- Bulgaria

- /

- Capital Markets

- /

- BUL:HVAR

If You Had Bought Holding Varna (BUL:HVAR) Stock Five Years Ago, You Could Pocket A 66% Gain Today

Stock pickers are generally looking for stocks that will outperform the broader market. And in our experience, buying the right stocks can give your wealth a significant boost. For example, the Holding Varna PLC (BUL:HVAR) share price is up 66% in the last 5 years, clearly besting the market return of around 24% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 3.7% in the last year.

Check out our latest analysis for Holding Varna

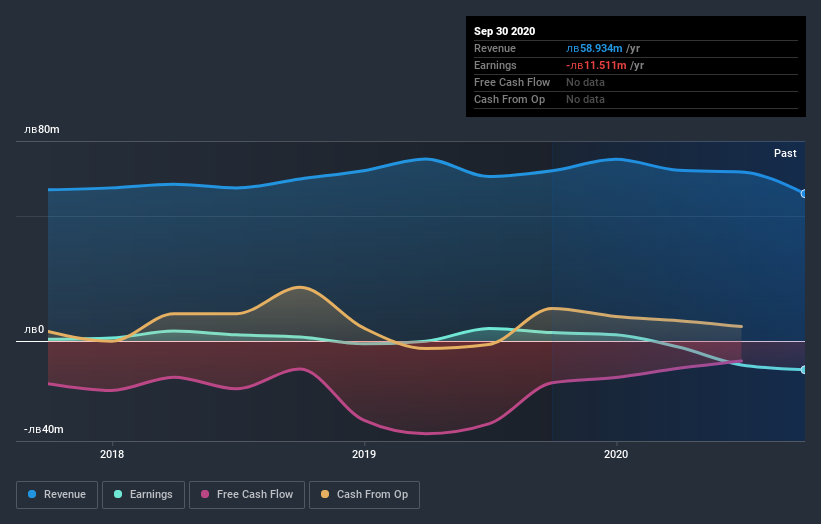

Because Holding Varna made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

For the last half decade, Holding Varna can boast revenue growth at a rate of 6.6% per year. That's a fairly respectable growth rate. Revenue has been growing at a reasonable clip, so it's debatable whether the share price growth of 11% full reflects the underlying business growth. If revenue growth can maintain for long enough, it's likely profits will flow. There's no doubt that it can be difficult to value pre-profit companies.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Holding Varna stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Holding Varna shareholders are up 3.7% for the year. Unfortunately this falls short of the market return. It's probably a good sign that the company has an even better long term track record, having provided shareholders with an annual TSR of 11% over five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. It's always interesting to track share price performance over the longer term. But to understand Holding Varna better, we need to consider many other factors. To that end, you should be aware of the 1 warning sign we've spotted with Holding Varna .

We will like Holding Varna better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BG exchanges.

If you decide to trade Holding Varna, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

If you're looking to trade Holding Varna AD, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Holding Varna AD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BUL:HVAR

Holding Varna AD

Manages a portfolio of investments in commercial companies that provide Bulgarian and foreign consumers with products and services in the field of tourism, finance, design, media, and communications.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives