After Leaping 27% Hyloris Pharmaceuticals SA (EBR:HYL) Shares Are Not Flying Under The Radar

Hyloris Pharmaceuticals SA (EBR:HYL) shareholders have had their patience rewarded with a 27% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 39% over that time.

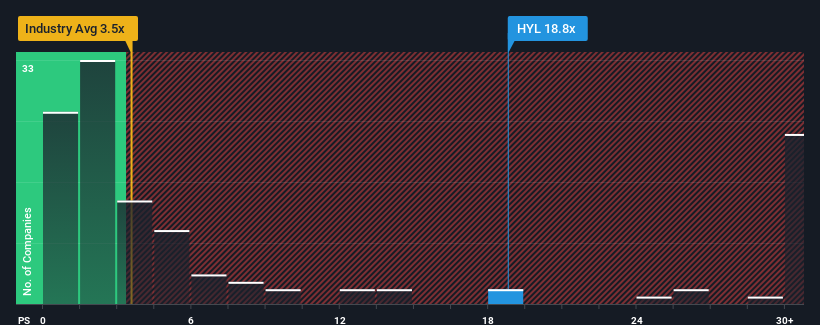

Since its price has surged higher, you could be forgiven for thinking Hyloris Pharmaceuticals is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 18.8x, considering almost half the companies in Belgium's Pharmaceuticals industry have P/S ratios below 3.5x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Hyloris Pharmaceuticals

How Has Hyloris Pharmaceuticals Performed Recently?

Recent times have been advantageous for Hyloris Pharmaceuticals as its revenues have been rising faster than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Hyloris Pharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start.How Is Hyloris Pharmaceuticals' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as Hyloris Pharmaceuticals' is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 138% gain to the company's top line. Pleasingly, revenue has also lifted 224% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 120% per year as estimated by the dual analysts watching the company. With the industry only predicted to deliver 9.3% per year, the company is positioned for a stronger revenue result.

In light of this, it's understandable that Hyloris Pharmaceuticals' P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

Hyloris Pharmaceuticals' P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Hyloris Pharmaceuticals' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

You always need to take note of risks, for example - Hyloris Pharmaceuticals has 1 warning sign we think you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

If you're looking to trade Hyloris Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hyloris Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:HYL

Hyloris Pharmaceuticals

Engages in the research, development, and manufacture of pharmaceutical products to address unmet medical needs.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives