- Brazil

- /

- Consumer Durables

- /

- BOVESPA:CYRE3

Should You Be Adding Cyrela Brazil Realty Empreendimentos e Participações (BVMF:CYRE3) To Your Watchlist Today?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Cyrela Brazil Realty Empreendimentos e Participações (BVMF:CYRE3). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Cyrela Brazil Realty Empreendimentos e Participações

How Fast Is Cyrela Brazil Realty Empreendimentos e Participações Growing Its Earnings Per Share?

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. You can imagine, then, that it almost knocked my socks off when I realized that Cyrela Brazil Realty Empreendimentos e Participações grew its EPS from R$0.91 to R$5.52, in one short year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Cyrela Brazil Realty Empreendimentos e Participações is growing revenues, and EBIT margins improved by 7.1 percentage points to 17%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

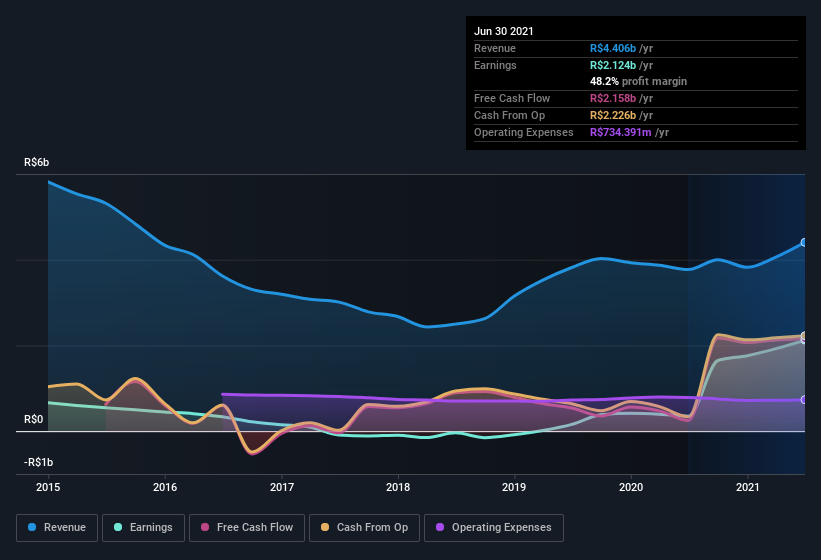

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Cyrela Brazil Realty Empreendimentos e Participações's forecast profits?

Are Cyrela Brazil Realty Empreendimentos e Participações Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Cyrela Brazil Realty Empreendimentos e Participações insiders have a significant amount of capital invested in the stock. Notably, they have an enormous stake in the company, worth R$2.0b. That equates to 28% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

Should You Add Cyrela Brazil Realty Empreendimentos e Participações To Your Watchlist?

Cyrela Brazil Realty Empreendimentos e Participações's earnings per share have taken off like a rocket aimed right at the moon. That EPS growth certainly has my attention, and the large insider ownership only serves to further stoke my interest. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So yes, on this short analysis I do think it's worth considering Cyrela Brazil Realty Empreendimentos e Participações for a spot on your watchlist. Before you take the next step you should know about the 3 warning signs for Cyrela Brazil Realty Empreendimentos e Participações that we have uncovered.

Although Cyrela Brazil Realty Empreendimentos e Participações certainly looks good to me, I would like it more if insiders were buying up shares. If you like to see insider buying, too, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:CYRE3

Cyrela Brazil Realty Empreendimentos e Participações

Develops and constructs residential properties in Brazil.

Undervalued with solid track record.

Market Insights

Community Narratives