Don't Race Out To Buy Grendene S.A. (BVMF:GRND3) Just Because It's Going Ex-Dividend

Readers hoping to buy Grendene S.A. (BVMF:GRND3) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date is commonly two business days before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is important as the process of settlement involves at least two full business days. So if you miss that date, you would not show up on the company's books on the record date. In other words, investors can purchase Grendene's shares before the 22nd of August in order to be eligible for the dividend, which will be paid on the 10th of December.

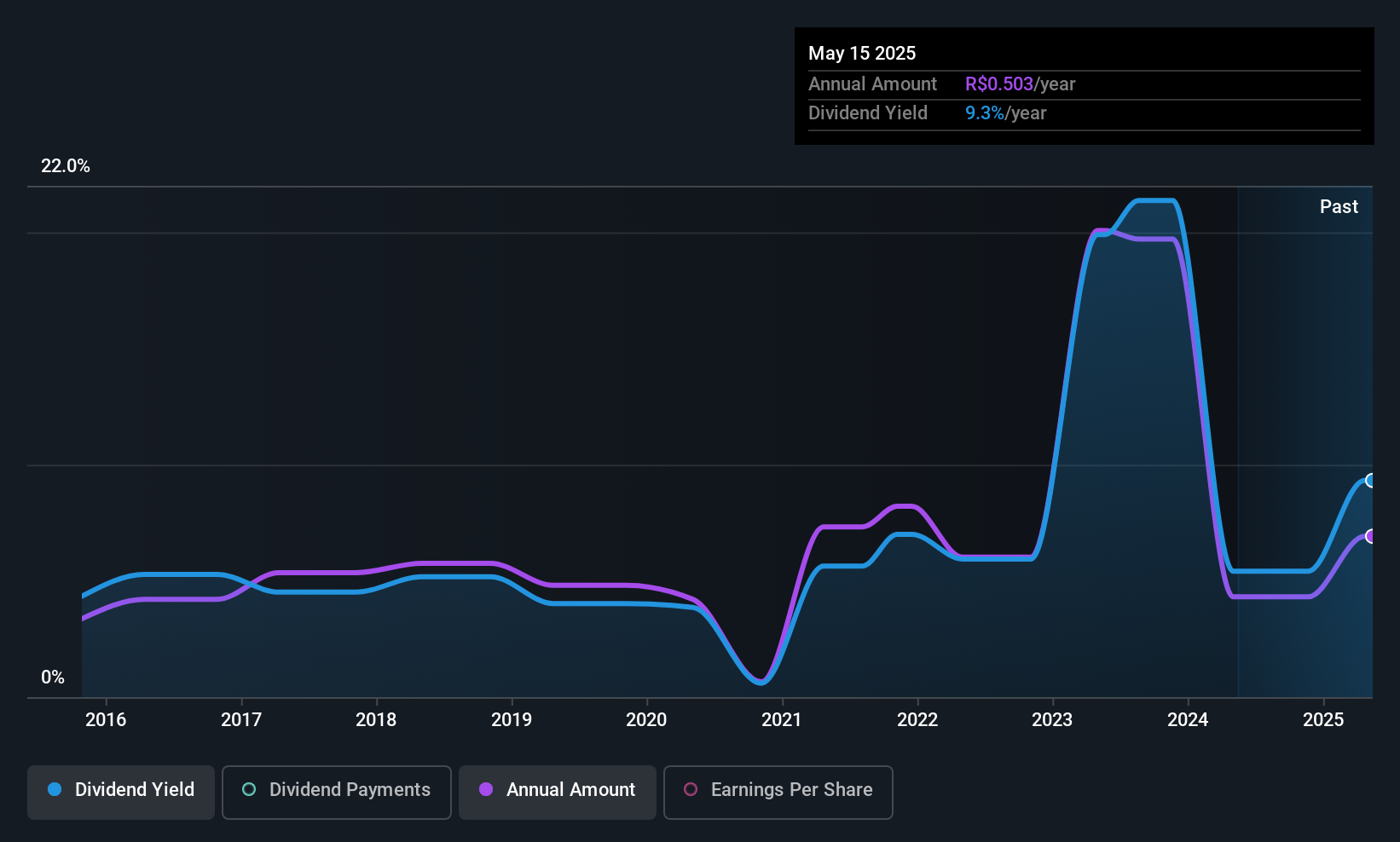

The company's next dividend payment will be R$0.1145286 per share, and in the last 12 months, the company paid a total of R$0.50 per share. Looking at the last 12 months of distributions, Grendene has a trailing yield of approximately 9.5% on its current stock price of R$5.30. If you buy this business for its dividend, you should have an idea of whether Grendene's dividend is reliable and sustainable. So we need to investigate whether Grendene can afford its dividend, and if the dividend could grow.

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Grendene paid out 65% of its earnings to investors last year, a normal payout level for most businesses. A useful secondary check can be to evaluate whether Grendene generated enough free cash flow to afford its dividend. It paid out more than half (70%) of its free cash flow in the past year, which is within an average range for most companies.

It's positive to see that Grendene's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Check out our latest analysis for Grendene

Click here to see how much of its profit Grendene paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. If earnings fall far enough, the company could be forced to cut its dividend. That explains why we're not overly excited about Grendene's flat earnings over the past five years. It's better than seeing them drop, certainly, but over the long term, all of the best dividend stocks are able to meaningfully grow their earnings per share.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Since the start of our data, 10 years ago, Grendene has lifted its dividend by approximately 7.5% a year on average.

To Sum It Up

Has Grendene got what it takes to maintain its dividend payments? Grendene has been unable to generate earnings growth, but at least its dividend looks sustainable, with its profit and cashflow payout ratios within reasonable limits. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

With that in mind though, if the poor dividend characteristics of Grendene don't faze you, it's worth being mindful of the risks involved with this business. For example, we've found 1 warning sign for Grendene that we recommend you consider before investing in the business.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:GRND3

Grendene

Engages in the development, production, distribution, and sale of plastic footwear for women, men, and children in Brazil and internationally.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)