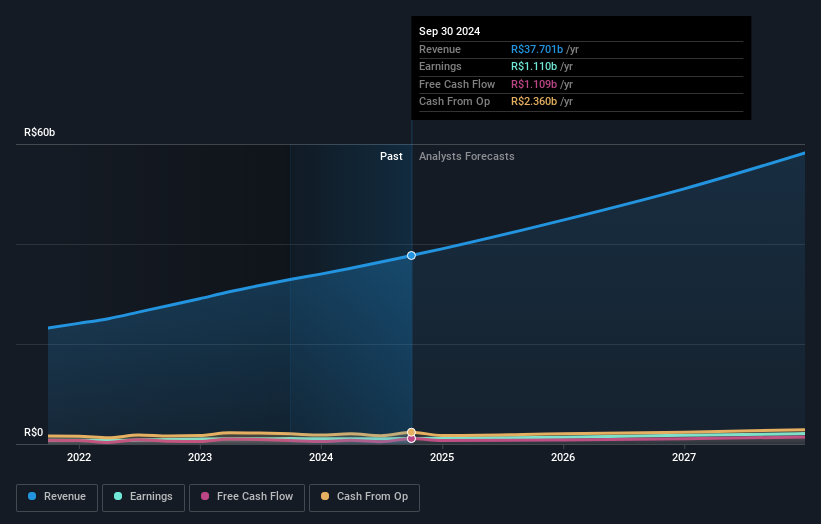

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Raia Drogasil is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We regret to report that Raia Drogasil shareholders are down 21% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 2.9%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 2% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Raia Drogasil better, we need to consider many other factors. For instance, we've identified 1 warning sign for Raia Drogasil that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:RADL3

Raia Drogasil

Engages in the retail sale of medicines, perfumery, personal care and beauty products, cosmetics, dermocosmetics, and specialty medicines in Brazil.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives