- Bulgaria

- /

- Specialty Stores

- /

- BUL:PET

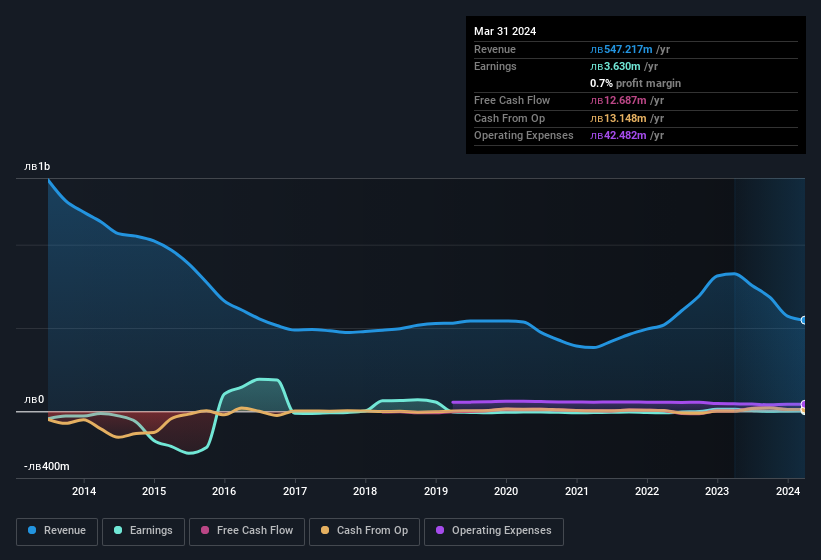

Shaky Earnings May Not Tell The Whole Story For Petrol AD (BUL:PET)

Investors were disappointed with Petrol AD's (BUL:PET) recent earnings. We think there is more to the story than simply soft profit numbers. Our analysis shows that there are some other factors of concern.

Check out our latest analysis for Petrol AD

How Do Unusual Items Influence Profit?

For anyone who wants to understand Petrol AD's profit beyond the statutory numbers, it's important to note that during the last twelve months statutory profit gained from лв8.4m worth of unusual items. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's as you'd expect, given these boosts are described as 'unusual'. We can see that Petrol AD's positive unusual items were quite significant relative to its profit in the year to March 2024. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Petrol AD.

An Unusual Tax Situation

Having already discussed the impact of the unusual items, we should also note that Petrol AD received a tax benefit of лв153k. It's always a bit noteworthy when a company is paid by the tax man, rather than paying the tax man. The receipt of a tax benefit is obviously a good thing, on its own. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. Assuming the tax benefit is not repeated every year, we could see its profitability drop noticeably, all else being equal.

Our Take On Petrol AD's Profit Performance

In the last year Petrol AD received a tax benefit, which boosted its profit in a way that might not be much more sustainable than turning prime farmland into gas fields. Furthermore, it also benefitted from a positive unusual item, which boosted the profit result even higher. Considering all this we'd argue Petrol AD's profits probably give an overly generous impression of its sustainable level of profitability. So while earnings quality is important, it's equally important to consider the risks facing Petrol AD at this point in time. Our analysis shows 4 warning signs for Petrol AD (1 makes us a bit uncomfortable!) and we strongly recommend you look at these before investing.

Our examination of Petrol AD has focussed on certain factors that can make its earnings look better than they are. And, on that basis, we are somewhat skeptical. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BUL:PET

Petrol AD

Engages in the processing, storage, wholesale, and retail sale of petroleum products and derivatives in Bulgaria.

Slight and slightly overvalued.

Market Insights

Community Narratives