Umicore (ENXTBR:UMI) Is Up 10.3% After Unlocking €410 Million by Selling Gold Inventories—What's Changed

Reviewed by Sasha Jovanovic

- In October 2025, Umicore announced it had sold its permanently tied up gold inventories from its Jewelry & Industrial Metals and Precious Metals Refining business units, generating €410 million in net proceeds and a significant after-tax capital gain of €370 million.

- This move enables Umicore to strengthen its balance sheet and optimize financing costs by shifting to revolving metal leases, increasing financial flexibility while maintaining operational effectiveness.

- Let's explore how Umicore's decision to unlock liquidity by selling gold inventories shapes its updated investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Umicore Investment Narrative Recap

To own shares in Umicore, you likely need to see value in its leadership in materials technology, its global recycling operations, and its ability to unlock capital even as some core markets face volatility. The recent gold inventory sale strengthens liquidity and financial flexibility, which could help address near-term funding needs, but does not fundamentally change the critical short-term catalyst: restoring growth and profitability in the Battery Materials and Recycling divisions after recent setbacks. The most pressing risk remains potential ongoing weakness in these units, especially if end-market demand continues to lag.

Among Umicore’s recent updates, the August 2025 half-year earnings stood out: the company posted €8.7 billion in revenue and returned to profitability after last year’s significant losses. This profit rebound was partly driven by one-off effects but reinforces the narrative that any near-term upside depends heavily on turning around performance in Battery Materials and Recycling, which continue to face challenges with slower electric vehicle demand and less favorable precious metals prices.

Yet, investors should not overlook how a persistently weak Recycling segment, alongside fluctuating metal prices, could...

Read the full narrative on Umicore (it's free!)

Umicore's outlook projects €3.8 billion in revenue and €344.5 million in earnings by 2028. This implies a 38.3% annual decline in revenue and an increase of €215.7 million in earnings from the current €128.8 million.

Uncover how Umicore's forecasts yield a €14.02 fair value, a 17% downside to its current price.

Exploring Other Perspectives

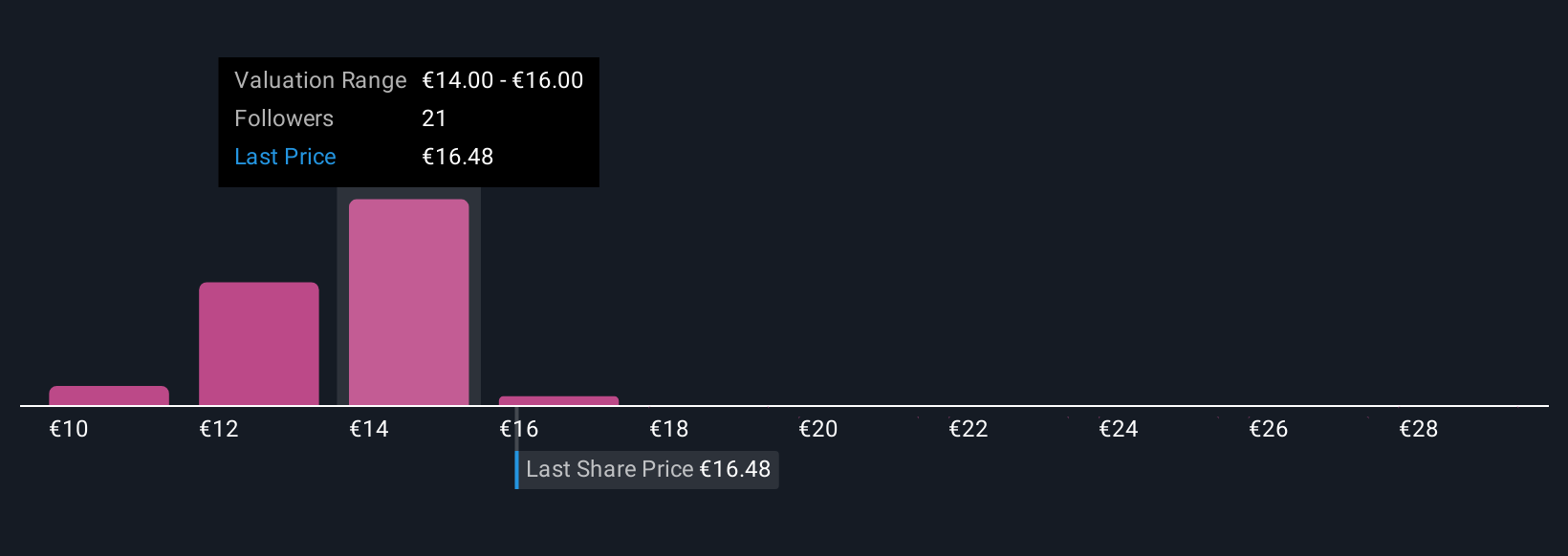

Simply Wall St Community members have posted 11 fair value estimates for Umicore, ranging from €10 to €30 per share. With wide differences in opinion, especially while the company’s key recycling and battery businesses work to recover, you can weigh several distinct outlooks on future performance.

Explore 11 other fair value estimates on Umicore - why the stock might be worth as much as 77% more than the current price!

Build Your Own Umicore Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Umicore research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Umicore research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Umicore's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:UMI

Umicore

Operates as a materials technology and recycling company in Belgium, Europe, the Asia-Pacific, North America, South America, and Africa.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives