Should Shareholders Reconsider Hybrid Software Group PLC's (EBR:HYSG) CEO Compensation Package?

Key Insights

- Hybrid Software Group will host its Annual General Meeting on 8th of May

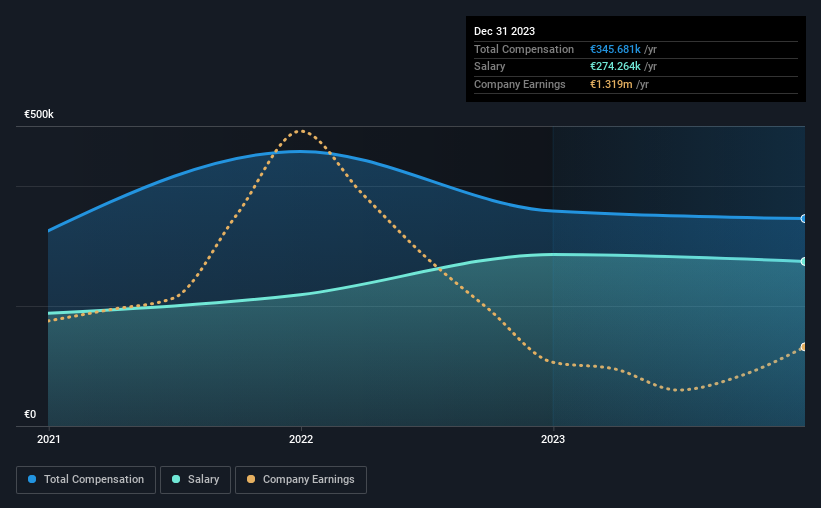

- CEO Mike Rottenborn's total compensation includes salary of €274.3k

- The total compensation is 40% higher than the average for the industry

- Hybrid Software Group's three-year loss to shareholders was 28% while its EPS was down 35% over the past three years

Shareholders will probably not be too impressed with the underwhelming results at Hybrid Software Group PLC (EBR:HYSG) recently. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 8th of May. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

Check out our latest analysis for Hybrid Software Group

Comparing Hybrid Software Group PLC's CEO Compensation With The Industry

Our data indicates that Hybrid Software Group PLC has a market capitalization of €112m, and total annual CEO compensation was reported as €346k for the year to December 2023. We note that's a small decrease of 3.5% on last year. We note that the salary portion, which stands at €274.3k constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the Belgium Software industry with market capitalizations under €187m, the reported median total CEO compensation was €248k. This suggests that Mike Rottenborn is paid more than the median for the industry.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €274k | €286k | 79% |

| Other | €71k | €72k | 21% |

| Total Compensation | €346k | €358k | 100% |

On an industry level, roughly 66% of total compensation represents salary and 34% is other remuneration. It's interesting to note that Hybrid Software Group pays out a greater portion of remuneration through salary, compared to the industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Hybrid Software Group PLC's Growth

Hybrid Software Group PLC has reduced its earnings per share by 35% a year over the last three years. It achieved revenue growth of 2.9% over the last year.

Few shareholders would be pleased to read that EPS have declined. The fairly low revenue growth fails to impress given that the EPS is down. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Hybrid Software Group PLC Been A Good Investment?

Given the total shareholder loss of 28% over three years, many shareholders in Hybrid Software Group PLC are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Hybrid Software Group that you should be aware of before investing.

Switching gears from Hybrid Software Group, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hybrid Software Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:HYSG

Hybrid Software Group

Develops software and hardware technology solutions for graphics and industrial inkjet printing in the United Kingdom, rest of Europe, North and South America, and Asia.

Excellent balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)