The Market Doesn't Like What It Sees From bpost NV/SA's (EBR:BPOST) Earnings Yet As Shares Tumble 25%

The bpost NV/SA (EBR:BPOST) share price has fared very poorly over the last month, falling by a substantial 25%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 31% share price drop.

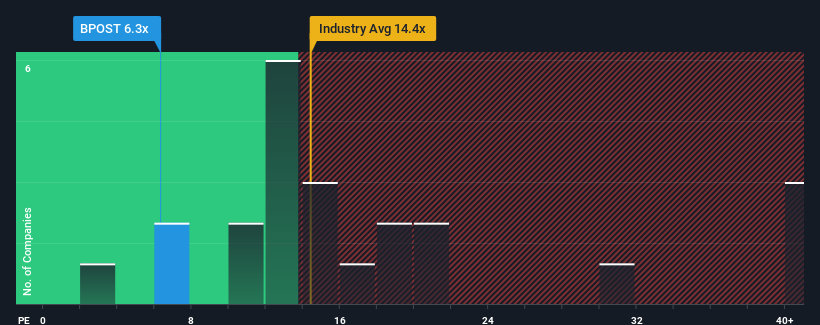

Although its price has dipped substantially, given about half the companies in Belgium have price-to-earnings ratios (or "P/E's") above 14x, you may still consider bpost/SA as a highly attractive investment with its 6.3x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, bpost/SA has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

See our latest analysis for bpost/SA

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as bpost/SA's is when the company's growth is on track to lag the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 52%. This means it has also seen a slide in earnings over the longer-term as EPS is down 32% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the eight analysts covering the company suggest earnings should grow by 10% over the next year. That's shaping up to be materially lower than the 15% growth forecast for the broader market.

In light of this, it's understandable that bpost/SA's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

bpost/SA's P/E looks about as weak as its stock price lately. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of bpost/SA's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 4 warning signs for bpost/SA you should know about.

You might be able to find a better investment than bpost/SA. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:BPOST

bpost/SA

Provides mail and parcel services to individuals, businesses, and public institutions in Belgium, rest of Europe, the United States, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)